Has the US dollar reached its high? This is being discussed more and more on Forex every day. However, it is worth remembering that there are always two currencies in any pair, so can the EURUSD rise when the eurozone economy is struggling? Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast for a week

Markets react violently to important events that concern them, but then they begin to act rationally, just like people. EURUSD failed to consolidate above 1.03. Despite the fact that the latest inflation data showed the first reduction in import prices in seven months. Even though US stocks rose again, closing the fourth week in the green, the first time since the end of 2021. What is the point of buying the euro if the eurozone economy is frankly weak? It’s time to understand that the unstable US dollar will not save everyone. Fortunately, all is not lost for the USD.

The rally in US stock indices, based on expectations of a slowdown in the Fed’s monetary restriction, forced hedge funds to actively sell USD as a safe-haven asset. In the week ending August 9, hedge funds became net sellers of the US dollar against eight major world currencies for the first time since August last year.

The growing probability that US inflation has reached its high reinforces the rumors that the USD index has already passed its peak. Société Générale officials say the Fed’s easing of monetary tightening is a clear sign of the USD decline. Other banks have their own opinion. ING believes that until investors are convinced that the Fed intends to stimulate and not slow down the US economy, the US dollar will continue to be in high demand. Westpac officials believe that the high will be reached in the fourth quarter when the markets fully believe that the peak of the federal funds rate is determined.

It is worth recalling that in early August, about 70% of Reuters experts predicted that the USD index had not yet reached its high. However, a third of respondents said it would happen within the next six months.

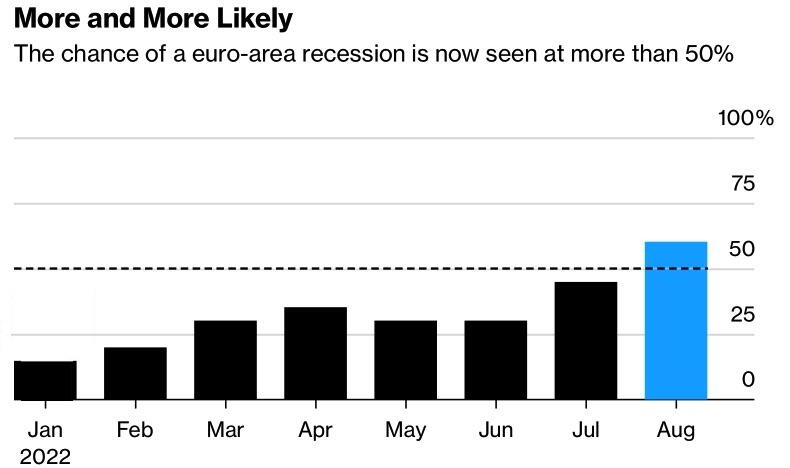

The attention to the Fed and the US dollar is understandable. It is all due to their importance to the global economy and financial markets. However, it is worth remembering that there are always two currencies in any pair. Moreover, European currencies are unstable, which forced the EURUSD bulls to exit longs and set back. According to Bloomberg experts, the probability of a recession in the eurozone over the next 12 months has increased from 45% to 60%, while a recession in Germany is likely to begin in the third quarter.

News about the UK GDP reduction in the second quarter dealt a serious blow to the euro. The recession expected by the Bank of England at the end of 2022 could come much earlier. It could worsen by the end of the year as households hit by the cost of living crisis will be overtaken by an energy crisis. The same prospect looms over the European economy. Under such conditions, the US economy looks attractive, encouraging investors to buy the US dollar.

EURUSD trading plan for a week

Risk appetite will gradually fall, leading to a slight decrease in US stock indices and increased EURUSD sell-offs. Hold the shorts formed at level 1.0355 and periodically add up to them.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.