Strong US PPI brought down stock indices, boosted treasury yields, and intensified EURUSD‘s decline. If there is no recession, the Fed may accelerate the monetary restriction. Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

The market follows the Fed. The monetary policy of the US central bank depends on the data, and the latest reports indicate that the US economy is strong. Everyone forgot about the imminent recession and the dovish reversal associated with it. Investors have again focused on the rising inflation that helped the US dollar in 2022. Therefore, the rise in Treasury yields and the EURUSD fall is not surprising.

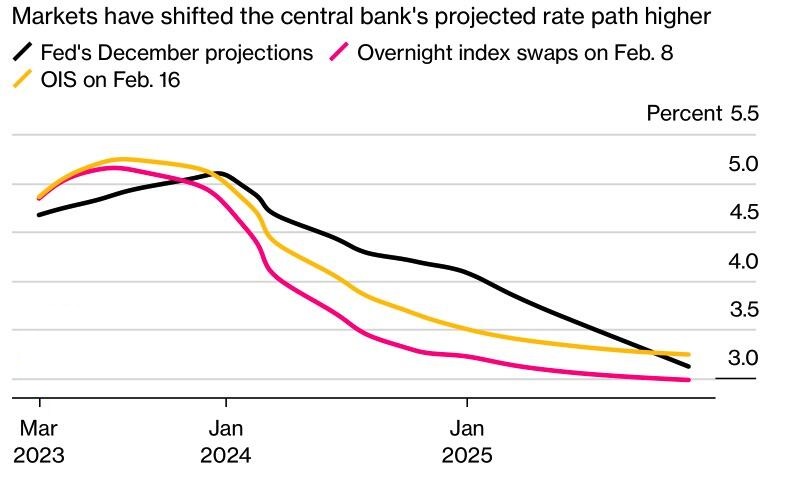

Perhaps the Fed officials will not raise rates too high. However, they are unlikely to reduce them before 2024. The reason for this is a strong economy and acceleration of inflation. Following consumer prices, producer prices also rose (by 0.7% MoM in January). The PPI slowdown from 6.5% to 6% YoY was not as significant as the 5.4% forecasted by Bloomberg. The market realized that reducing the inflation rate from 6% to 3% is much more difficult than from 9% to 3%. This means that the cycle of monetary tightening will continue, and rates will remain high for a long time.

Moreover, the Fed can accelerate the monetary restriction. Cleveland Fed President Loretta Mester said the central bank needs to move faster as the economy requires it. Louis Fed President James Bullard sees no reason to delay the federal funds rate hike to 5.5%. The fight against inflation will be long, so the sooner borrowing costs peak, the better.

The hawkish speeches of the FOMC officials allowed the derivatives market to hope for a rate increase of 50 bps at the March Fed meeting. This circumstance contributes to an increase in treasury yield and a fall in stock indices and EURUSD.

The decline in gas prices in Europe to €52 per MWh (compared to €350 in the summer) is not helping the euro. Due to a warm winter and LNG supplies, storage facilities are 65% full (twice as many as a year ago). The probability of a recession in the eurozone due to the energy crisis has fallen to almost zero, but this does not save EURUSD. On the contrary, a member of the Governing Council, Fabio Panetta, said that the ECB needs to slow down and raise the deposit rate not by 50, but by 25 bps, as inflation will quickly slow down due to falling gas prices, creating problems for the euro.

ECB Chief Economist Philip Lane also said that the eurozone economy has not yet fully felt the monetary tightening.

Weekly EURUSD trading plan

The contrast between the aggressive speeches of the Fed’s main hawks and the restrained stance of the ECB centrists, together with a strong US economy, contribute to the fall of the main currency pair. Hold short trades entered at the level of 1.0705, followed by profit-taking and a reversal when the price rebounds from 1.061 or convergence zones 1.0565-1.0585 and 1.0485-1.0505.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.