The oil price is an important indicator of the economy. Oil is the most used resource in the world; many wars have raged over black gold. The cost of crude oil is closely monitored by everyone – especially since the corona crisis; many investors are looking for the price expectations for the coming period. After reading this article, you will be aware of all developments in this exciting sector. We’ll discuss our oil price expectations for 2021 and beyond. We’ll also discuss the oil brands Brent and WTI, in particular, as we go in-depth on the history of this commodity and look at the oil price forecast.

Oil Brands

When talking about the commodity oil traded on the financial markets, we can distinguish two types. The most popular, and also the most traded, is the American oil called WTI. The other popular variant is Brent.

West Texas Intermediate (WTI)

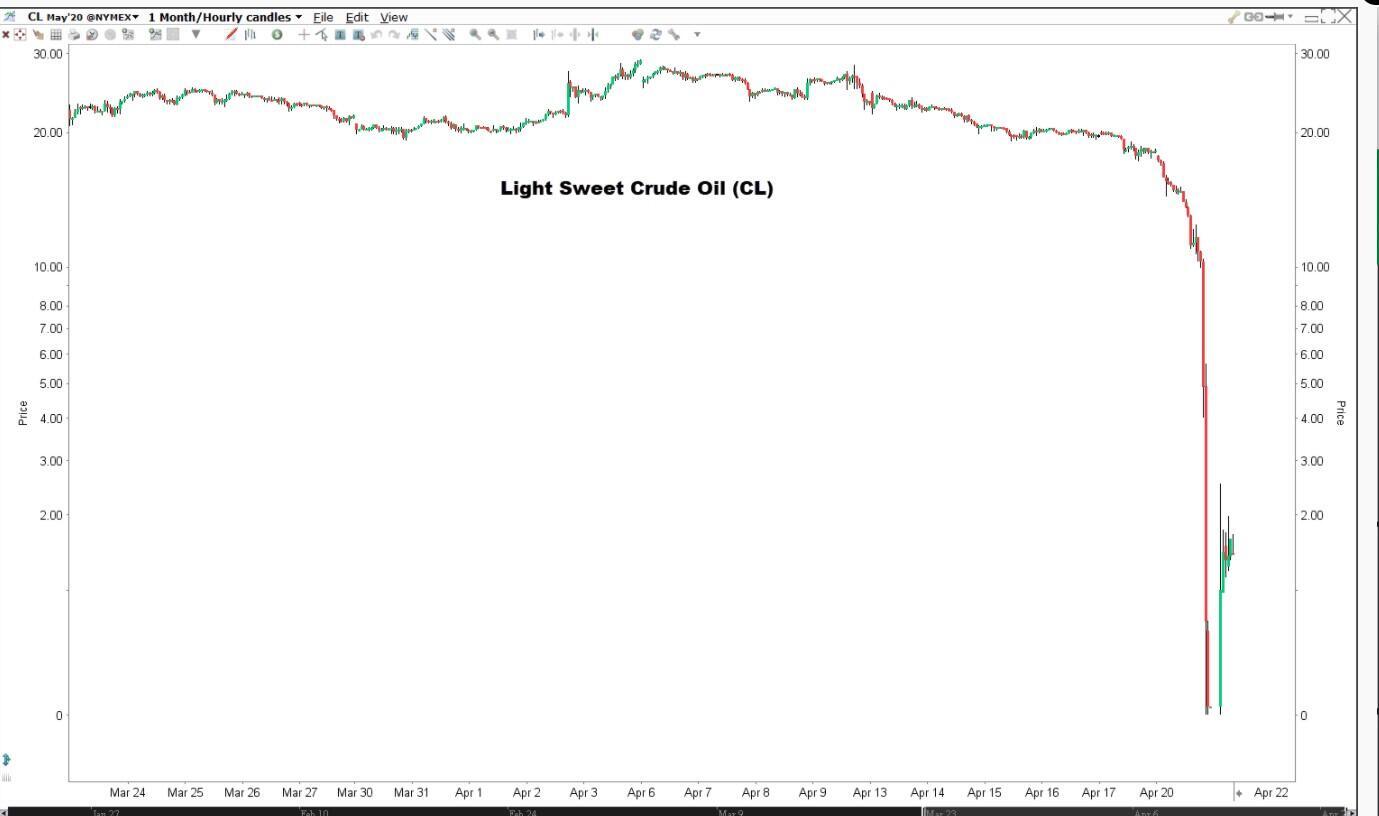

Light sweet crude oil (WTI) is widely used in US refineries and an important benchmark for oil prices. WTI is a light oil with a high API density and low sulfur content. This determines the density of the oil in relation to water. WTI oil is widely traded between oil companies and investors. Most trading is done through futures through CME Group. The Light Sweet Crude Oil (CL) future is one of the most traded futures worldwide.

Most of the oil of this type is stored in Cushing, an important hub for Oklahoma’s oil industry. Here are large storage tanks connected to pipelines that transport the oil to all United States regions. WTI is an important feedstock for refineries in the Midwestern United States and on the coast of the Gulf of Mexico.

Brent Crude Oil

Brent oil is an important benchmark for petroleum rate, especially in Europe, Africa, and the Middle East. Its name is derived from the Brent oil field in the North Sea. This Royal Dutch Shell oil field was once one of Britain’s most productive oil fields, but most of the platforms there have since been decommissioned.

