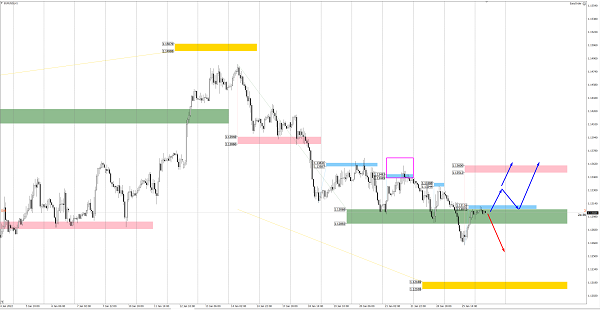

The euro continues following a short-term downtrend as of Wednesday morning. Yesterday, market participants attempted to break out the Target zone 1.1306 – 1.1289. However, the US session closed within support limits.

Today, the buyer has tested local resistance — the Additional zone 1.1311 – 1.1307. I suggest shorting the euro from that zone with a target at yesterday’s low.

If the Additional zone is broken to the upside, the correction might continue with a target at 1.1360 – 1.1351 — in the Intermediary zone. The Intermediary zone is the short-term downtrend’s limits, so we should also consider selling the euro after that zone is tested.

The Fed’s interest rate decision is due today, and market volatility might increase. I recommend securing your trading positions as much as possible: move some of them to a breakeven point or fix a part of profits.

Trading plan for EURUSD for today:

Sell according to the pattern from the Additional Zone 1.1311 – 1.1307.

TakeProfit: 1.1265.

StopLoss: According to pattern rules.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.