The euro is too weak to strengthen against the US dollar. However, EURUSD bulls are supported by the actively growing S&P 500 and falling Treasury yields. How long will it last? Let us discuss the Forex outlook and make up a trading plan.

Fundamental US dollar forecast for a week

The higher the US stock indices rise, the more likely the Fed will continue to aggressively raise the federal funds rate. Moreover, the higher the risk that the stock price will fall. Asset managers understand this, but keep repeating the mistake of using corrections to buy stocks. Most recently, they had the lowest share of these stocks in portfolios in decades and are now chasing the impulse ignoring the Fed and its own forecasts. The ongoing S&P 500 rally and expectations that the central bank will promise to slow down monetary restriction in the minutes of the July FOMC meeting finally stopped the EURUSD decline.

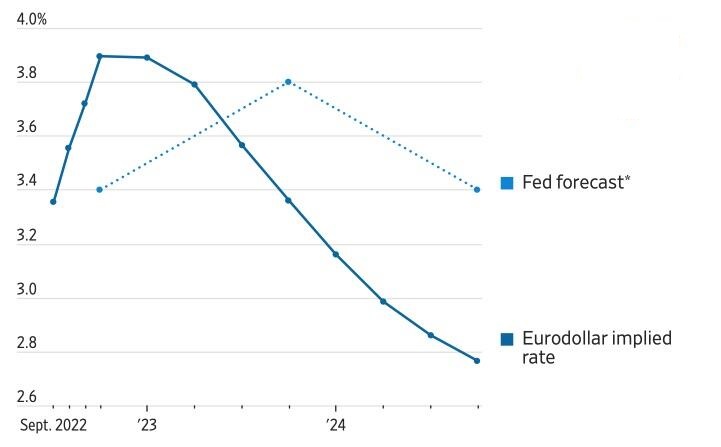

According to the consensus estimate of Wall Street experts and major investors, the yield on 10-year treasuries in 2023 will soar to 3.4%. However, assuming the Fed starts cutting the federal funds rate in 2023, the figure is unlikely to rise much from the current 2.8%. The market is confident that high inflation is temporary and that by the end of the year the Fed will realize this and become dovish. Forecasts of lower rates in the long term are very favorable for stocks.

Investors believe the labor market will cool down over time, leading to slower wage growth. But not enough to reduce the population’s income. On the contrary, it is rising, which is good news for corporate profits and the S&P 500.

Thus, the stock market has all the prerequisites for growth. However, the return of financial conditions to April levels, when the Fed had just started raising rates, suggests that the US central bank could show its displeasure and signal an increase in borrowing costs by 75 basis points in September. Currently, CME derivatives indicate a 40% chance of this outcome. If it is higher, stock indices will decline, and the US dollar will strengthen.

To begin with, the USD must cope with the minutes of the July FOMC meeting. Despite the rate increase from 1.75% to 2.5%, the Fed could hint at a slowdown in monetary restriction. Together with an inflation decrease in the US, it can support the EURUSD bulls.

However, at the end of July, the Fed did not have such problems as actively growing stock indices, falling Treasury yields and weakening financial conditions. In mid-August, the situation changed. Therefore, in Jackson Hole, Jerome Powell can declare that the Fed can’t turn dovish. The Central Bank is patient, but there is a limit to patience.

EURUSD trading plan for a week

It is unlikely that the short-term EURUSD growth can confuse someone. As winter approaches, the energy crisis will intensify. In the US, gas prices soared 1.5 times over the year, while in Europe they rose almost six times. This is enough to use the euro’s correction above $1.02 to add up to short trades.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.