The Fed has tightened monetary policy at the fastest pace since the 1980s, but a slowdown in the US economy could force it to make a pause. How will this affect EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

From decisiveness to gradualism. The Fed has stopped giving guidance on how much it intends to raise the federal funds rate in the future and has moved into data-driven and decision-making mode from meeting to meeting. Not surprisingly, US stocks rose, Treasury yields fell, and EURUSD soared above 1.02. Instead of tightening financial conditions, the central bank has loosened them again.

Until last month, the Fed hadn’t raised borrowing costs by 75 basis points at a single meeting since 1994. The current monetary tightening is the fastest since the 1980s, with rates rising since March as much as in the entire 2015-2018 cycle. According to Jerome Powell, the interest rate has reached a long-term neutral level, neither stimulating nor pressing down the economy. This gives the FOMC officials some room for maneuver. Among other things, it suggests a slower monetary tightening, which has supported the stock market and the EURUSD.

If Jerome Powell had admitted that the Fed was going to trigger a recession to slow inflation, investors would have reacted differently. But the Fed Chair insists that the US economy is not yet in a recession. However, the strongest yield curve inversion in two decades signals that it is not far off.

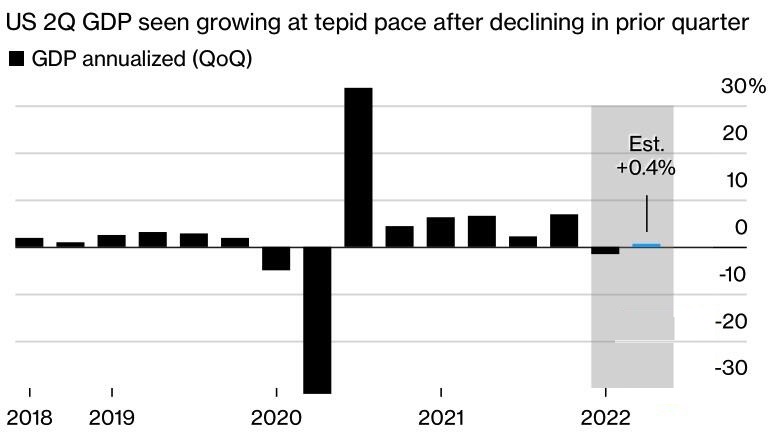

For the EURUSD bulls, it was enough that Jerome Powell acknowledged that worsening data could lead to slower monetary tightening. Investors believe that the central bank has passed the peak of aggressiveness, and its pace of monetary tightening will be slower. In this regard, the decline in US GDP in the second quarter supports the current market version of a rate hike to 3.3% in 2022, followed by a cut in 2023.

Bloomberg expects the US economy to expand 0.4% Y-o-Y and 0.1% Q-o-Q, although Atlanta Fed’s leading indicator signals a technical recession.

Markets expected Powell to signal a shift from aggressive to gradual monetary tightening and a lack of clear guidance on the future trajectory of the federal funds rate. However, unlike the ECB, the Fed has not entirely abandoned its forecasts. In particular, the Fed Chair repeated several times that, according to the dot plot, the borrowing costs could rise to 3.5% this year and almost 4% next year. According to the former head of the New York Fed, William Dudley, such references mean that the central bank will go further than the financial markets suggest.

Weekly EURUSD trading plan

I believe the weak report on the US GDP for the second quarter could send the EURUSD up to 1.03. However, if this level is not broken out, and the price returns to a range of 1.012-1.027, it will be relevant to sell.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.