In 2022, the Fed was ready to sacrifice the economy to stop inflation. Now that high prices are back, the old mantra is relevant again. How does it affect EURUSD? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

In the midst of winter, the US economy has become hot. Inflation began to accelerate against strong data on employment, retail sales, PMI, and consumer spending, which rose by 1.8% MoM in January. The PCE price index jumped 0.6% MoM and accelerated from 5.3% to 5.4% YoY. Core inflation of 4.7% beat Bloomberg’s forecast of 4.4%. Many in the market wondered if the Fed would break something to beat high prices. In 2022, such a question determined the stance of EURUSD bears.

In January, both the PCE index and the Powell price index (the cost of services, excluding housing and energy) increased. According to the Fed chairman, the latter may be the most important one. As a result, the derivatives market raised the expected federal funds rate ceiling to 5.39%, the highest level since the beginning of the monetary restriction cycle. Derivatives signal that the borrowing cost will soar to the abovementioned level by August. However, in early February, experts predicted that the central bank would end monetary tightening in March.

It seems that it was easier for the market to survive the sales of 2022 than the unexpected heat in the US economy in the middle of winter. The transition from the January S&P 500 rally to the fall of the stock index cost EURUSD dearly. The euro has already fallen by 4.5% against the US dollar from the February high levels, and this is not the limit. Nordea Markets forecast EURUSD to fall to 1.03 on the background of a higher federal funds ceiling. In a joint study, economists from New York and Columbia Universities and analysts from JP Morgan and Deutsche Bank noted that the rate ceiling would have to be raised to 6.5%. Thus, the economy will not be able to avoid a mild recession.

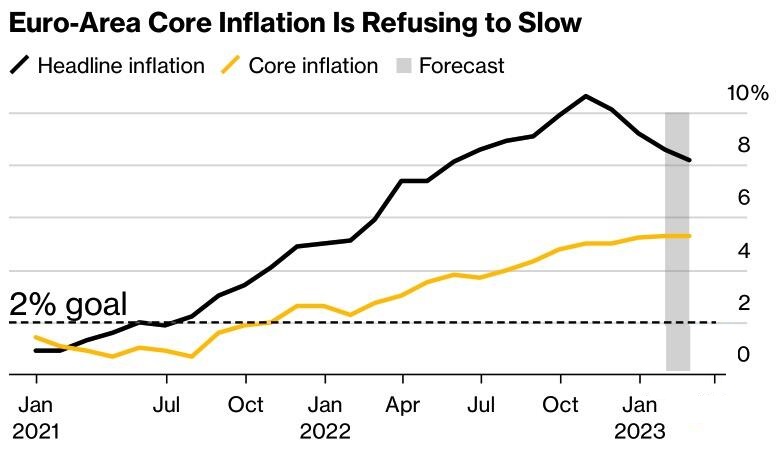

According to Bloomberg experts, neither the recovery of the Chinese economy nor the reluctance of eurozone core inflation to decline from a historical high of 5.3% does not help the euro. Bloomberg also forecasts a slowdown in consumer prices from 8.6% to 8.2% in February.

China’s GDP growth will depend on the willingness of its population to spend the colossal sums of money they have accumulated during the pandemic. Not so long ago, Americans and Europeans spent their savings very actively. However, Asia is a special case. The continent’s savings rate rose to a record high of 33% in 2022.

Weekly EURUSD trading plan

The eurozone’s stability and the rapid recovery of the Chinese economy may contribute to the acceleration of US inflation. If the Fed raises the federal funds rate to 6.5%, the greenback will continue to strengthen. In my opinion, the USD will dominate Forex until the release of the February US jobs report. As long as EURUSD is below 1.0585, continue short-term sales towards 1.0485 and 1.0325.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.