Much has been said about the divergence between the Fed’s and the ECB’s monetary policies. However, the Federal Reserve’s aggression has its reasons, just like the ECB’s unwillingness to change policy. Their moves are related to the economy. Let’s discuss it and make a trading plan for EURUSD.

Quarterly fundamental forecast for euro

Even if the EURUSD is stabilizing at the end of the year, the market tends to believe the main currency pair will likely continue trending downward in 2022. The reason for that includes some factors other than just monetary policies, such as the weakness of the eurozone’s economy and a slowdown in global GDP growth pace. Also, euro bears will grow more confident next year as global stock indexes might not repeat the 2021 success.

Almost an 8% euro fall against the US dollar means that a US QE withdrawal in March and two or three federal funds rate hikes in 2022 have already been priced in EURUSD quotes. The Fed must grow more aggressive for the slump to continue, whereas the ECB’s hawkish mindset might pull the pair back.

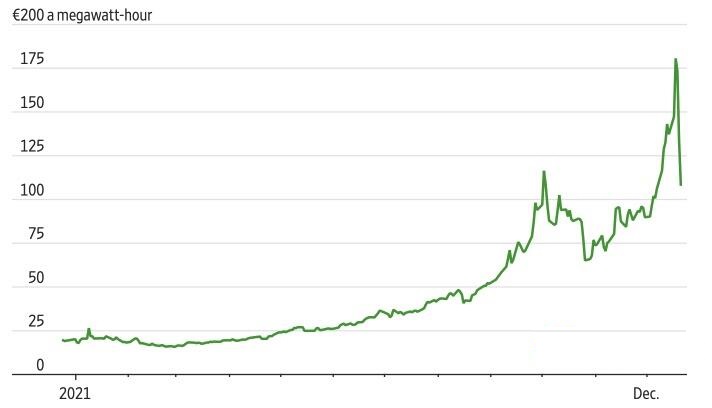

Besides Omicron, which makes governments reimpose restrictions, Europe has to deal with a severe energetic crisis. Russia is cutting down gas supplies, and a shutdown of nuclear reactors in France puts pressure on its nuclear-reliant power network in the cold months of the year. I can’t see any gleam of hope as Germany has suspended its approval process for the controversial Nord Stream 2 gas pipeline until the second half of 2022, which will likely result in a shortage of gas supplies in summer when Europe will need gas to fill its storages.

Record high gas prices lead to growing expenses and make some companies cut or shut down production. At the same time, household electricity bills are growing, which reduces consumer purchasing power. Economic activity levels drop, and GDP slows down. US economic growth rates will also fall in Q1 amid fiscal and monetary stimuli exhaustion, but Europe will be more compromised because of the energetic crisis and lockdowns.

In 2021, the euro could bank on soaring global stock indexes, including US ones, but next year, EURUSD bulls will likely get in a less favorable situation.

The S&P 500‘s average annual increase has been 8.4% since 1957. The index grew 29%, 16%, and 26% in 2019, 2020, and 2021, respectively. The S&P 500 has had 68 record closes this year — the best result since 1995.

The three best years of stock market performance have led to higher P/E ratio estimates. They are now 21, above the five-year average of 19. That factor, as well as GDP slowdown, fiscal stimulus exhaustion, and toughening of the Fed’s monetary policy, let us expect the S&P 500‘s rally to slow down in 2022. Wall Street Journal’s consensus forecast is that the index will grow as little as 4.5%. Morgan Stanley expects it to fall by 6.9%.

Quarterly trading plan for the EURUSD

So, the divergences between monetary policy and economic growth and weaker demand for risk will continue driving the EURUSD down to 1.1. My advice is to sell the pair.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.