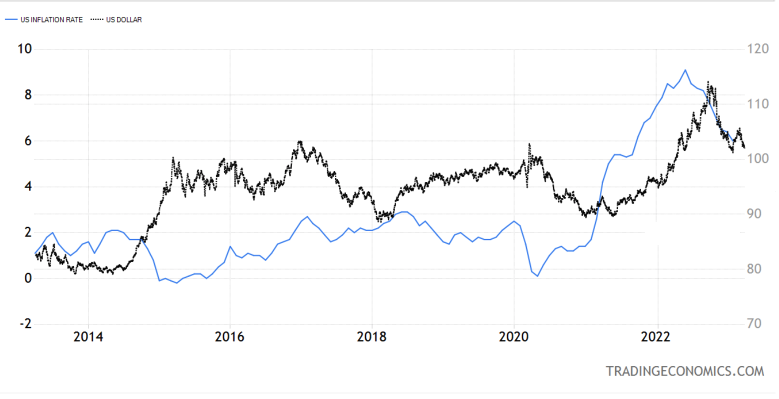

The USD index reaches a maximum when American inflation passes its high. No matter how much the EURUSD bears resist, the pair will still grow sooner or later. Let’s discuss this topic and make up a trading plan.

Monthly US dollar fundamental forecast

Bull markets remain longer, and bear markets hit harder than you can imagine. Investors were scared by rumors that due to the oil price rise and the subsequent acceleration of the US inflation, the Fed may once again turn into an aggressive hawk and provoke a recession. When the US faces an economic downturn, and other major economies of the world avoid it, the US dollar, as a rule, weakens. This fact allowed EURUSD bulls to correct the situation very quickly.

The Fed is more worried about recession than inflation for the first time in the last 18 months. The latter can be curbed by raising the rate at the right time. However, if to turn hawkish again, such an environment will be unfavorable for the greenback, according to Standard Chartered. According to the dollar smile theory, USD rises when the US economy is either expanding rapidly or is in a deep recession. In the meantime, the banking crisis is not as terrible as it could be, so EURUSD purchases seem safe.

History has proven that USD passes its high when inflation passes its peak. Thus, the best days of the greenback are left behind.

If the Fed is really more concerned about recession than inflation, the release of weak US macro statistics will be bad news for the greenback. The fall of the US ISM Manufacturing PMI in March from 47.7 to 46.3 allowed EURUSD bulls to fully recover after the OPEC+ production cut by 1 million bpd. It gave rise to rumors that the rise in oil prices would allow the US inflation to reach a new local high, and the Fed to continue the monetary tightening cycle. However, concerns about the recession eventually outweighed. Moreover, the PMI quite accurately signals an approaching recession. For the fifth month in a row, the index has been below the critical level of 50, which indicates a reduction in part of the economy.

The recession theme in the eurozone fades into the background, which allows the ECB to continue tightening monetary policy, and the EURUSD to grow. According to the head of the Bank of Austria, Robert Holzmann, if nothing terrible happens before May, the ECB will raise the deposit rate by 50 bps at the next meeting. Neither the banking crisis nor the sharp rise in oil prices due to the surprise from OPEC+ will force the ECB to change its strategy.

Monthly EURUSD trading plan

Thus, fundamentals continue to play on the euro’s side. At the same time, updating the local EURUSD highs near 1.0925 will allow the pair to continue growing in the direction of the previously announced targets at 1.12 and 1.14, and to add up to long trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.