In early 2022, some investors expected that the EURUSD downtrend could turn up in the second half of the year. The war in Ukraine has put off this idea. Is the euro trend to turn up soon? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

When one race car starts to accelerate and the other, on the contrary, slows down, the illusion of overtaking arises. Ultimately, it is not a fact that the catcher will really increase speed and be able to overcome the handicap, and the one in front will slow down. But investors don’t need facts, they buy news. The speculation that the ECB could tighten monetary policy faster than expected has sent the EURUSD to its monthly high.

Christine Lagarde noted in her blog that the ECB could exit its 8-year experiment with negative rates by the end of the third quarter. This implies an increase in the deposit rate to zero at two of the next three meetings of the Governing Council by 25 basis points each. Earlier, officials spoke only about the start of the monetary tightening process, presumably in July. Now its speed is supposed to be increased, which encourages the EURUSD bulls.

According to Lagarde, after September, the ECB is likely to continue to raise borrowing costs to a neutral level, which neither stimulates nor constrains the euro-area economy. Earlier, Governing Council officials suggested that the rate should be in the range of 1%-1.5%. According to Commerzbank, at each of the seven meetings from July to April 2023, the European Central Bank will raise the deposit rate by 25 basis points and bring it to 1.25% by the end of the period. The derivatives market expects the ECB rate to rise by 110 basis points by the end of this year.

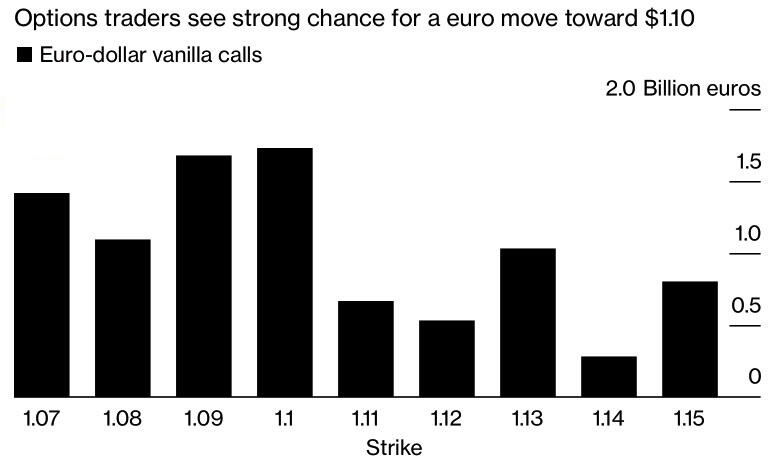

The hawkish stance of Christine Lagarde narrowed the yield spread between US and German bonds, which strengthened the euro and increased the popularity of EURUSD buy bets to 1.1 in the options market.

The rally of the main currency pair would hardly have been so impressive if it were not for talks about a slowdown in the Fed’s monetary tightening process. Atlanta Fed President Raphael Bostic supports the idea of raising the federal funds rate by half a point at each of the next two FOMC meetings in June and July but believes that a pause should be made in September. Kansas City Fed President Esther George also speaks about adjustments in the monetary policy tightening process starting from August.

The idea of the EURUSD trend reversal up due to a slowdown in the Fed’s monetary tightening and the ECB’s willingness to start raising interest rates in July was being discussed in Forex in early 2022. However, the war in Ukraine, the associated energy crisis, and fears of stagflation have encouraged investors to buy the US dollar. According to Deutsche Bank, the financial world has accumulated too much US currency, which led to its revaluation. Now, investors are selling the greenback off.

Weekly EURUSD trading plan

The new story is the old one. The idea of the euro trend reversal is good, but the conflict in Ukraine is far from easing, and there are risks of a UK-EU trade war. The EURUSD rally should not go far. If the price goes below 1.065, one could consider entering short trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.