The ECB officials’ speeches about raising rates in July encourage the EURUSD bulls. However, Forex pricing depends on the speed of monetary tightening rather than on the date of its start. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

Most traders follow the principle ‘buy the news, sell the facts’, and central banks take advantage of this. James Bullard says any Fed’s action tightens monetary immediately. The ECB also resorts to verbal interventions, as the regulator is not satisfied by high inflation or the euro exchange rate. However, investors don’t believe the ECB’s words, considering the EURUSD sell-offs.

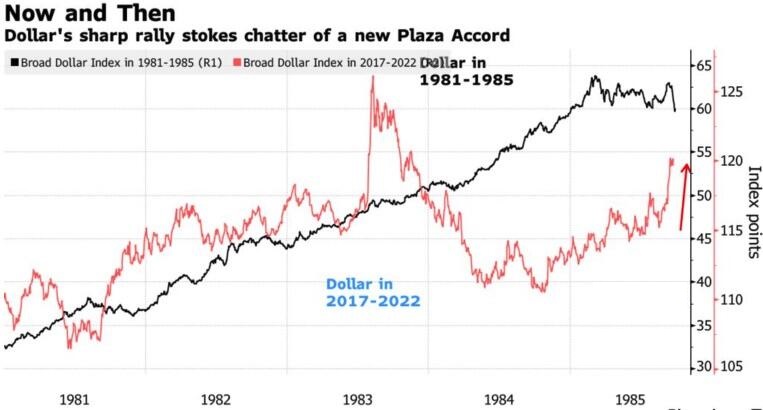

France and Germany are worried about a weak euro. Francois Villeroy de Galhau says the euro weakness is not in line with the ECB’s price stability goals, causing turmoil in financial markets and making investors wonder if there is a limit to the central bank’s patience. According to Deutsche Bank, a fall in EURUSD below 0.9 could trigger a coordinated foreign exchange intervention along the lines of the Accord Plaza in 1985. In the five years prior to that agreement, the trade-weighted USD index rose 12%. From 2017 to 2022, its growth was 14%.

Dynamics of trade-weighted USD index

Just as then, the US is suffering from high inflation, and the Fed is willing to hike the interest rates aggressively. The parallels are obvious, but I personally have one question. Why should the Fed, which is actively tightening financial conditions, weaken them by depreciating the dollar? Perhaps this would be appropriate in case of a recession, but not now. It is unlikely that the EURUSD bears should be discouraged by the possibility of a coordinated foreign exchange intervention.

The ECB, conversely, is interested in interventions as it understands the negative consequences of the euro drop against the backdrop of the energy crisis. Being a net importer of commodities, the euro area faces a sharper rise in prices. The policymakers can only talk about the excessively low exchange rate of the regional currency and convince the markets of the deposit rate hike in July. At the same time, Bloomberg experts suggest the interest rate should come out of the negative zone by December. Still, they do not agree with the opinion of the derivatives market about increasing borrowing costs by 110 basis points by the end of 2022. This will be harmful to the euro area in its current position.

Dynamics of market expectations for ECB interest rates

The Bank of France estimates that a 1% increase in rates will increase debt servicing costs by €40 billion over ten years, which is equivalent to the country’s defense budget. But the euro area, amid the crisis in the cost of living and the war in Ukraine, is forced to increase spending, raising the amount of borrowing. It will take $317 billion just to move away from dependency on Russian gas.

Weekly EURUSD trading plan

In such an environment, the ECB can’t afford to raise the rates aggressively, unlike the Fed. Therefore, the EURUSD downtrend remains strong. Sell trades entered at level 1.053 are already yielding profit. If the price goes below level 1.046, one could consider adding up to the shorts.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.