If we assume that the conflict in Eastern Europe is to end soon, the EURUSD trend will depend on market expectations for the interest rate changes by the Fed and the ECB. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

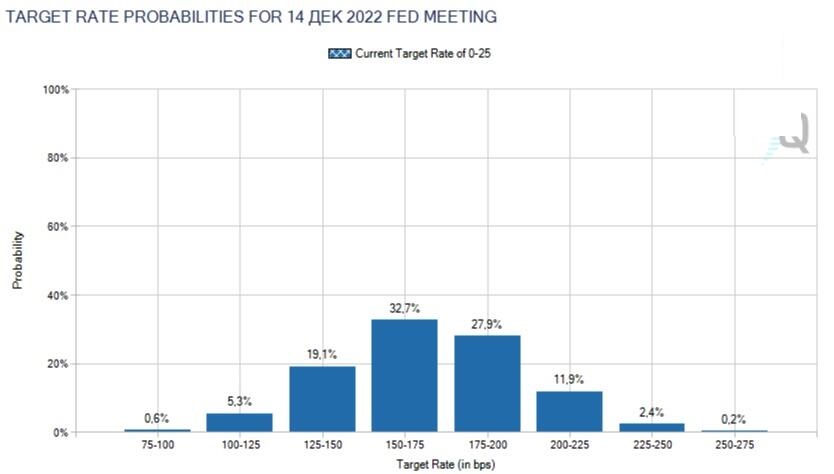

Panic makes people go to extremes. Some investors are selling off stocks, being afraid that the Fed will raise the federal funds rate six or seven times in 2022. Others, on the contrary, hope that the US central bank will put off monetary tightening and support the stock market amid the geopolitical conflict in Eastern Europe. The Fed didn’t start raising the rates in 2015 due to turmoil in China’s stock market. However, the Fed will hardly retain the rate at the current level in March because of a potential Russian invasion.

The Fed cannot save investors from supply chain problems or war, but it cannot ignore the risks of an inflationary spiral associated with them. Therefore, the FOMC officials sound hawkish, making the derivatives market believe in six or seven rate hikes in 2022.

The FOMC officials agree that the policy should be tightened, but there are arguments over how quickly they should raise the rates. James Bullard believes that the federal funds rate should rise by 100 basis points over the next three FOMC meetings, but other Fed’s policymakers are not that aggressive. Federal Reserve Bank of San Francisco President Mary Daly and her Philadelphia Fed peer Patrick Harker says the Fed should taper monetary stimulus gradually. Minneapolis Fed president Neel Kashkari warns that aggressive monetary tightening could press down the US economy. Cleveland Fed president Loretta Mester suggests pausing after two or three rate hikes and looking at incoming data.

The Fed won’t delay the start of monetary tightening because of the events in Ukraine. However, six or seven rate hikes in 2022, signalled by the derivatives market, look too aggressive. Investors are running to extremes selling off US stocks amid Joe Biden’s comments that a Russian invasion of Ukraine could take place within the next few days.

The euro is surprisingly stable amid the drawdown of US stock indexes. Capital inflows into US ETFs increased in February from $20 billion to $40 billion, while the investments in European ETFs declined from $26 billion to $4 billion. Therefore, investors believe that the euro-area economy will be weaker than the US because of the energy crisis and geopolitics.

Weekly EURUSD trading plan

Therefore, if the Russia-Ukraine conflict soon ends and the key factor of Forex pricing is the monetary policy, the EURUSD stabilization in the range of 1.134-1.1380 could be explained by the words of the ECB’s chief economist about monetary normalization and the expectations of Russia-US negotiations next week. The pair should continue trading flat, although the rise in should support the euro. It is still relevant to buy.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.