Hawkish ECB and an unpleasant surprise from US retail sales forced EURUSD to fluctuate a lot. Why did this happen? Let’s discuss this topic and make up a trading plan.

Weekly US Dollar fundamental forecast

The Fed really wants the market to work for it, while the ECB is very aggressive. A serious confrontation of the world’s largest central banks will soon come to Forex. The strongest EURUSD fluctuations at the December 15 trading session proved this. Having soared above 1.07, the main currency pair plummeted down amid the collapse of stock indices after disappointing data on US retail sales. So the bad news for the economy has suddenly become bad for stocks as well?

Over the past few months, there has been a confrontation between the markets and the Fed. Investors relied on a dovish reversal, while the Fed severely punished them for it. However, under the influence of slowing inflation, the US regulator was forced to reduce the speed of monetary restriction, which immediately affected stocks, bonds, and the US dollar. Financial conditions have returned to June levels, which complicates the return of prices to the target. What should the central bank do?

Fed officials see that investors are no longer afraid of inflation. Slowing the CPI to 7% increases their greed. Neither the increase in the ceiling of the federal funds rate from 4.6% to 5.1%, nor the increase in forecasts for the base PCE from 3.1% to 3.5% in 2023 help. Derivatives still forecast inflation at 2.6% in 12 months and a 50 bps rate cut from its high in 2023. If the market is no longer afraid of high prices, you need to intimidate it with something else. For example, recession. This is the only way to stop the S&P 500 rally.

The Fed worsens the GDP forecast for 2023 from 1.2% to 0.5% and raises the unemployment estimate to 4.6%, which is in line with the economic downturn. The impending recession is bad news for stocks and good news for the US dollar, which should tighten financial conditions. Not surprisingly, stock indexes collapsed in response to an unpleasant surprise from retail sales.

Thus, the Fed is playing by its own rules, hoping that the markets will help it do its job. This gives the EURUSD bears hope for a strike back. However, their opponents have a very powerful ally, the ECB.

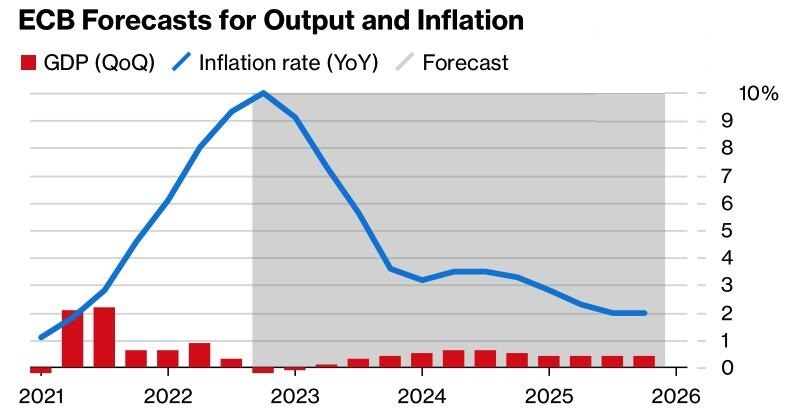

It’s been a while since ECB was such hawkish. Despite the increase in the deposit rate by 50 bps, and not by 75 bps as before, ECB officials announced the launch of a €15 billion QT in March, while Christine Lagarde warned that price pressure may increase in early 2023. Thus, the ECB will have to make a lot of effort to return prices to the target. According to the forecast that this will happen no earlier than in three years means that rates will continue to rise. Societe Generale believes that they will grow to 3.75%.

Weekly EURUSD trading plan

The Fed deliberately scares the markets with a recession, since they are no longer afraid of inflation, while the ECB is determined to continue monetary restriction. In the medium and long term, this means that the EURUSD rally will continue, but in the short term, the risks of correction are growing. In this regard, the fall of the pair below 1.0625 and 1.0595 serves as a reason for sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.