The correlation between these two futures’ price development is high, and we have seen several times in recent years that Brent’s price was more than $10 higher than usual. At the end of 2020, the difference was approximately $3. Such differences are caused, among other things, by supply and demand, including the costs for shipping or storing oil.

A Recent History of Oil

At the end of April 2020 (due to the Saudi and Russia conflict – more on that later), the oil price crashed, and the May WTI future even dipped below $0. The stock markets recovered strongly during the summer, and the oil price had also found its way up again. In August, the oil price rose well above $ 40 a barrel. With that price, the largest oil companies got some air also, but it is still far from enough for most to make a profit.

At the beginning of September, the oil price had suddenly fallen hard again. Simultaneously, with the mini-crash with the US stock markets, a crude oil barrel’s worth dropped by about 15% to below $37 a barrel. This brought the oil price back below $40 a barrel for the first time since July. The drop is partly because Saudi Arabia had lowered its sales prices for October and the fear that the number of COVID-19 infections will increase rapidly in several countries.

The rebound in the number of infections could thwart the global economic recovery and decrease fuel demand. With several refineries lowering tariffs again, it seems they want to prevent oil stocks from rising back to record levels. The oil price was able to recover so strongly in recent months, thanks to the OPEC + countries’ agreements regarding the reduction in production. However, due to the crisis, many countries are looking for additional income sources. Therefore, some countries are not fully complying with the agreements made. As a result, more oil flows into the market, which also has a depressing effect on oil prices.

March 9th, 2020: 30% Oil Price Crash

Monday, March 9th, can go into the history books as “Black Monday” for the oil price. Negotiations between Saudi Arabia and Russia had come to nothing.

The oil price was under pressure in previous months due to the spread of the coronavirus. The world economy was on the back burner, and as a result, the oil demand had declined considerably. By limiting oil production, the countries that are part of the oil cartel hoped to stabilize or increase the price themselves. Saudi Arabia, in particular, is strongly in favor of limiting oil production.

Saudi Arabia was now trying to force Russia in another way to join the OPEC plan. The Saudi’s were going to increase production considerably and flood the market with oil. As a result, the price of a crude oil barrel had opened more than 30% lower, the lowest price since 2016. A low oil price is disastrous for most countries. Most OPEC countries are almost entirely dependent on oil revenues.

America’s shale farmers may be hit hardest. The shale revolution seems to be built more and more on quicksand, as costs remain high and the new resources that are found have a much shorter lifespan. Even with an oil price of around $60 a barrel, many of these producers were already struggling. The unrest surrounding the coronavirus also makes it difficult to raise external capital. With Saudi Arabia pushing the oil price further down, the situation seems to be untenable for many producers. Players with a fragile balance and relatively high costs are unlikely to make it. What Saudi Arabia failed to achieve in 2016 now seemed to have a good chance of success.

April 21st, 2020: WTI Goes Below Zero

In April 2020, we saw a situation in the oil markets that has never occurred before. The West Texas Intermediate Crude Oil (WTI) futures contract for May fell more than 100%. The price fell during the day and took an unprecedented dive later in the evening to $ -37.63/barrel, meaning that oil producers would indeed have to pay buyers to collect the oil.

This is mainly because the storage capacity in Cushing, Oklahoma is full. And it is precisely there that this oil is delivered. Traders and large companies who were long yesterday but ran out of storage capacity or liquidity to purchase oil were forced to close futures before expiry.

Shale Oil Influence

Oil production increased rapidly, and OPEC was not happy about this. They saw the increase in supply in the Middle East as competition. OPEC, therefore, came up with the idea of fully opening the oil taps. The production costs of shale oil were many times higher. The result was a drop in oil prices from about $110 a barrel to below $30 at the beginning of 2016. OPEC hoped to wipe out shale farmers in this way.

This strategy failed, and the OPEC countries themselves ultimately suffered considerable disadvantages from this strategy. For years they saw their income more than halved. In the meantime, the shale farmers have learned to work cheaper and more efficiently, and they are already profitable at a lower oil price. What’s typical of this form of oil extraction is that production can be increased quickly.

OPEC Influence

Demand for oil will remain stable in the coming years. But it is also apparent that there is a lot of extra supply on the market now that American oil production is rapidly increasing. Shale oil, in particular, is extracted from the ground here. The shale revolution was set in motion in 2014 by the sharp rise in oil prices. This form of oil extraction was therefore profitable, despite the high production costs. Due to the attractive market, the oil companies sprang up like mushrooms.

OPEC is trying to limit production to keep the oil price at a reasonable level. Most countries benefit from a somewhat higher, but in any case, stable, oil price. According to OPEC, the oil industry must invest more than $11,000 billion over the next 20 years. If producers don’t do that, there will be a shortage. In principle, shale farmers have already invested enough in recent years to absorb a large part of these shortages.

Furthermore, OPEC states that demand continues to increase despite the emergence of electric cars and the like. OPEC writes that the massive expansion of air travel creates a greater demand for oil than the emergence of alternative energy sources can diminish.

Since the low oil price in 2016, OPEC has been trying to support the low oil price. This is done by agreeing on production restrictions with all countries that are members of OPEC. The agreements do not always go smoothly, as Iran and Iraq do not always adhere to these agreements. On the other hand, the US and other countries continue to produce more and more oil, putting oil prices under pressure for a long time.

Oil Price Today

At the time of writing (December 21, 2020), the price of WTI Crude Oil was 47.44 USD/barrel, while Brent Crude Oil was selling for 50.61 USD/barrel.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.