While other markets calmed down being worried about the Fed’s actions, the stock market is playing with fire. Jerome Powell must act decisively, and he should signal active steps in Jackson Hole. How will the EURUSD react? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

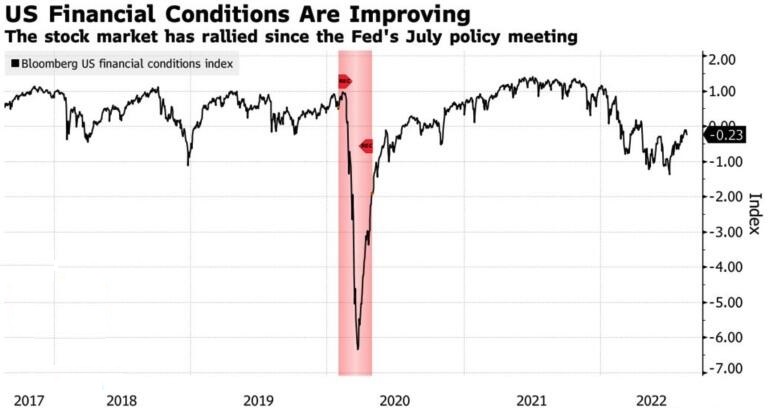

The US stock market went down on the expectations that Jerome Powell’s speech in Jackson Hole would discourage the S&P 500 bulls. The Fed can and must show how it can manage financial markets at the macro level. Otherwise, the US central bank will fail in tightening financial conditions and curbing inflation. The drop in stock indexes and the rally in 10-year Treasury yields towards 3% have driven the EURUSD close to parity.

According to the Bank of New York Mellon, euro bearish sentiment is now at its highest level since October 2020. Sellers got it wrong at that time, and hopes for a global economic recovery carried the major currency pair above 1.23. This time, the rally will hardly repeat. Now speculators are getting rid of EURUSD for the right reasons. The US economy looks better than the European one, US interest rates are higher than in the euro area, and the demand for safe-haven assets is rising. Even the information about the presence of the Russian president at the G20 summit in Indonesia forced investors to buy greenbacks. In my opinion, this is already too much. The euro bears have enough reason to go ahead.

According to Bloomberg experts, the euro-area PMI will be below the critical level of 50 for the second consecutive month, signalling a recession. Germany is most likely already in recession, and the Bundesbank’s calls for an ECB rate hike due to potentially the highest inflation in 70 years scares investors. Monetary tightening will exacerbate the already difficult situation in the currency bloc.

The US dollar lures back investors naturally. The US stock indexes look overbought. The P/E ratio for the S&P 500 stocks has recently risen from 15.3 to 18.6. It has not yet fully felt the impact of QT, the quantitative tightening programme. But the programme scale will grow to $95 billion a month from September.

In the summer, stock indices broke away from the economy, which, by the way, is in a technical recession, although there is a high chance of avoiding a full-fledged recession. The stock market broke away from the Fed’s estimates too. FOMC forecasts suggest a rise in the federal funds rate to 3.8% by the end of 2023, followed by a decrease in 2024. CME derivatives see a peak of 3.7% by mid-2023, with further monetary easing in the second half of next year. So, the S&P 500 rally had no real reasons.

Weekly EURUSD trading plan

In my opinion, if expectations of Jerome Powell’s hawkish stance in Jackson Hole provoke a serious drop in the stock market, EURUSD will drop to 0.985 before the end of August. The second scenario is the price consolidation on the eve of an important event. Anyway, it will be relevant to sell.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.