Despite the best EURUSD daily rally over the past six years on March 9, the overall downtrend continues. Let us discuss the reasons for the domination of bears and make up a trading plan.

Weekly euro fundamental forecast

The euro area is facing stagflation, the prices are rising while the GDP expansion is slowing down. There is a dispute between the hawks and the doves of the governing council. As a result, there are both wild changes in forecasts and ambiguous wording. All this generates a sense of panic among ECB members. The EURUSD was jumping up and down amid the release of the ECB meeting’s outcomes, the US inflation report, and news from Ukraine. The euro surged above $1.11 and dropped below $1.1.

At first glance, the ECB gave a hawkish surprise, announcing a faster QE tapering. The pace of asset purchases under QE will be slowed down from €40 billion in April to €30 billion in May and to €20 billion in June, although it was previously expected that there would be a gradual reduction from €40 billion to €20 billion by October. Unconventional monetary policy could end in the third quarter. The previous plan was for October. On the other hand, the European Central Bank abandoned the idea of ending QE shortly before the rate hike, saying that it will happen after the QE end and will proceed gradually. This can be interpreted as the victory of doves.

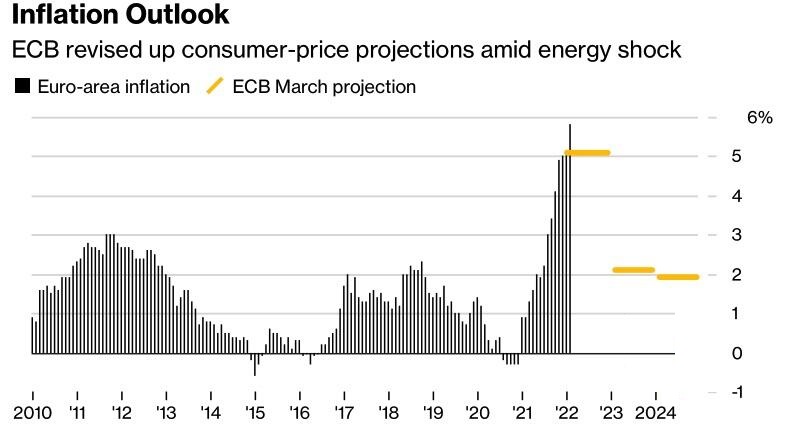

The ECB forecasts have been radically changed. Estimated inflation in 2022 has been raised from 3.2% to 5.1%, although the ECB still expects it to fall below its 2% target in 2024. GDP will grow by 3.7%, not 4.2%, as previously expected. In the negative scenario, the economic expansion will be 2.3%.

The ECB tried to sound optimistic, but more and more experts talk about a recession in the euro area because of the depression of the turmoil in the commodity market associated with the events in Ukraine. The proximity of the currency bloc to the conflict zone, its dependence on energy supplies from Russia make this scenario quite plausible. According to Goldman Sachs, the region will face a decline in GDP already in the second quarter, and inflation will rise to 8%. At the same time, US Treasury Secretary Janet Yellen calls the US economy strong and the job market outlook excellent. She does not see any risk of recession.

Markets did not believe in the ECB’s hawkish surprise. They expect a 43-basis-point increase in the deposit rate in 2022, which is nothing compared to the expected 165 basis-point hike in the federal funds rate. Moreover, inflation in the USA in February accelerated to 0.8% monthly and 7.9% on an annual basis and can continue rising. The divergence in the economic growth and monetary policy supports the EURUSD downtrend. Furthermore, ABN Amro considers the pair’s drop to parity as the base scenario. According to the bank, when there is a panic in the market, investors prefer safe-haven assets, and the turmoil will continue for a long time.

Weekly EURUSD trading plan

I believe the ongoing divergences in the economy and monetary policy, the continued uncertainty regarding events in Ukraine, and the associated high demand for safe-haven assets are the reasons to sell the EURUSD down to 1.09 and 1.065.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.