Just a fortnight ago, investors believed the Fed would bring the interest rate to 3.5% by mid-2023, and the FOMC hawks wanted to see the suggested level by the end of 2022. Nonetheless, the situation has changed in late May. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

Although markets are growing on the news, they look at the facts. The fact is that investors expect the US economy to weaken and inflation to slow down. If so, the Fed could be far less aggressive than currently expected. That is why investors are exiting USD longs and sending the EURUSD up.

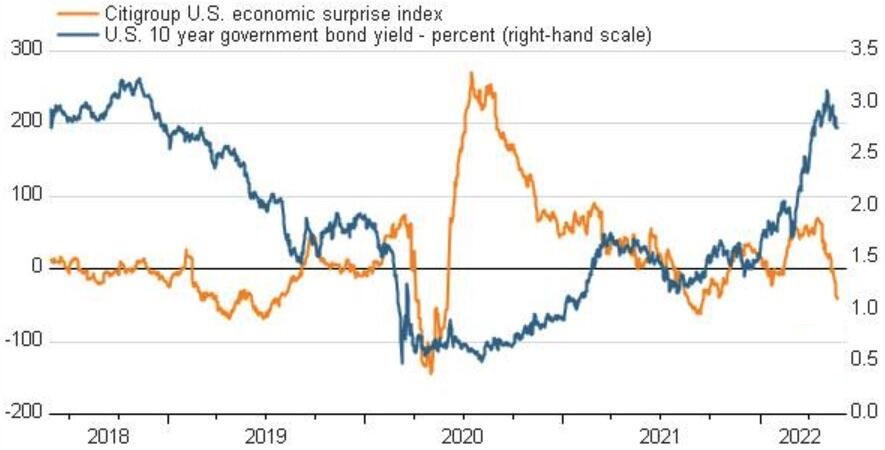

A series of weak reports on the US PMI, new home sales, durable goods orders, and GDP sent the US economic surprise index to the lowest level since September 2021. If a moderate start of the Fed’s monetary tightening and hawkish speeches of the FOMC officials have significantly tightened US financial conditions, what will be next?

The Fed, of course, has made progress. The St. Louis Fed President James Bullard not long ago said that the Fed had barely lifted a finger when the US economy responded. The federal funds rate will grow to 2% in June and July. What’s next? Will the US economy move closer to a recession?

According to Bank of America, the Fed will suspend the process of monetary restriction in September if financial conditions tighten further or inflation slows down. This scenario seems quite likely to me. According to a study by the New York Fed, short-term inflation expectations are rising, while long-term ones have drawn a plateau. Jerome Powell and his colleagues managed to get things done with minimal means, so it may not be worth going too far with an aggressive increase in borrowing costs, reducing the economy’s chances of a soft landing.

The Congressional Budget Office forecast suggests a slowdown in the US GDP from 3.1% to 2.2% in 2023, which is lower than 2.6% in 2019, that is, before the pandemic. Inflation, which currently exceeds 8%, should decrease to 4.7% by the end of this year, and next year it will fall to 2.7%. With consumer prices moving like this and a recession looming on the horizon, the Fed would have no reason to raise the federal funds rate above 3%.

Currently, the derivatives market expects the federal funds rate to rise by 50 basis points in June, by another half a point in July, and finally by a quarter a point in September. If the US domestic data continue to be disappointing and inflation slows down, CME derivatives will begin to signal a pause in the rate-hiking process at the end of the third quarter. And that’s bad news for the US dollar. Another reason to sell the greenback will be a weak core PCE report, as Bloomberg economists expect it to shrink from 5.2% to 4.9% in April, as well as a poor US jobs report.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.