In 2022, stagflation, a combination of high inflation and a halt in economic growth, contributed to the USD strengthening. Investors believe that prices will continue to slow down in 2023. But what if this does not happen? Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly Euro fundamental forecast

Worries about a new round of inflation in 2023 led to increased Treasury bond yields and a fall in stock indices. The Santa Claus rally in the US stock market is postponed. It may even be canceled. In this case, EURUSD will not be able to break above 1.0655 and consolidate there. This was proven by another failed test of the upper border of the short-term consolidation range.

China’s decision to ease COVID restrictions has caused investors to worry about the biggest tail risk in 2023. Despite the rise in COVID cases, China is moving towards reopening the economy. On the one hand, this is good news for risky assets. On the other hand, this contributes to the growth of inflationary fears. China is the world’s largest consumer of raw materials, and rising domestic demand could trigger a new super-cycle. Annandale Capital analysts predict Brent to rise to $120 per barrel. Rising energy costs will accelerate inflation, forcing the Fed to return to aggressive tightening.

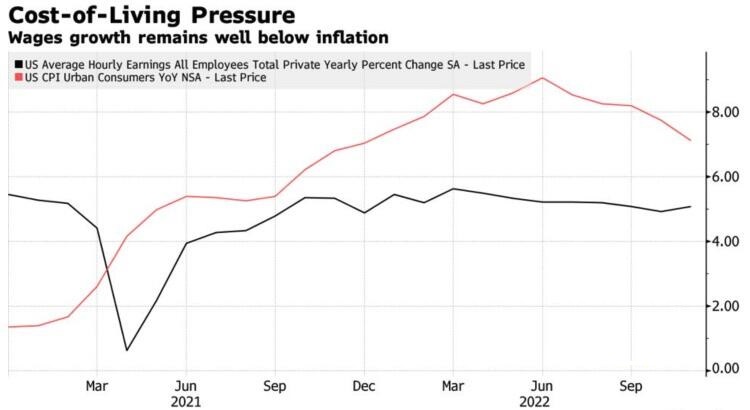

There is another reason for concern. Nikko Asset Management experts call 2023 the year of the battle of workers against treasurers, for whom the issue of salary increases, including mass strikes, will become a real headache. If the treasurers are satisfied, stagflation is inevitable. This is bad news for stocks and bonds and good news for the US dollar.

Similar trends are taking place in other developed countries. Not surprisingly, ECB Vice President Luis de Guindos is calling for prudent action. According to him, the Eurozone economy is in an extremely difficult situation. High inflation rates are combined with a halt in economic growth. In such an environment, individuals and businesses to be careful and focus on the long term. This sounds like an implicit message not to demand higher wages, which will further drive inflation.

At the end of 2021, the Fed and the markets believed that inflation would slow down. Now they are expecting a similar dynamic from consumer prices. If the forecasts were wrong in 2022, why won’t the same happen in 2023? Resuming stagflation will contribute to the S&P 500 decline, pushing up Treasury yields and strengthening the US dollar.

Weekly EURUSD trading plan

Inflation will continue to slow down, and the Fed will stop raising the federal funds rate in the first half of 2023. Expecting EURUSD to strengthen in the medium term looks reasonable, but anything can happen in the short term. Without a Santa Claus rally in the US stock market, EURUSD is unlikely to stay above 1.06. Use the euro decline below the support of 1.061 for sales.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.