No matter how strong the trend is, a correction is inevitable. Whether it will start for EURUSD now or a little later is of no fundamental importance. Divergences in monetary policy and economic growth will be pressing the pair down. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The 66th record high of the S&P 500 in 2021 discouraged the EURUSD bears just as well as the rumors about the Bank of England’s rate hike after the release of the UK inflation data. However, taking profit is nothing more than getting rid of ballast. Most traders will hold down their shorts while the cowardly ones, as usual, will make far less of the profit. For a deep correction upward, there should be more significant factors, which have been missing so far.

Investors have at last understood Christine Lagarde’s words that bets on the ECB rate hike in 2022 do not correspond to the regulator’s plans. In her speech to the European Parliament, the ECB president stressed that tightening monetary policy will do more harm than good, and the conditions for the rate hike will not be met next year. As a result, money markets shifted expectations for the rate hike to 2023, and the euro has weakened against the US dollar and other world currencies.

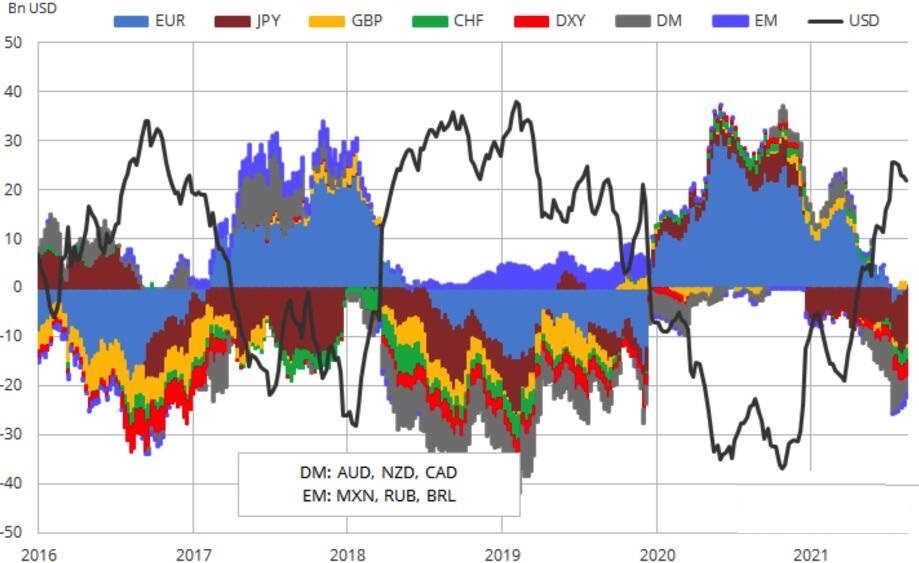

It should be noted that when EURUSD was trading near 1.1 at the end of 2019, the euro net speculative shorts were significantly higher than at present. The downtrend is far from being exhausted, and most investors understand this.

The EURUSD downtrend is based on divergence in monetary policy. While the ECB does not think about raising rates, the Fed is willing to tighten monetary policy. Even one of the most strong FOMC doves, the President of the Federal Reserve Bank of Chicago, Charles Evans, says that a rate hike in 2022 may be appropriate.

Reuters experts are more conservative. According to their consensus forecast, the federal funds rate will rise for the first time in the fourth quarter of 2022, followed by two more hikes in the first and second quarters of 2023. The rate is expected to reach 1.25%-1.5% by the end of 2023. At the same time, 27 out of 42 analysts believe that it is necessary to start tightening monetary policy earlier, in September. According to Bank of America, the double pressure of rising prices and wages will make the central bank raise the rates in the summer, if not sooner.

Reuters experts expect that the US GDP will accelerate from 2% to 4.8% in the fourth quarter, and by the end of 2022, the economy will expand by 3.9%. New York Fed President John Williams believes that the recovery is progressing steadily, the United States has a huge increase in employment, and unemployment is falling very quickly. However, things are different in the euro area with its energy crisis and the threat of an EU-UK trade war.

Weekly EURUSD trading plan

The divergence in monetary policy and economic growth will encourage the EURUSD bears for quite some time. Therefore, it is relevant to sell the pair on the rebound from resistances 1.143, 1.1455, and 1.1495 or if the pair goes down below the support at 1.133.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.