The market cannot fall indefinitely. Sometimes corrections occur in a bearish trend. Will EURUSD buyers be able to arrange one? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental analysis

Due to strong corporate data, the best daily rally in US stock indices over the past month allowed the euro to cheer up. EURUSD bulls managed to return the pair above level 1.08. However, the problems of high inflation, the armed conflict in Ukraine, and the COVID-19 outbreak remain. This is how the market works. Eventually, after recessions, buyers bounce back, and corrections occur.

Despite the S&P 500 growth on April 19, the IMF warns that the Fed’s desire to curb inflation could lead to more aggressive monetary tightening than investors currently expect. As a result, the sell-off of stocks and bonds may continue. The debt market decline has been called the worst in a generation. The 10-year Treasury yield is very close to 3%, which was facilitated by FOMC officials’ hawkish comments. According to Minneapolis Fed President Neel Kashkari, if global supply chain disruptions persist, the central bank will have to act aggressively to reduce inflation. Chicago Fed chief, Charles Evans, is satisfied with 2022 rate hikes, including at least two big 50 basis points moves.

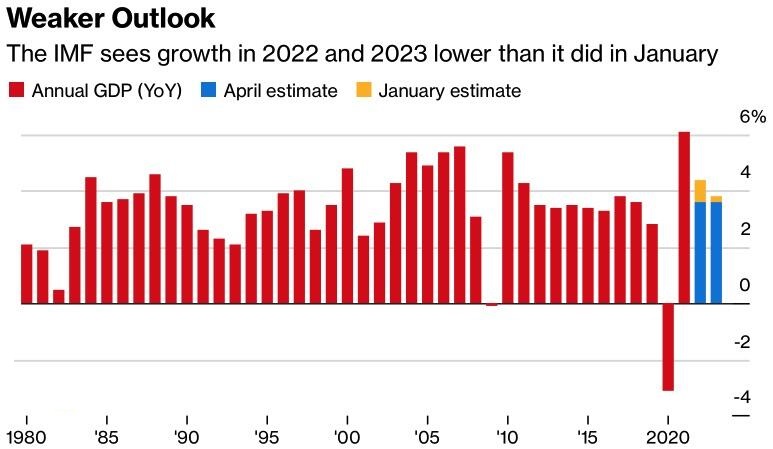

According to the IMF, the high speed of the Fed’s monetary policy tightening will affect the financial markets and the economy. IMF officials predict that US GDP in 2022 will grow not by 4%, as expected in January, but by 3.7%. 0.3% is a drop in the bucket compared to 1.1% for the Eurozone. The IMF has lowered its GDP growth forecast for the European currency bloc from 3.9% to 2.8%, citing the negative consequences of the armed conflict in Ukraine. In general, the global economy will expand not by 4.4% but by 3.6%.

The faster growth of the US economy compared to the European one and the divergence in the Fed’s monetary policy and the ECB do not leave the EURUSD bulls a chance. The best they are capable of is a correction. However, the euro buyers must cope with political uncertainty before going ahead. According to opinion polls, before the debate on April 20, Emmanuel Macron is ahead of Marine Le Pen by 10%. However, everything will be decided in the second round. If the opposition leader wins, European stocks are expected to fall and French debt to be sold off, while EURUSD will head towards parity.

The final results of the election will be known only in June when it becomes clear whether Le Pen won a majority in parliament to support her proposals to revise the free trade agreement and restore border controls.

Weekly EURUSD trading plan

Thus, despite the local success of the euro, the EURUSD downtrend continues. It is possible to sell the pair when the price rebounds from resistances at 1.085, 1.092, and 1.095 unless the bulls have enough strength to get to these levels.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.