What to choose, the fight against inflation or the banking crisis? Fed officials must make this difficult decision. What will they prefer, and how will the EURUSD react? Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US dollar fundamental forecast

The Fed’s March meeting is a unique event. As a rule, before the FOMC meetings, the markets know about the central bank’s plans. They take information from the speeches of officials and macro statistics. This time, the Fed itself does not know what the Fed will do. The pause will signal that the regulator is not confident about the stability of the banking system and the US economy. The Fed sees problems that are not yet visible to the market. On the contrary, raising the rate risks increasing stress.

Jerome Powell needs to be both a firefighter and a policeman at the same time. The Fed has to solve the problems of cooling high inflation and a red-hot labor market while keeping the banking system healthy. The central bank is between the hammer and the anvil, although rising stocks and the fastest one-day rise in the yield of two-year US treasury bonds since 2009 suggest that the worst is over. Is it worth relaxing? In 2008, a week after the collapse of Lehman Brothers, the S&P 500 rose, but then declined by 46%.

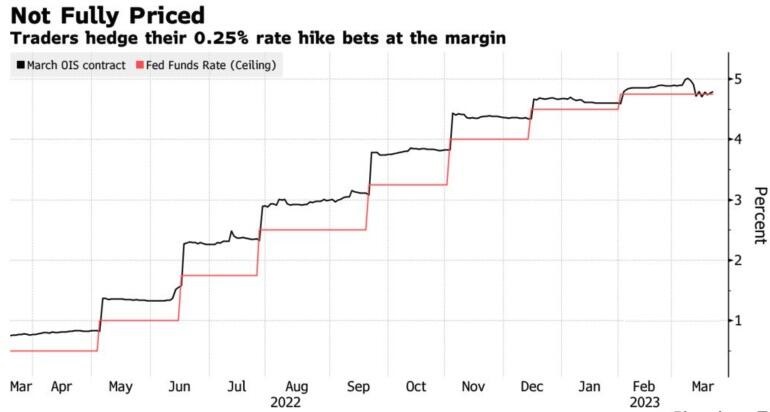

The increase in the possibility of a 25 bps federal funds rate hike from 60% to 89% within three days in March suggests that investors are confident that the Fed will focus on fighting inflation. However, 11 out of 98 Bloomberg experts expect a pause. Nomura Securities analysts even predict the easing of monetary policy.

The reason is that the banking crisis has done part of the work for the Fed. Financial conditions tightened to the levels from which the monetary restriction began. Apollo Global Management believes that the market turmoil associated with a series of bankruptcies is equivalent to a 150 bps increase in the federal funds rate. This makes sense because, despite the help from the Fed and other regulators, banks will become more cautious, while lending growth will slow down, impacting GDP growth. At the same time, household spending will decrease, and they will think twice about whether to borrow money before a recession.

Fed officials have many options on how to act further. They may raise rates but calm the markets with dovish rhetoric. They can also pause but signal the resumption of the monetary restriction cycle in the future. However, markets are concerned about the FOMC forecasts. In December, they predicted a rise in borrowing costs to 5.1% and no dovish reversal in 2023. If the Fed leaves the proposed ceiling unchanged and signals a rate cut this year, the EURUSD rally will continue.

Weekly EURUSD trading plan

On the contrary, an increase of the expected peak to 5.25-5.5% can temporarily strengthen the USD. In this scenario, expect a euro decline to the support at $1.0715, which will allow buying a pair cheaper. It is reasonable to increase the targets for EURUSD long trades to 1.09 and 1.1.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.