The Fed will raise rates faster than the ECB, the US economy is stronger than the European one, and the demand for the US dollar as a safe-haven asset is skyrocketing. Are there any doubts about the EURUSD trend? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

If any significant bad event happens in the world, including stock market crashes, geopolitical conflicts, or whatever, everyone wants to buy the US dollar. There is no other alternative. In this regard, the intention of the Fed to quickly bring the federal funds rate to a neutral level, the war in Ukraine, and the outbreak of COVID-19 naturally increase the demand for the greenback, strengthening it. The EURUSD bulls can only bet on local corrections up while there are now signs of the general trend reversal.

According to American intelligence, Russia is preparing for a protracted war in Ukraine. The WHO warns that China’s zero-COVID strategy is unsustainable and could cost 1.6 million lives. New York Fed President John Williams expects the Fed to act quickly to bring rates back to normal levels as soon as possible. Cleveland Fed President Loretta Mester says the central bank does not rule out a 75-basis-point rate hike at one of the FOMC meetings in 2022. If inflation remains elevated in the second half of the year, it will become a necessity.

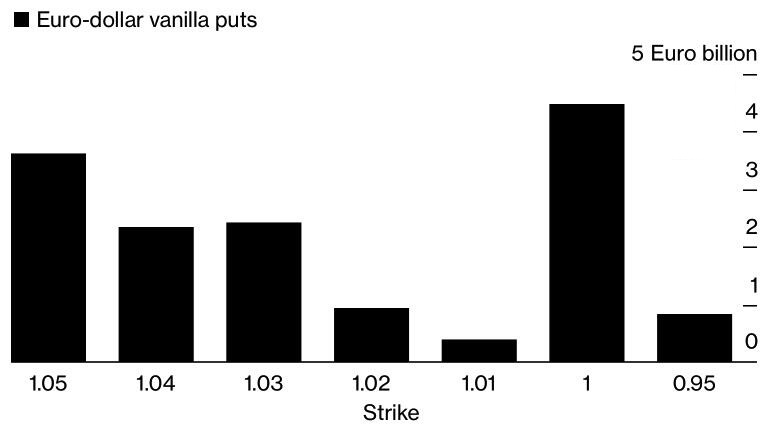

Therefore, the existing global problems will continue affecting markets. Investors bet on the EURUSD further decline. The idea of a drop to parity is currently the most popular in the options market. The derivatives market evaluates the chances of such an outcome over the next 12 months as fifty-fifty.

The euro could be supported in the short term by the EU’s delay in imposing an embargo on Russian oil or the hawkish comments of ECB officials, but the long-term trend remains down. The Fed will raise rates faster than the ECB, and the US economy is stronger than the euro-area one. Since the pandemic’s start, due to massive fiscal stimulus, the US economy has recovered faster and has grown more than its main competitors. Yes, the US GDP suffered a downturn in the first quarter, but consumer expenditures remained strong, unlike those in France and Spain, which reported a reduction.

The lack of significant gains for the euro in response to Joachim Nagel’s hawkish speech also suggests that the ECB’s strength is not unlimited. The Bundesbank chief said the risk of acting too late “is increasing notably,” urging central bankers to hike the deposit rate in July amid historically high inflation. Consumer prices in the euro area rose by 7.5%. The indicator grew by 7.8% in Germany, the highest rate since 1981.

Weekly EURUSD trading plan

Therefore, the EURUSD medium-term trend will hardly turn up. In the short-term, there could be a correction up if US inflation in April is well below the forecast of 8.1%. In this case, one could consider purchasing the euro if the price breaks out the resistance levels of $1.058 and $1.061. If the inflation report is close to Bloomberg forecasts, most traders will likely sell the pair down to 1.041 and 1.031.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.