For the second time in the last two years, the EURCHF level of 1.05 has not been broken out. In the spring of 2020, this required the National Bank’s currency interventions. However, now the regulator is no longer actively interfering in Forex. Let us discuss the Forex outlook and make up a trading plan.

Quarterly Swiss franc fundamental forecast

When you look at one point all the time, it’s hard to see what’s going on in other places. Investors’ attention in Forex is so focused on withdrawing monetary stimulus by the Fed and the associated strengthening of the US dollar that other events are often ignored in vain. It is noteworthy that the euro fell below 1.05 against the Swiss franc for the first time since summer 2015. Traders are testing the strength of the SNB again. In the spring of 2020, the bank passed the test with flying colors, but in 2021 it may abandon currency interventions.

Swissy is traditionally perceived as a safe haven asset in Forex. Therefore, the growth of political and geopolitical risks, especially in Europe, often leads to its strengthening. In this regard, widening yield spreads for peripheral eurozone bonds with their German counterparts is a strong argument in favor of EURCHF sales.

Investors are sensitive to the return of the Brexit issue, including threats by the UK to use Article 16 of the Brexit agreement due to tensions over Northern Ireland and the deteriorating epidemiological situation in Europe. Germany faces the fourth wave of the pandemic and reports a record number of COVID-19 cases per 100,000 people, while Austria is imposing tough restrictions on the unvaccinated. How not panic in such a situation? Do not forget about the April 2022 presidential elections in France. Although Emmanuel Macron is still leading in opinion polls, the intention of hedge funds to hedge the risks will certainly support the franc in the medium term.

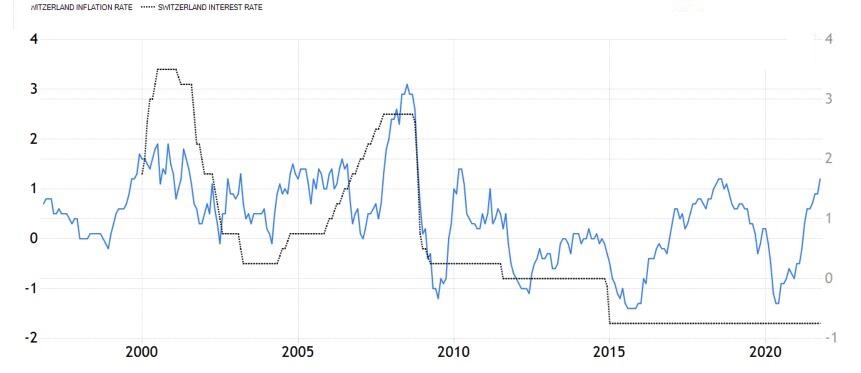

The rise in real Swiss bond yields and the associated capital inflows into the country support the Swissy. Unlike most countries in the world, Switzerland has so far managed to prevent inflation from accelerating. It accelerated to 1.3% in October, but it is still very far from the 2% target. At the same time, SNB forecasts for consumer prices for 2021 at 0.5% and for 2022 at 0.7% suggest that the central bank may not use foreign exchange interventions to restrain EURCHF bears.

Trying to prevent inflation from above 2%, the regulator should support the idea of franc strengthening. A strong national currency limits the rise in import prices and prevents the CPI from accelerating. In this regard, comments from SNB officials that the strong Swissy is holding back inflation may indicate their satisfaction with Forex developments.

Quarterly EURCHF trading plan

On the other hand, Switzerland is threatened by a combination of slow GDP growth and higher price levels, stagflation. In such conditions, strengthening the currency could negatively affect exports and further slow down the economy. In my opinion, SNB considers this to be a lesser problem and will not strive for EURCHF level 1.05 as before. This increases the risk of the pair falling to 1.033 and 1.026. The reason for the formation of shorts may be a rebound from the resistance at 1.055, 1.058 and 1.062, or a breakout of support at 1.045.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.