While markets are still ahead of the European Central Bank meeting, the prospects for the euro-area economy have become rather gloomy. How will this affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Euro fundamental forecast today

The US money has been nourishing the rest of the world for decades. Americans used to spend more than earn, which resulted in a permanent trade deficit, supporting the export-led economies of China and the euro area. But in April, the US trade deficit fell by $20.6 billion, or 19.1% M-o-M, the fastest pace on record. Warehouses in the USA are overwhelmed with goods, and high inflation undermines demand. If imports continue to fall, this will be bad news for the global economy but will support the US GDP and the greenback due to the rise of net exports.

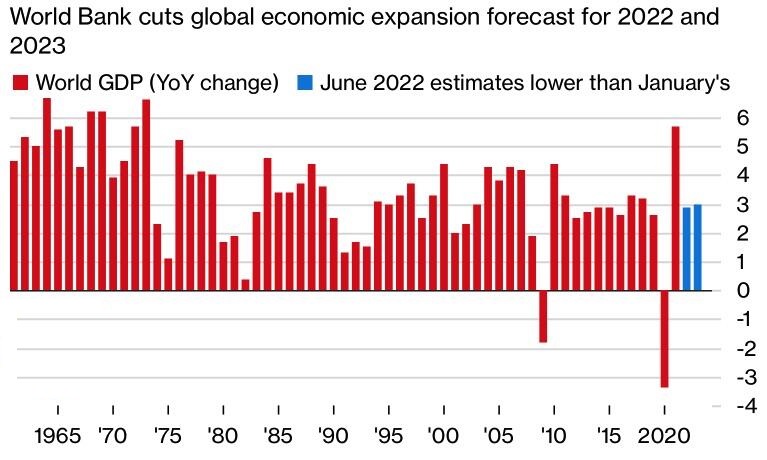

Lower US imports add more negative to the global economic forecasts, which aren’t that positive already. The World Bank, citing the damage from the war in Ukraine and COVID-19, lowered its estimate of global GDP for 2022 from 4.1% in January to 2.9%. In 2023, it will expand by 3%. This is the base scenario. On a downbeat, more aggressive than expected rate hikes by central banks and higher energy price growth will slow the rate down to 2.1% this year and 1.5% next year.

The forecast for the US GDP for 2021 was lowered by 1.2% and for the euro area – by 1.2%. But the situation could worsen, which will press down the forecast. Goldman Sachs believes that the escalation of the armed conflict in Ukraine and the cessation of Russian gas supplies to Europe will send the euro-area economy into a short but sharp recession. The IEA warns that in the event of a cold and long winter in the Northern Hemisphere amid increased economic activity in China, the euro area faces rationing of natural gas consumption, starting with large industrial facilities. Russia has already begun to redirect energy flows from Europe to Asia, and, most likely, these processes will accelerate.

Therefore, the euro-area economy problems should worsen by the end of the year, forming the ECB to suspend monetary tightening. Currently, the deposit market sees a deposit rate increase at every Governing Council meeting in 2022. Moreover, at one of the meetings before October, the central bank should supposedly make a rate hike of 50 basis points. At first glance, it looks logical. Isn’t it a mistake to think that it is possible to return inflation of 8.1% to the target of 2% by an insignificant increase in rates?

The ECB hawks go ahead, and Christine Lagarde expresses concerns. Being a lawyer by training, Lagarde consulted European Central Bank Chief Economist Philip Lane. However, Lane could be wrong in suggesting that gradual monetary tightening will curb inflation. Should the European centra bank be more aggressive? Expectations of the ECB hawkish surprise keep the euro from falling against the US dollar.

EURUSD trading plan today

The EURUSD naturally consolidates in the range of 1.063-1.077 ahead of the ECB meeting. Investors don’t take active steps, so I recommend waiting and seeing.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.