The US dollar doesn’t act as a safe-haven currency. The bad news about the debt ceiling weakens it, while the good news drives the EURUSD down. Why is this happening? Let’s discuss this topic and make up a trading plan.

Weekly US dollar fundamental forecast

The growth of EURUSD volatility looks logical. It was caused by the inappropriate behavior of the Republicans, who refused to negotiate a debt ceiling, while President Biden said that it was time for opponents to abstain from extreme viewpoints. The main currency pair rebounded from the important support at 1.076 and returned to 1.08-1.085. It was called the balance zone around which consolidation would form.

Statements by opponents who believe in a ceiling deal and hawkish statements by FOMC members have dropped EURUSD. However, the neutral rhetoric of central bank officials and Joe Biden’s angry message to the Republicans at the G7 summit in Japan brought the euro back to life. The US dollar doesn’t act as a safe-haven currency. In May, its rate is driven by Treasury yields and the possibility of a 2023 dovish reversal in the futures market.

Treasury rates have risen for five consecutive days, hoping that default and recession can be avoided and the Fed can raise borrowing costs to 5.5% in June. However, the situation changed in the week ended May 19, allowing EURUSD to reach the bottom.

According to Jerome Powell, the Fed faces uncertainty about the delayed effects of monetary tightening and the banking crisis. Central bank officials can afford to evaluate the data before deciding whether to raise rates. Investors interpreted this message as a hint of a pause in June. Minneapolis Fed President Neil Kashkari also mentioned it by saying that there is a difference between a pause and an end of a cycle. The effects of the banking crisis are unclear, while inflation is still very high.

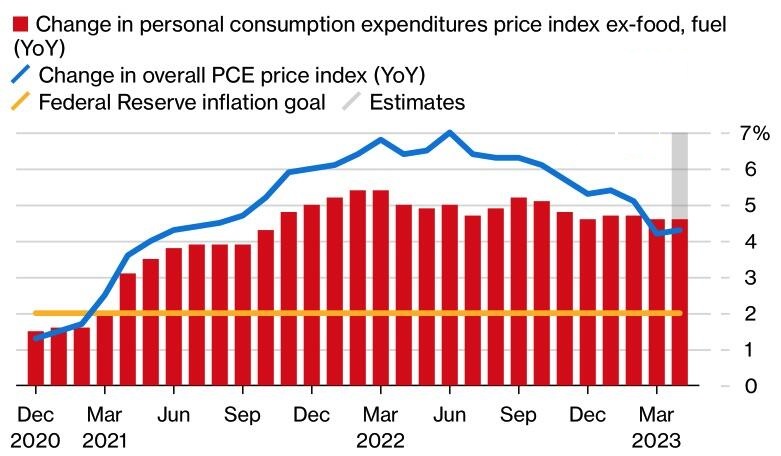

According to Bloomberg forecasts, the PCE index (the Fed’s preferred inflation indicator) rose by 4.6% YoY and 0.3% MoM in April. Thus, it’s too early for the Fed to rest on its laurels.

Thus, EURUSD is supported by concerns about the debt ceiling and pause expectations at the June FOMC meeting. About 71% of investors surveyed by Bank of America believe that the problem with the borrowing limit will not be resolved until June 1, although most of them hope that a default can be avoided. At the same time, Goldman Sachs claims that the government will run out of money not on June 1 but a week later.

Weekly EURUSD trading plan

As soon as there is good news about the talks between Democrats and Republicans, and Fed officials start discussing a rate hike in June, the US dollar strengthens. In the context of uncertainty around the debt ceiling and monetary policy, the chances of EURUSDconsolidation in the range of 1.076-1.09 increase. Stick to sales strategies on the rise.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.