Encouraged by the US economic strength and the Fed’s willingness to get rid of monetary stimulus, the EURUSD bears have sent the pair to the lowest level since June 2020. Will the price fall lower? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Why is the US dollar strengthening? The answer to this question was given by strong US economic data and the minutes of the FOMC November meeting. Due to the exceeding growth of the consumer expenditures over inflation, and the drop in jobless claims to a 52-year low, the US economy has confirmed its strength. Furthermore, the Fed is going to speed up tapering the QE. Therefore, the EURUSD bulls seem to be discouraged. However, as often happens in the market, when the majority is sure of something, the opposite things happen.

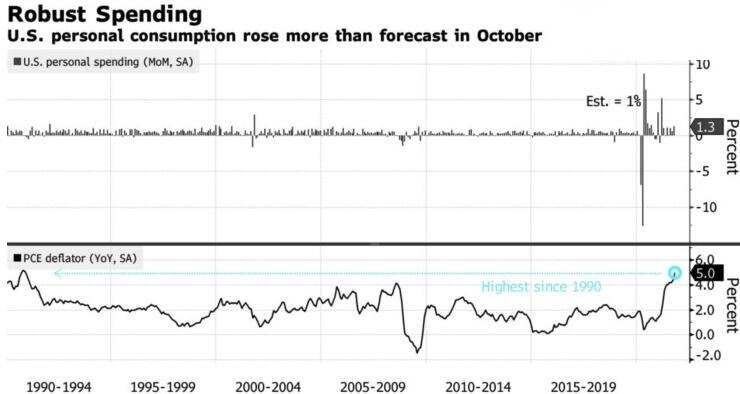

One of the main bullish drivers for the greenback in late autumn has been the hawkish tone of the Fed’s officials. James Bullard, Richard Clarida, and Christopher Waller spoke about the need to accelerate the pace of tapering stimulus and complete the process sooner than the Fed currently plans. Furthermore, a number of FOMC officials expressed the same idea in early November, being concerned about the permanent nature of high inflation. The Fed’s desire to get rid of monetary stimulus had come before the strong reports on the US labour market, retail sales and before it became known that the PCE accelerated from 4.4% to 5%, the highest level since 1990.

If the Fed increases the volumes of the cuts in the monthly asset purchases from $15 billion to $30 billion in December, QE could finish in March. In this case, the central bank may raise the federal funds rate in the quarter. Besides, the CME derivatives have increased the chance of monetary restriction in March to 50%, the chances of a monetary tightening at three FOMC meetings in 2022 to 65%.

The target for accelerating normalization is far, but recent data show it is achievable. Consumer spending in October rose by 1.3% and adjusted for inflation – by 0.7%. It seems that high prices do not worry Americans, which suggests an optimistic outlook for the US economy.

Strong domestic data give grounds to raise forecasts for US GDP. JP Morgan raised its estimate of economic growth in the fourth quarter from 5% to 7%, Morgan Stanley – from 3% to 8.7%; Capital Economics expects an expansion of 6.5%. At the same time, the euro area, with its worsening epidemiological situation, lockdowns, and the energy crisis, is unlikely to encourage the EURUSD bulls at the end of this year.

However, many bearish drivers have already been priced in the euro-dollar exchange rate. It’s hard to expect the Fed to raise rates in 2022 not three but four times or to complete the QE in January. According to Bloomberg research, the pressure of the supply shock in the US is starting to ease while it is getting stronger in the euro area. This presupposes a slowdown in US inflation and a continuation of the acceleration of European inflation. How long will the ECB ignore high prices?

Weekly EURUSD trading plan

I believe the EURUSD could be corrected up amid exciting shorts. This scenario will work out if the price breaks out the resistance at 1.1225 and consolidates above. Otherwise, the sell-off will continue, driving the price towards 1.112 and 1.104

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.