The Fed will no longer risk its economy to beat inflation. This is exactly the news that the US stock indices and EURUSD were waiting for. What’s next? Let’s discuss the topic and make up a trading plan.

Weekly US dollar fundamental forecast

To trade in Forex, you need to be a little crazy, like the last day of autumn or the whole of 2022. Currently, the volatility of the major currency pairs significantly exceeds historical levels. This year’s turmoil has seriously changed trading, making investors’ jaws drop. Especially on November 30th when EURUSD fluctuated in a trading range of 1.0325-1.0395. The pair left it only to re-enter later and rush to the opposite border.

Investors experienced every single emotion after the release of disappointing data for eurozone inflation, ADP private sector employment in the US, and job vacancies. The tragedy reached its peak after Jerome Powell’s speech. His reluctance to turn super hawkish contributed to the US stock indexes soaring and returning EURUSD above 1.04.

According to Jerome Powell and his colleagues, they do not want to go too far because lowering rates is not what central bank officials would like to do in the near future. This is why the Fed is slowing down monetary restriction. The US regulator needs to determine the right rate level, although there is not enough data. In such conditions, there is no need to rush.

Jerome Powell tried to justify his non-hawkish comments by saying that you can’t change the rate prematurely and by promising that the Fed will stay in place until inflation returns to its 2% target. However, the markets only heard what they wanted to hear. The Fed is starting to consider bilateral risks. In Jackson Hole, Jerome Powell announced his readiness to fight high inflation, no matter how it affects the economy. However, at the end of autumn, everything changed. The Fed intends by all means to avoid recession in the US economy.

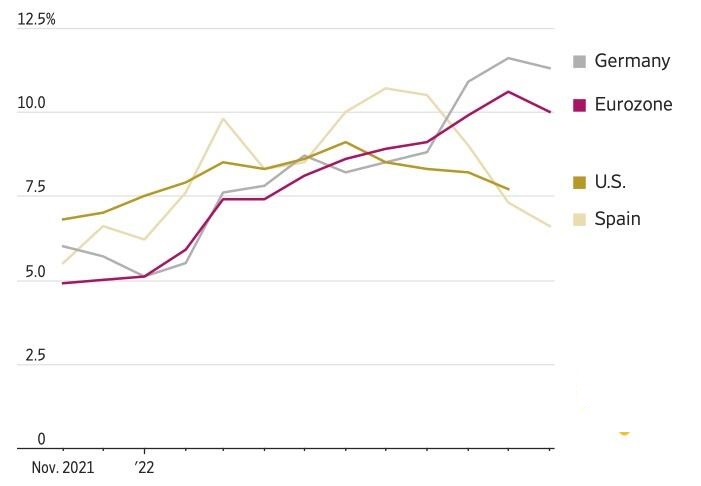

The willingness of Jerome Powell to take into account bilateral risks, both for inflation and the economy, is good news for the stock market and EURUSD. The US dollar has passed its peak and will weaken. Under such conditions, the slowdown of the European CPI from 10.6% to 10% in October is much less important for the EURUSD than before.

Weekly EURUSD trading plan

Slower consumer price growth in the eurozone allows the ECB to reduce the speed of rate hikes, which will weaken the euro. However, against the backdrop of a general flight from the dollar, this is unlikely to change the bullish EURUSD sentiment. Moreover, the expected disappointing US jobs report can speed up the rally. Hold and periodically add up to euro long trades entered after the reversal in the level of 1.039. Focus on 1.05 and 1.061 as initial targets.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.