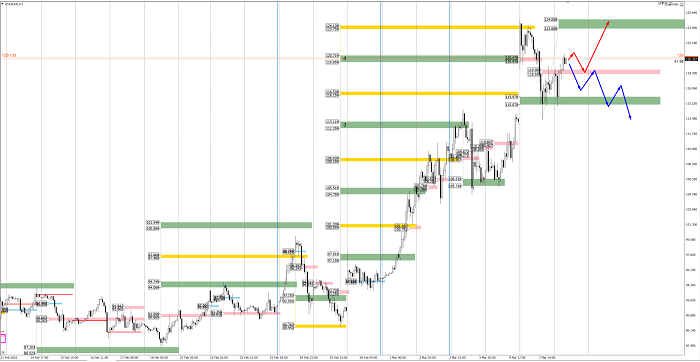

Yesterday, oil corrected down to the Intermediary Zone 120.47 – 120.02. Then buyers’ reaction and another test of the Gold Zone 4 124.13 – 123.75 occurred. After that, a powerful bearish impulse began. The key support of the short-term uptrend was broken out as well. As a result, traders reached the lower Target Zone 115.97 – 115.07.

After reaching the lower TZ, buyers showed interest and tested the key resistance of the short-term downtrend 119.08 – 118 55. Then another attempt was made to break out the lower TZ, but it was unsuccessful. Now the prices are above the key resistance of 119.08.

Thus, events on the short-term timeframe develop very quickly. If the price manages to consolidate above the IZ at the European session, then the trend will again reverse up. In this case, consider purchases with the target at the upper TZ 124.85 – 123.80.

If the price returns below the resistance level of 119.08, then continue looking for sales with the target at yesterday’s low.

USCrude trading ideas for today:

- If the price consolidates above level 119.08, buy in the zone of 119.08 – 118.55.

TakeProfit: Target Zone 124.85 – 123.80.

StopLoss: 116.80. - If there is a return under the resistance of 119.08, sell according to the pattern.

TakeProfit: 113.53.

StopLoss: according to the pattern rules.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.