Fed acts aggressively, but other central banks follow its path. Europe raises rates, supporting European currencies. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

The world’s leading central banks follow the Fed’s path of aggressive monetary tightening, weakening the US dollar against a basket of major currencies. Furthermore, the ECB spares no effort to calm the euro-area bond market. Although the US stocks are down and the Treasury yield is up, creating a favourable environment for the greenback, the EURUSD is up above 1.05.

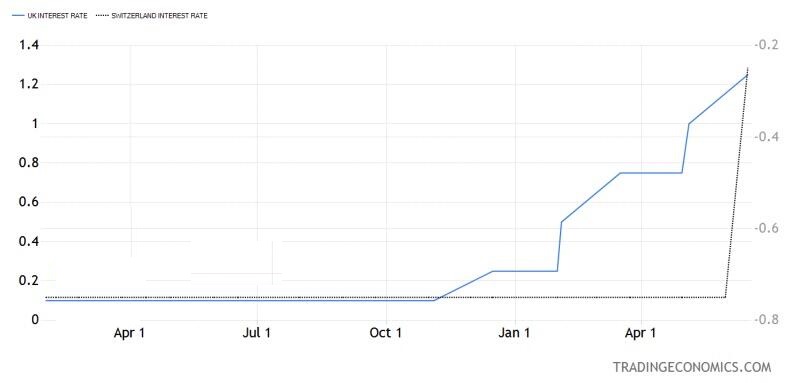

The decision of the Swiss National Bank to raise rates for the first time in 15 years by 50 basis points caused a shock in financial markets. The franc, which I recommended buying in hopes of a hawkish surprise from the SNB, soared against the euro at the fastest pace since the Brexit referendum in 2016. Against the US dollar, it posted the best daily performance in 7 years. The pound’s rally also looked impressive thanks to the Bank of England’s hint of decisive moves in the future, which pushed up expectations of the BoE rate hike to 3% by the end of 2022. Investors bet on a 50-basis-point rate hike at each of the three subsequent MPC meetings.

The future trajectory of the ECB deposit rate looks rather steep, especially in the context that the central bank knows how to prevent the euro-area breakup. Christine Lagarde presented to the finance ministers of the euro-area member countries a plan to close spreads on the European bond market. According to the ECB president, the program will be activated if the yield spread exceeds the threshold values. The new mechanism is designed to prevent the pressure of irrational market movements on individual countries of the community. Although Germany and the Netherlands believe that the situation is not urgent, Lagarde insists that the ECB must eliminate the risks of fragmentation in order to ensure the pursuit of effective monetary policy throughout the euro area.

Thus, European central banks are catching up with the Fed, supporting European currencies. However, this circumstance will hardly turn the EURUSD trend up. The Fed is still the most aggressive.

The Fed has changed the federal funds rate by 75 basis points over the past two decades. In 2008, Ben Bernanke did this three times. Only it was about cutting borrowing costs, not hiking. In 2020, the central bank cut the rate by 100basis points. Alan Greenspan called it a risk management system. The Fed must decide where the greatest risks lie and then err on the side of doing too much to minimize those risks, cut off the tails of the distribution, in statistics-speak. In 2022, this system works exactly the opposite. The Fed is not afraid of a recession simply because the rates will rise so high by the time of a potential recession that there will be enough room for cutting.

Weekly EURUSD trading plan

If the EURUSD breaks out the resistance at 1.06, it could be corrected up to 1.07 and 1.077, where sellers will go ahead. If the price goes below 1.045-1.046, it will be relevant to sell.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.