Earlier FOMC officials unanimously talked about aggressive rate hikes to fight inflation, now, they are increasingly worried about the economy. Is it strong enough? How will the disputes among the Fed’s officials affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

No one knows how the war in Ukraine will end, and how quickly China will suppress the COVID-19 outbreak. Geopolitics and the pandemic create serious problems for the European and Chinese economies, and uncertainty presses down the euro and yuan. However, the US dollar has its own difficulties. No one knows how high the Fed will raise the federal funds rate, and the turmoil in the US stock market starts to affect the greenback.

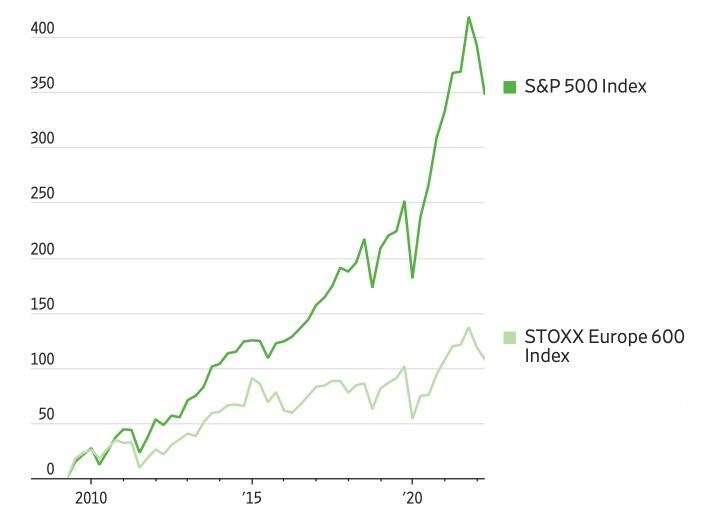

The decline in the global risk appetite is considered one of the key drivers of the US dollar strengthening. When the US stocks fall in value, the demand for the dollar rises, fuelling the EURUSD rally. However, everything has its limit. Forex rates are determined by capital flows, and when these flows reverse, intermarket analysis will fail. Thus, one of the reasons for the greenback’s strength is the outperformance of the US stock indices over the European ones. From 2009 to 2021, the S&P 500 was up by over 400%, while the EuroStoxx 600 was up only by 137%.

Earlier FOMC officials unanimously talked about aggressive rate hikes to fight inflation, now, they are increasingly worried about the economy. Is it strong enough? How will the disputes among the Fed’s officials affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

No one knows how the war in Ukraine will end, and how quickly China will suppress the COVID-19 outbreak. Geopolitics and the pandemic create serious problems for the European and Chinese economies, and uncertainty presses down the euro and yuan. However, the US dollar has its own difficulties. No one knows how high the Fed will raise the federal funds rate, and the turmoil in the US stock market starts to affect the greenback.

The decline in the global risk appetite is considered one of the key drivers of the US dollar strengthening. When the US stocks fall in value, the demand for the dollar rises, fuelling the EURUSD rally. However, everything has its limit. Forex rates are determined by capital flows, and when these flows reverse, intermarket analysis will fail. Thus, one of the reasons for the greenback’s strength is the outperformance of the US stock indices over the European ones. From 2009 to 2021, the S&P 500 was up by over 400%, while the EuroStoxx 600 was up only by 137%.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.