Fed is focused on the labour market. Only if the wage growth rate slows down from the current 5%-6%, they could speak about the victory over inflation. But even in this case, there will be some problems. How will it affect the EURUSD trend? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Even if we reach the peak, we won’t know much about the descent. The producer prices index has confirmed the general trend for US inflation. In April, its annual growth rate decreased from 11.5% to 11% but continues to be recorded in double digits for the fifth month in a row. That is why investors still believe in 50-basis-point rate hikes at the next two or three FOMC meetings, and the EURUSD has reached the downside targets at 1.044 and 1.041, which I indicated earlier.

The bad news is that consumer prices continue to rise by 8% or more. The good news is that, based on an analysis of CPI components, TIPS yields, and labour market indicators, inflation will roughly halve over the next 12 months. Thus, wage growth accelerated from pre-pandemic 3.5% to 5%-6%, which corresponds to inflation at 4% at current levels of productivity. If the Fed wants to see consumer prices at 3%, it needs to slow down wages.

The FOMC officials understand this. Christopher Waller says inflation is a tax that everybody pays. Unemployment is a tax a fraction of the population pays. The Fed is trying to curb the CPI, which will be good in any case, and there is a price to pay. Jerome Powell agrees that there is some pain in the process of bringing inflation down to 2%. After all, it would be much worse if consumer prices stayed at elevated levels for a long time.

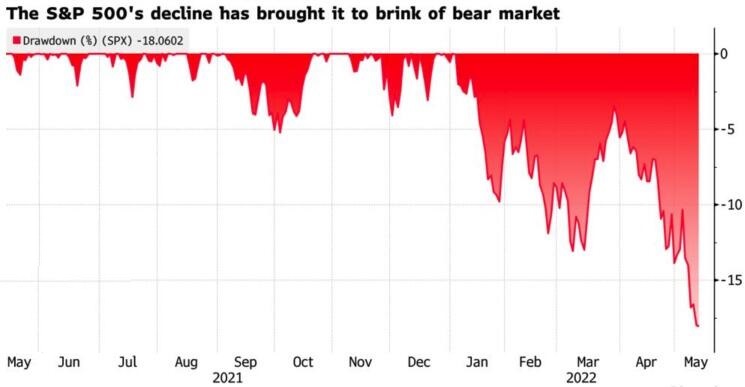

Thus, the US central bank targets the labour market, which means serious problems for the stock indexes. The S&P 500 is poised to close in the red for the 6th straight week, the longest losing streak since 2011. However, stocks crashing into bear market territory hurts consumer sentiment and signals an approaching economic downturn. Over the past 95 years, the broad market index has fallen by 20% or more 14 times. Only in two of these episodes, the US GDP did not shrink — in 1966 and 1987.

A decline in the global risk appetite supports the US dollar as a safe-haven currency. Furthermore, the EURUSD bulls have more trouble. A downturn in China’s GDP presses down global growth. China is one of the largest commodity importers, being in the centre of global trade. Germany’s economy is hit the most.

Weekly EURUSD trading plan

In addition, the Brexit topic is being discussed again, and there is a new round of energy crisis amid Russian sanctions against European gas companies. So, the EURUSD is naturally down below 1.04. Although the ECB officials speak about rate hikes in July or even in June, the derivatives market believes the Fed will make three big moves, bringing the borrowing cost almost to 3% in 2022. Considering other problems in the euro area, the euro should continue falling to $1.031.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.