Due to the later lifting of COVID-19 restrictions, the eurozone lagged behind the US in economic growth in 2021, but in 2022 it caught up with its counterpart. The same applies to the monetary policy of the Fed and the ECB. How does its speed affect EURUSD? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

Things in life don’t always go the way we want them to. The markets behave like naughty children. They demand that the Fed fulfill its desires for the federal funds rate to rise to 4.9% (not as high as in accordance with the FOMC 5.1% forecast) and fall by 50 bps by the end of 2023. However, monetary policy easing occurs when the economy is weak. When it is strong, waiting for a serious inflation slowdown is an illusion. Or not? Are the markets still right and will the EURUSD rally continue?

For decades, good economic news has also been good news for the stock market. Strong GDP indicated strong corporate profits rather than too high inflation. In 2022, everything has changed. The rise in consumer prices to their highest levels in 40 years has made investors more worried about the Fed’s aggressive monetary tightening than about economic growth. Bad news turned good for the S&P 500. In January, the market returned to its traditional behavior, once again proving that last year was abnormal.

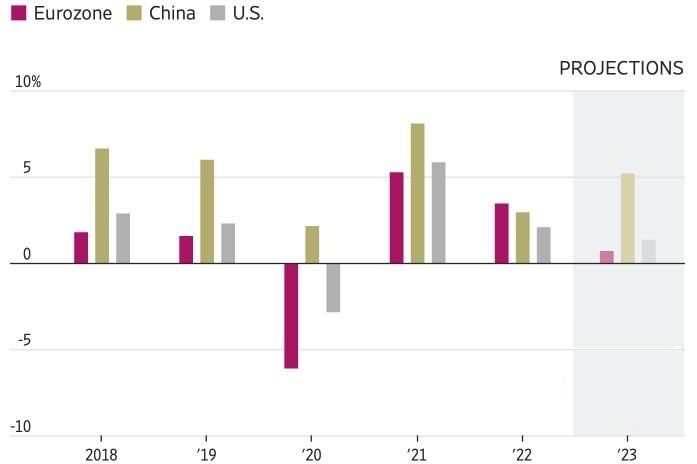

According to Christine Lagarde, 2022 was very strange. At the end of last year, the eurozone GDP, for the first time since 1974, overtook China and the US at the same time due to the later opening of the European economy after the pandemic. The first half of 2022 was phenomenal for European countries, as was the 5.9% US GDP growth in 2021.

Thus, the EURUSD rally is the result of the eurozone’s delayed response to the pandemic. The later opening of its economy led to a later GDP acceleration and an ECB monetary restriction lagging behind the Fed. The economy and central banks have found themselves at different stages of the same cycle, with the US dollar’s benefits bearing fruit and the euro’s just beginning to capitalize on them.

Not surprisingly, the market is lowering the expected Federal funds rate peak and expecting a Fed dovish reversal as early as 2023. The ECB deposit rate ceiling has already risen to 3.5%, with some banks seeing it at 3.75%. In the third quarter of 2022, the same thing happened with expectations for the US borrowing cost. The US dollar was actively growing and reached a 20-year high in autumn.

Weekly EURUSD trading plan

Investors fear a repeat of last year’s events, when the Fed punished stock indices for their desire to get ahead of the regulator. However, now the central bank intends to resist global trends. In accordance with them, there is no doubt that the EURUSD uptrend will continue. The pair may once again go beyond the lower border of consolidation 1.083-1.093. Therefore, enter purchases when EURUSD returns to the trading range.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.