While analysts wonder if there are political connotations in Powell’s decision to abandon the Fed’s mantra about the transitory nature of high inflation, investors discuss the Fed’s actions related to interest rates. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Investors are focused on the meetings of the Fed and the ECB. The fuss around the omicron has somehow eased, though it is still a matter of concern. Markets are more worried about a hawkish change in Jerome Powell’s tone, who abandoned his mantra about the transitory nature of elevated inflation and changed the Fed’s priorities. Now the Fed is more focused on curbing inflation than reaching full employment. What are the reasons for this metamorphosis, and how will it affect the EURUSD.

FOMC officials’ speeches have convinced that the process of winding down QE will go faster. The program has become a barrier to raising the federal funds rate. Markets are confident that the central bank will announce the completion of asset purchases by March instead of the previously expected June. The sooner QE ends, the better for the US dollar.

Everything is more or less clear with interesting rates. In previous FOMC forecasts, officials’ opinions on the timing of the rate hike were approximately equally divided between 2022 and 2023. Bloomberg experts expect to see at least two interest rate hikes next year. If so, it will be the most hawkish shift of the dot plot since its inception in 2012.

The derivatives market shares the opinion of analysts, expecting the federal funds to rise by 66 basis points by late 2022, which means it will be hiked by 25 basis points at two or three meetings.

Investors will look in the accompanying FOMC statement and Jerome Powell’s speech for reasons why they abandoned the old mantra. There are two opposite opinions in the market. The first one suggests the Fed could have been led by the White House, which spares no effort to curb inflation. The second one means Powell openly opposed Treasury Secretary Janet Yellen, who believes in the temporary nature of high prices. In the latter case, the independence of the central bank is emphasized.

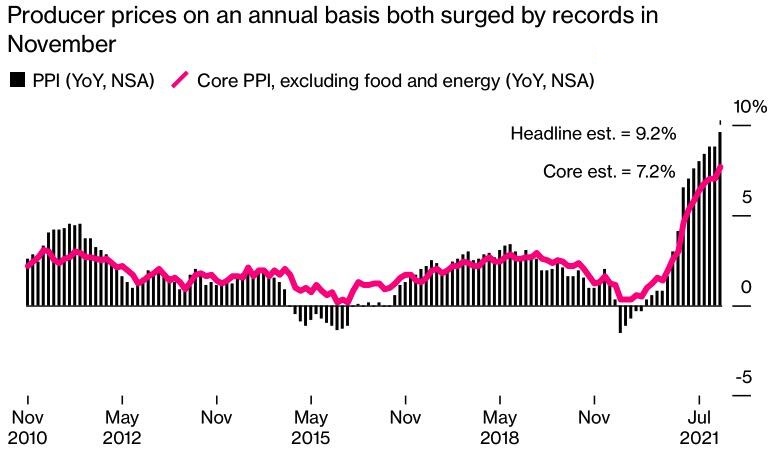

The Federal Reserve has also been encouraged to take active steps by the report on producer prices. The indicator in November rose by 9.6%, which was еhe highest rate since 2010. Core PPI has hit a new all-time high of 7.7%.

I believe the faster completion of the quantitative easing program by March, the FOMC forecast of two increases in the federal funds rate, and the absence of any ideas about the temporary nature of high inflation in the accompanying statement of the Committee have been priced in the dollar pairs. The EURUSD won’t sharply drop unless there are more hawkish surprises from the Fed, which is unlikely now. Otherwise, the central bank risks causing a crash in stock indexes. This is clearly not included in the regulator’s plans, which prefers to prepare the markets for its verdicts for a long time and methodically.

Weekly EURUSD trading plan

Therefore, I suppose the euro won’t fall deep. If the price breaks out the support at 1.125-1.1255, it could slide down to1.122 and 1.119, where the EURUSD bulls should go ahead.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.