The ECB spends no effort to stop widening of the euro-area bond yield spread. Financial markets were calmed down, and the EURUSD stabilized. The talks about a recession in the US press down the US dollar. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Jerome Powell says it is difficult to curb inflation and avert a hard landing but possible. The problems of the ECB and the BoJ look more serious. They have to fight against rising prices and markets. The BoJ is to defend bond yield targets, and the ECB is to counter the growing risks of the euro-area break-up, as the bond yields in some countries rise faster than in others. Investors believe that Christine Lagarde and her colleagues will solve this problem. This circumstance is one of the factors of the EURUSD stabilization.

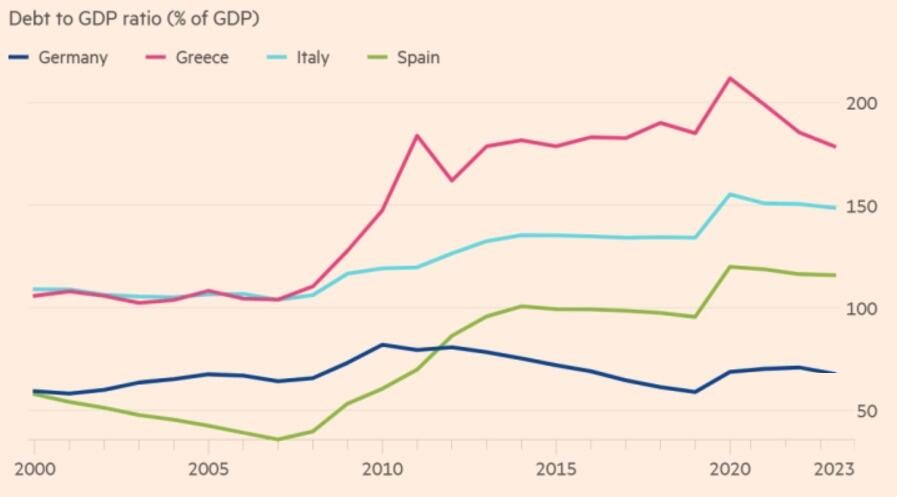

In fact, suppressing the highest-ever inflation and preventing a sharp rise in bond yields are two mutually inverse tasks. When the central bank follows the path of monetary tightening, the debt market rates also rise. Due to the heterogeneity of the currency bloc’s economies, including different debt-to-GDP ratios, investors are dumping Italian securities faster than German ones. As a result, the bond yield spread widens, which reminds me of the euro-area debt crisis in the early 2010s.

At that time, Mario Draghi reassured the markets, saying that the ECB would do everything necessary to save the euro, which calmed the financial markets. Now, the markets are cheered up due to ECB’s anti-fragmentation program. It is likely to include active purchases of Italian, Greek, and other debts and the simultaneous sale of bonds of other countries on the balance sheet.

Earlier, the wealthy Northern countries resented liquidity injection into the peripheral member states. Now, the ECB’s hawks do not argue, supposing the use of the anti-fragmentation package will allow the ECB to raise rates higher than otherwise.

It seems that the European Central Bank took into account the experience of the Fed and its own concerning inflation. It will not wait until something breaks (CPI will skyrocket). The regulator believes that something is already broken (the debt market). The willingness of Christine Lagarde and her colleagues to take active steps encourages the EURUSD bulls.

The US dollar is pressed by a new round of talks about recession. Experts polled by Wall Street Journal give a 44% chance that the recession will happen within the next 12 months, which is higher than the April (28%) and January (18%) polls. Furthermore, ahead of the 2007-2009 crisis, the chance was 38%; ahead of the 2020 recession, it was 26%. According to the Conference Board, 60% of 750 CEOs and other senior executives expect the US economy to contract within 12-18 months. Bank of America puts a 40% chance of a recession in 2023, and the New York Fed puts an 80% chance of a hard landing.

Weekly EURUSD trading plan

The last time investors were talking about a recession, the president of the Atlanta Fed, Raphael Bostic, suggested a pause in the Fed’s monetary tightening, sending the US dollar down. If the FOMC officials say something like that now, the EURUSD could break out the resistance at 1.056, encouraging traders to enter short-term longs.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.