Whereas Europe and America have forgotten about COVID-19, Asia faces the hugest outbreak since the pandemic. Lockdowns in China won’t do any good to the Chinese and global economies or the EURUSD. Let’s discuss it and make a trading plan.

Weekly fundamental forecast for euro

Trouble comes in threes. Besides the war in Ukraine, the Fed’s policy tightening, and expectations of weak corporate reports for US technology companies, there is now another negative factor — a new outbreak of COVID-19. Investors believe it’s the most dangerous occurrence for financial markets. A pandemic is approaching Beijing, which will not do any good to the Chinese economy, global GDP, or the EURUSD bulls.

It is believed that the USD index drops when the US economic growth rates fall behind. The driving force for the US economic growth is the US, China, and the eurozone. Unfortunately, we cannot expect that Europe will be able to resist the US economy as it’s close to the military conflict in Ukraine and depends on Russian oil and gas imports.

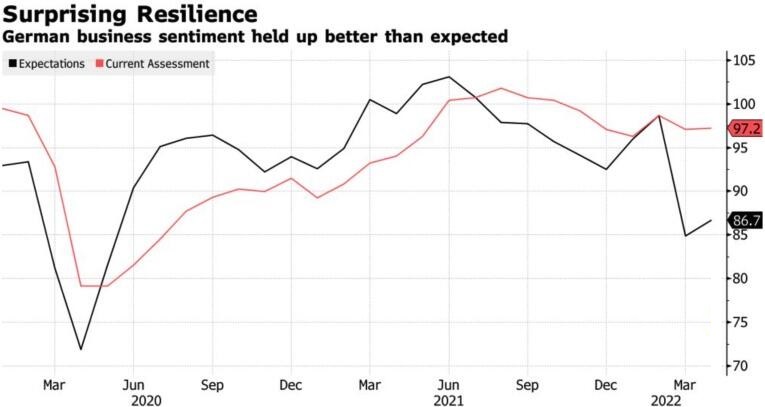

True, German IFO says that German business sentiment is gradually improving after the first shock which followed the aggressive Russian invasion of Ukraine. Goldman Sachs predicts the ECB will start raising rates in July, continue doing so in September and December, and finally bring them to 1.25% in 2023 due to stable domestic demand and breaches in supply chains. However, JP Morgan has downgraded forecasts for the eurozone’s GDP from 3% to 2.7% in 2022 and from 2.3% to 1.3% in 2023. The reasons for that are delayed effects of an embargo on Russian oil and gas imports and “headwinds” from China.

I have believed up to now that the USD dollar will dominate in Forex for some time due to geopolitics and the Fed’s intention to raise rates aggressively, and then the EURUSD bulls will take over the initiative. I wanted to think that the war in Ukraine would end soon, and the eurozone’s economy would recover faster, whereas the Fed’s large-scale policy tightening would slow down the US economy. Thus, I expected the euro/dollar to grow to 1.1 by the end of 2022.

Unfortunately, China’s trouble and the delayed effects have corrected my theory. The global economy may face stagflation, which combines extremely high prices and a serious GDP slowdown. The IMF has downgraded its forecast for the Chinese economy to 4.4% in 2022, which is much lower than Beijing’s official target of 5.5%. The outbreak of COVID-19 provoked the biggest daily sale of Chinese stocks in the past two years and made the yuan decline to its lowest since the end of 2020.

Weekly trading plan for EURUSD

When the eurozone and China make no progress, the global economy will hardly look better than the US. On the contrary, the idea of “US exclusivity” is making a comeback. That limits the EURUSD‘s potential. My advice is to hold short trades opened at 1.092 and build them up on pullbacks with targets at 1.065 and 1.06.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.