Financial Markets

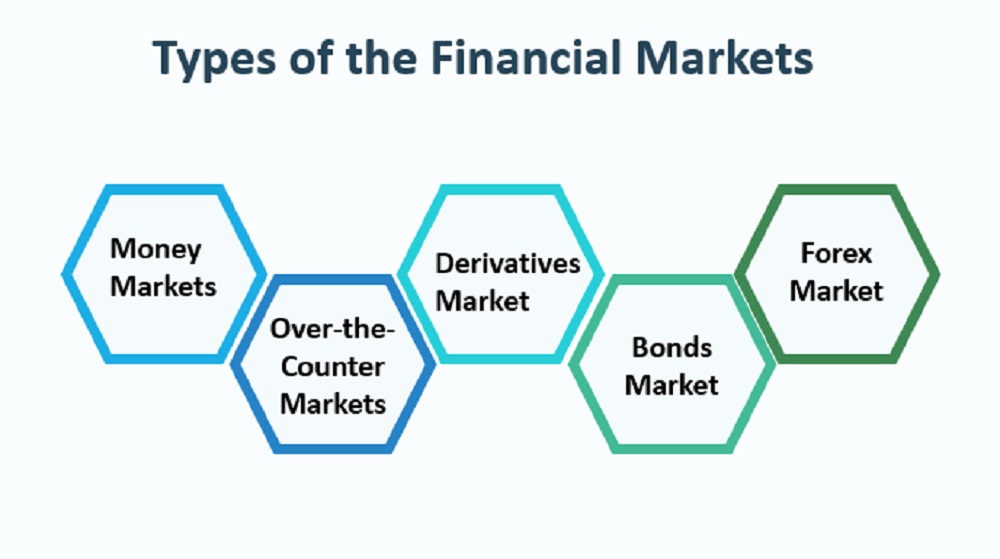

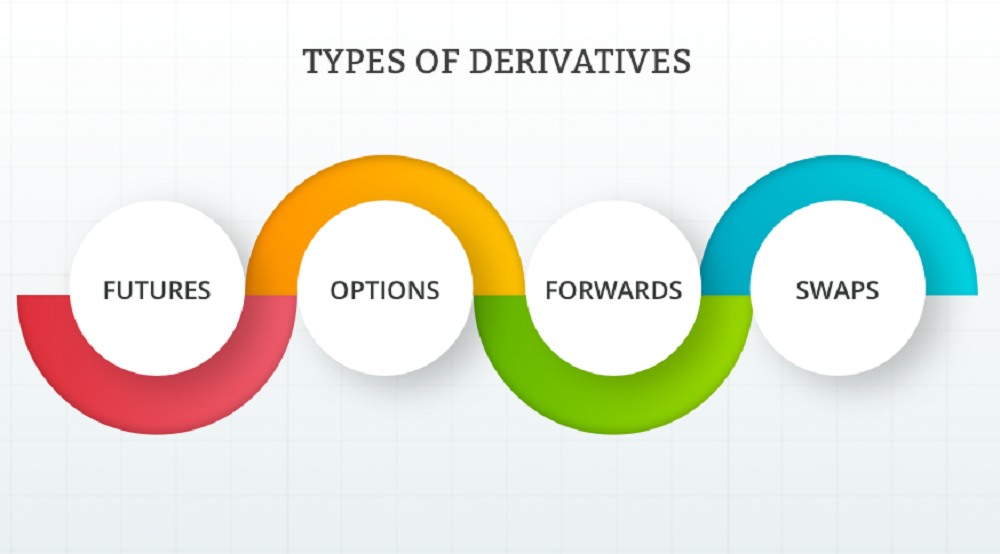

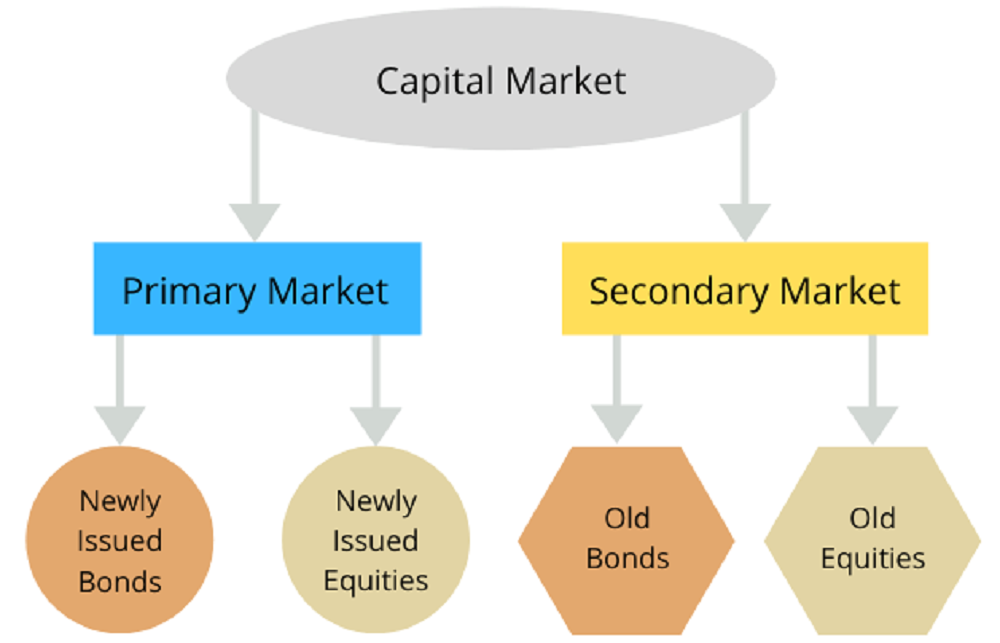

Financial Market is the main topic of daily business activities. TABLE OF CONTENTS What Are Financial Markets? Understanding Financial Markets Types of Financial Markets Forex Market Cash Market Commodity Market Derivative Market Capital Markets Equity Capital Market (ECM) Bond Market Over-the-Counter Market Cryptocurrencies Market Examples of Financial Markets Financial Markets FAQs What Are Financial Markets? […]