It would seem that the positions of the EURUSD buyers are hopeless. Both monetary policy and economics play into the hands of their opponents. However, when there is no chance left, Santa Claus helps. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

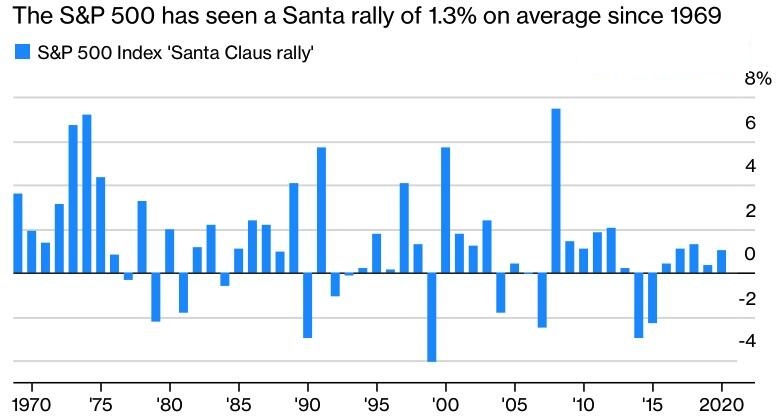

The Santa Claus rally in the US stock market keeps EURUSD from falling. An event that takes place five days before and two days after Christmas happens with 80% probability and brings about 1.3% to the S&P 500 growth on average. It doesn’t matter what drives stock purchases during this period, whether it’s optimism about the upcoming New Year, holiday spending, traders’ vacation or organizations that draw up the balance. The main thing is that investors believe in Santa.

The 69th record close of the S&P 500 is impressive, but the situation risks turning upside down in 2022. A slowdown in GDP growth and corporate profits, a tightening of the Fed’s monetary policy, an overvaluation of stocks and an increase in bond yields will all contribute to the correction of the US stock index. As a rule, it indicates a deterioration in global risk appetite and supports the US dollar.

According to Atlanta’s Fed leading indicator, the US economy will expand by 7.6% in the fourth quarter. Nevertheless, Moody’s Analytics lowered its forecast for January-March from 5.2% to 2.2%, justifying its decision by Omicron’s negative impact on consumer and business activity. According to the company, the effect of the new COVID variant on GDP has a lot in common with Delta. The previous strain of the virus slowed down the US economy from 6.1% to 2.3% in the third quarter of 2021. Pantheon Macroeconomics is of a similar opinion. Analysts of the consulting firm have lowered their estimate of GDP growth in January-March from 5% to 3%.

Uncertainty about the economic impact of Omicron keeps the 10-year US Treasury yield stable. Meanwhile, 2-year rates hit a 22-month high, signaling that the Fed will turn a blind eye to a GDP growth slowdown early next year and implement its aggressive plan to raise the federal funds rate by 75 bps. The likelihood that borrowing costs will increase in March is about 50%. If they start to grow, it will immediately encourage EURUSD bears to go ahead.

Meanwhile, the People’s Bank of China has signaled about the possible monetary policy easing in 2022. Bloomberg experts expect the PBoC to reduce the standard contributions to the reserve fund and lower interest rates to help the slowing Chinese economy. Monetary expansion is likely to support domestic demand, including demand for commodities. Rising commodity prices will further accelerate inflation, which in turn will push the Fed to aggressively raise rates and benefit US dollar buyers.

Weekly EURUSD trading plan

In my opinion, traders should not expect a serious correction and the downtrend’s break, although the EURUSD pair is much closer to the upper border of the consolidation range of 1.1225 – 1.1355, which increases the risks of its breakout. The Euro Rally creates ideal conditions for its sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.