Alpha, beta, and delta variants of COVID-19 used to cause turmoil in financial markets. Omicron appears in late November. Before that, few people knew this letter of the Greek alphabet. Now, we have to learn it. Let us explore the influence of the pandemic on Forex and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

While most investors were scared by the new strain of COVID-19 hailing from South Africa, the more forward-thinking have adopted a risk-and-hedge strategy. Perhaps the omicron will hinder the global economic recovery, but ultimately humanity will find a way to defeat it, which means the panic will not last long. Is the strategy of March 2020, buying income-generating assets on drawdowns, relevant today?

The primary beneficiaries of the new coronavirus variant have become the funding currencies, such as the euro and the yen. Their volatility has risen sharply, forcing carry traders to sell emerging markets’ currencies. As a result, the EURUSD pair featured the best growth since December. The losers are the currencies whose exchange rates already include the chances of rate hikes by central banks. Among the G10s, these are the Norwegian krone, Canadian and New Zealand dollars, and the greenback. Before the news about the omicron, the derivatives market bet on three Fed’s rate hikes in 2022б now it seems less likely. If the new COVID-19 variant disrupts the global economic recovery, central banks will have to abandon normalization and return to easing monetary policy.

Doctors from South Africa say people infected with the omicron do not have any dangerous symptoms, and Pfizer has announced that it will develop the vaccine against the new variant of COVID-19 in early 2022. Markets have been somehow reassured. However, high volatility is expected at the turn of November and December, both in Forex and the US bond market. 10-year Treasury yield has had the worst drop since March 2020, weakening the US dollar against a basket of currencies.

The FOMC officials downplay the impact of the new COVID-19 variant on the economy. Raphael Bostic says he is hopeful that the momentum of the US economy will carry it through the next wave of the coronavirus pandemic, and the past experience will help defeat the omicron, which is unlikely to create more economic problems than the previous coronavirus variants. Atlanta Federal Reserve President remains open to accelerating the pace of the central bank’s bond taper. He hopes to finish the bond purchasing programme by the end of the first quarter and see two rate hikes in 2022.

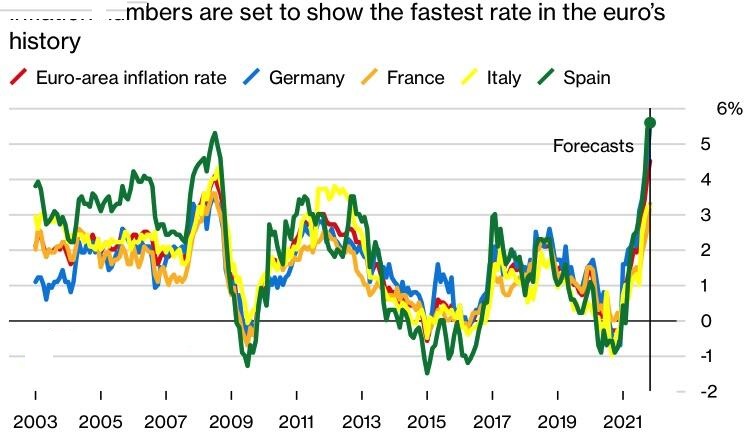

In theory, the EURUSD bulls could be supported by the acceleration of euro-area inflation from 4.1% to 4.4% in November, a record level for the entire existence of the euro. In such circumstances, the ECB must sound hawkish. In fact, the central bank expects a slowdown in CPI already in the first half of 2022, the surge in consumer prices is driven by soaring energy prices, while core inflation is unlikely to rise above 2.2%.

Weekly EURUSD trading plan

If markets shortly recover from the turmoil caused by the omicron, the EURUSD downtrend should soon restore. If the pair fails to consolidate above 1.1325 – 1.1335, it will signal the bulls’ weakness and give a reason to sell the euro. Otherwise, the negative news about the new coronavirus variant will allow the bulls to develop a correction up.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.