Previously, the Fed spared no effort to save the economy. Now, the US central bank is to tighten monetary policy aggressively to curb inflation. How does this affect financial markets and EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

In 2020, the Fed was called crazy because of the huge monetary stimulus, a sharp reduction in the federal funds rate, and an unprecedented quantitative easing program. In 2022, the Fed is also acting weird but in a different way. Just as the central bank eased monetary policy nearly two years ago, it is now going to tighten it. Aggressively and without regard to the financial markets.

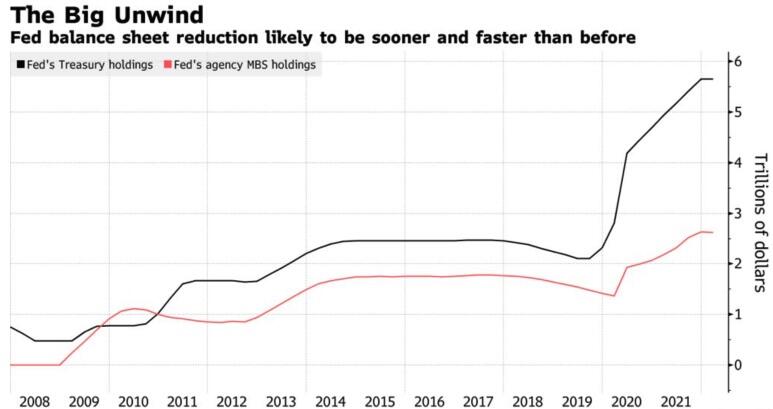

In the past, the standard mechanism for normalizing monetary policy was to quit the QE first, then raise interest rates several times, and only after that, provided the recovery is still on track, the central bank should consider the balance sheet unwinding. The US was the only country to meet those criteria during the most recent recovery – but only two years after the first rate hike – and even then, it was only able to unwind about $750 billion of the $3.6 trillion acquired since 2006. The quantitative tightening was consistent and even. But this time, it’s different. Due to high inflation, the central bank should act differently.

According to 26 out of 51 experts polled by Reuters, the Fed will begin to reduce its balance sheet in the third quarter. 11 believe that this will happen in the second quarter. The use of two instruments of monetary tightening simultaneously will enable the central bank to raise the interest rates less aggressively. According to JP Morgan, in 2022, the Fed will have to hike the federal funds rate not three or four times but six or seven to curb inflation.

Dynamics of Fed’s bond holdings on balance sheet

However, some market analysts believe that central banks cannot be aggressive in the fight against high prices. This can lead to financial instability due to the huge scale of government debt. In 2007, the share of the US government debt in GDP was only 60%, and now the figure has jumped to more than 120%. Servicing such debt in the face of growing bond yields becomes a problem.

I suppose the country that issues the money, in which its borrowings are denominated, may not worry about such problems. The Fed is likely to be more concerned about financial markets’ reaction to its actions than about the Treasury’s difficulty in servicing the US government debt. And investors are really on the verge of panic. They are dumping Treasuries, pushing the 10-year yield to a two-year high, and actively selling tech stocks. The Nasdaq Composite was the first major US stock index to start a correction, slipping 10% from its November highs.

Weekly EURUSD trading plan

The dollar is to grow in price amid the rally in Treasury yields and a drop in US stock indexes. However, the UK inflation has surged to 5.4%, increasing the odds of the BoE rate hike at its next meeting. Therefore, the sterling has strengthened, supporting other European currencies, including the euro, and encouraging the EURUSD in the short term. Furthermore, the 10-year German bond yield has been above zero for the first time in the past 30 months. According to fundamental analysis, these are just reasons for an upward correction, which should be used to sell the pair on the breakout of the supports at 1.134 and 1.132.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.