An increase in global risk appetite is bad news for safe-havens, such as the US dollar. The dollar weakens amid the US stock market rally ahead of Christmas. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

Any rally, including the Santa Claus rally, needs a reason. Strong US domestic data and good news about the omicron form from South Africa and UK supported the growth in US stock indexes. An increase in global risk appetite presses down safe0havens, weakening the US dollar against a basket of major currencies. However, the drivers of the S&P 500 Christmas rally have controversial consequences for the EURUSD.

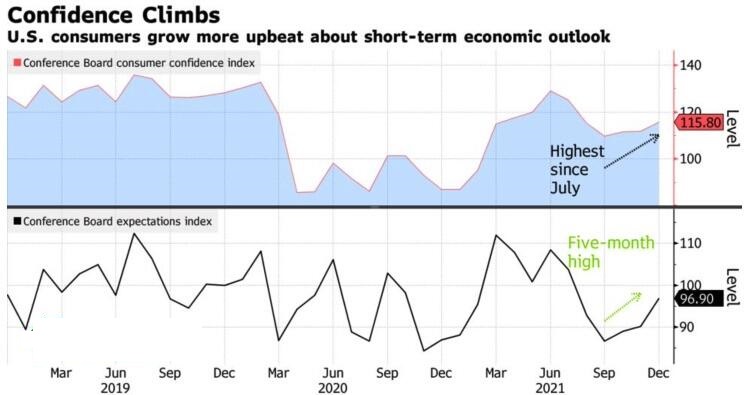

Stock buyers welcomed the strong data on US consumer confidence and easing concerns about inflation. The stock market rally is also supported by the news that the sales of homes in the US secondary market have been increasing for the third consecutive month; the US real estate market could finish the year with the best results since 2006. As the New Year approaches, investors are getting more clarity that the economy as a whole remains strong.

Nonetheless, the more positive US economic data are provided, the more likely the Fed will speed up monetary tightening, which will support the US dollar. Currently, the derivatives market evaluates the chances of the federal funds rate hike in March as fifty-fifty, and if they start to grow, the EURUSD bears will be encouraged to go ahead.

Of course, much will depend on inflation, which, according to more than 30% of the approximately 700 respondents in the global Markets Live Global Survey, is the greatest risk for financial markets in 2022. The logic is simple: central banks can be wrong when predicting consumer prices. They can either tighten monetary policy too quickly or, conversely, change it extremely slowly. In the first case, the economy may seriously slow down. In the second, inflation will spiral out of control.

The second tail risk in the equity markets is the pandemic, the spread of which is fraught with the introduction of new restrictions and a slowdown in global GDP growth. The third biggest risk is political issues, including US-China trade wars and other trade conflicts, as well as the threat of military conflicts, including between Russia and Ukraine.

In my opinion, a shift of focus to inflation can fundamentally change central banks’ viewpoint. Those of them who previously weakened their local currencies to support local exporters can take action to strengthen national currencies. If this process becomes widespread, further growth of the USD index will be difficult.

Weekly EURUSD trading plan

Amid the Santa Claus rally in the US stock market, the EURUSD has approached the upper border of the consolidation range of 1.1225-1.1355. If the price breaks out the resistances at 1.1355 and 1.1375, it could advance to 1.145. However, one should be prepared to quickly transform short-term purchases into sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.