The start of the Fed’s monetary tightening cycle and the FOMC hawkish forecasts should have strengthened the US dollar. However, the greenback is feeling under the weather amid the rise in stock indexes. What’s the reason? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

What does the market fear? Continued armed conflict in Ukraine, the spread of COVID-19 in China, a weak economy, and an overly aggressive Fed. The talks about the progress in ceasefire talks between Moscow and Kyiv, a drop in the number of new coronavirus cases in China, the rise in the US retail sales by 0.3% M-o-M in February, and the fact that the Fed hasn’t begun the monetary tightening cycle with a half-a-point rate hike have resulted in the best S&P 500 two-day rally since April 2020. The EURUSD bulls have been encouraged to go ahead.

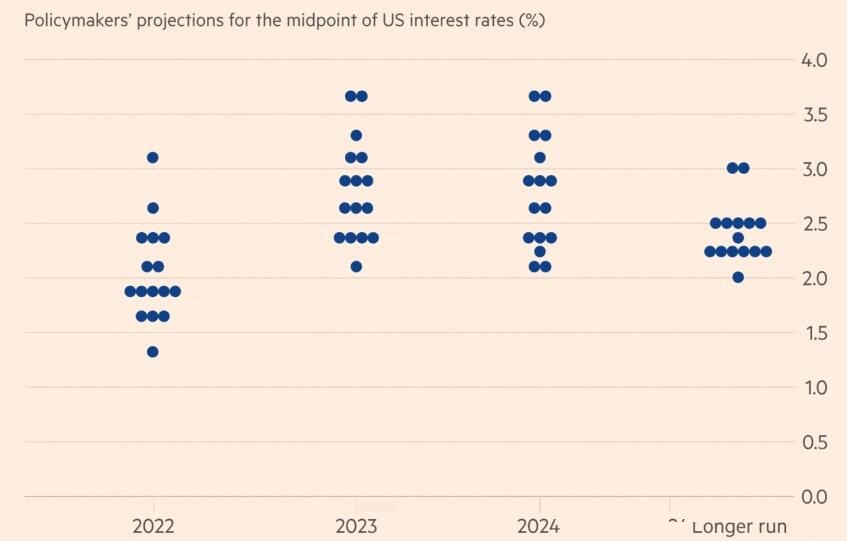

The Fed raised the federal funds rate by 25 basis points for the first time since 2018. The FOMC median forecast assumes that the borrowing costs will rise to 1.875% by the end of 2022 and to 2.75% in 2023, which implies seven quarter-point increases this year and three or four next year. Seven officials want even more activity in 2022, which means a more aggressive monetary restriction than in 2015-2018 when borrowing costs rose following nine meetings of the Committee. The current trajectory is more like in 2004-2006 when the central bank raised rates 17 times in a row.

Jerome Powell says the Fed is determined to bring the country back to price stability and the US economy is very strong and well-positioned to endure tight monetary policy. Considering the rise in stock indexes, the stock market believes the Fed Chair, in contrast to the bond and futures markets. Investors assume a high risk of a recession, as indicated by the inversion of the spread between the yields of 10-year Treasuries and two-year Treasuries. Markets doubt that the US economy won’t crash under borrowing costs at 2.75%. Such a serious forecast, which, by the way, is higher than the neutral rate of 2.4%, may indicate that the Fed is behind schedule. The only way to catch up is to raise rates by half a point at the next FOMC meeting.

Interest rate swaps signal a high probability of a 75-basis-point rate hike at the next two FOMC meetings. Besides, the chance of the rate hike by 50 basis points is estimated as four to five.

Furthermore, the FOMC has lowered its GDP forecasts for 2022 to 2.8% from the previous reading of 4%. The uncertainty around the conflict in Ukraine and the epidemiological situation in China make me feel that markets are suffering an illusion.

Weekly EURUSD trading plan

The outbreak of the COVID-19 is still not resolved, the conflict in Eastern Europe continues, and the Fed could raise the federal funds rate by half a point in May. Why are S&P 500 and EURUSD rising? Markets want good news and price some positive in the quotes of the asset. However, one should get realistic. Uncertainty and Fed’s aggressive monetary tightening suggest investors sell the US dollar. If the EURUSD doesn’t go above 1.1055-1.1075, it will be relevant to sell.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.