The EURUSD is falling fast and has nothing to cling to. Will the US GDP and European inflation data help the bulls? Let’s discuss it and make a trading plan.

Weekly fundamental forecast for euro

An energy crisis and fears of another economic recession worldwide have turned the EURUSD bulls into whipping boys. The main currency pair came close to the level of 1.05. Its breakout will increase the risk of reaching parity for the first time in 20 years. But first, sellers need to update the minimums of 2017 and December 2020 at 1.034 and 1.02.

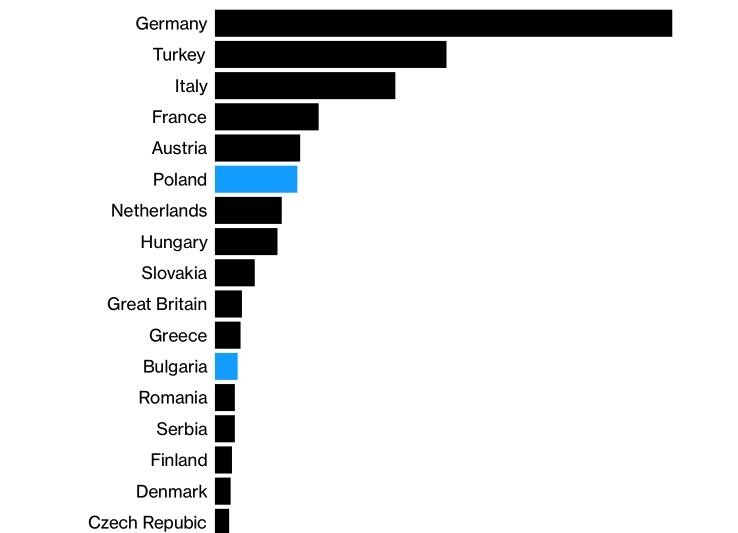

Cutting off natural gas supplies to Poland and Bulgaria was interpreted differently in Europe. Someone called this step the Kremlin’s “adventure” and “bluff,” while someone believed it was the beginning of gas wars. Other countries from the “unfriendly list” may follow Poland and Bulgaria soon. Even if the gas price has not reached March’s peaks yet, its 11% growth amid halting supplies to Warsaw and Sofia speaks loud and clear. The situation is getting worse against the backdrop of the euro’s fall because gas prices are expressed in dollars in global markets. The countries that depend on Russian gas supplies the most are seriously at risk.

The German economy is at the edge of recession, while the US GDP’s slowdown from 6.9% to 1.1% in the first quarter does not mean the USD weakness. In fact, the main trouble of January-March concerned gas stockpiling, which was not as fast as in October-December. However, when Europe is worried about the energy crisis and the war in Ukraine, the States may face an economic downturn due to the Fed’s policies. The Federal Reserve intends to aggressively tighten monetary policy, but a rate hike to 3-4% or even 5-6% does not guarantee a victory over inflation.

In the past decades, the global economy has been characterized by chronic weak demand and seemingly unlimited supplies of capital, workforce, and raw materials. That resulted in repressed inflation. Demand has recently grown up amid fiscal and monetary stimuli, whereas supply reduced because of the pandemic and the war in Ukraine. The Fed cannot control the latter process. According to the Federal Reserve Bank of New York’s research, there exists a strong correlation between inflation and the global supply chain pressure index. It’s supply issues that are the main factor in the growth of prices.

Two hundred Reuters experts think that central banks’ excessive ardor is one of the five key risks for the global economy. They will raise rates aggressively, but it won’t significantly reduce inflation. Instead, it may cause a recession. In such times, the US dollar feels at home.

Weekly trading plan for EURUSD

So, the EURUSD pair is reaching fast the targets mentioned earlier amid the energy crisis in Europe and the high demand for the greenback as a safe-haven asset. At the same time, weak stats on the US GDP and strong data on the European inflation can pull the pair back to 1.055 and 1.06. Such pullbacks can be used to sell the EURUSD.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.