After the release of data about US consumer prices slowdown, more EURUSD bulls entered the market. They predict the pair’s growth to 1.1. Isn’t it too early? Let’s discuss the topic and make up a trading plan.

Weekly US dollar fundamental forecast

Hopes that the Fed will trigger a recession with aggressive monetary tightening dominated Forex for most of 2022. They also contributed to the growth of the USD index to 20-year highs. As soon as the strategy began to falter due to the slowdown in the rate of monetary restriction and inflation, EURUSD rose sharply, almost reaching 1.05. However, have prices really peaked? What if this is not the case and the rate ceiling is higher than 5%? In this case, interest in the US dollar should return.

According to Goldman Sachs, the greenback will fluctuate in the future. USD will not only grow like in 2022, but its dynamics will be positive. The bank’s experts predict the trade-weighted USD index to strengthen by 3% in 2023 due to the strong US economy that can avoid a recession, and the fact that other regulators are still following the Fed. The main risks are the earlier opening of the Chinese economy, and the unexpected de-escalation of the Russia-Ukraine conflict.

According to Deutsche Bank, the reduced geopolitical tensions could lift the euro by 5 cents from current levels. The bank analysts predict EURUSD to rise to 1.1 by the end of 2023 due to the Fed’s erroneous dovish reversal, while the ECB will continue to raise the deposit rate towards the 3% expected by the derivatives market.

Alas, but so far, a reversal is not expected. St. Louis Fed President James Bullard said the federal funds rate should rise to at least 5.25%. The charts even show a level of 7%.

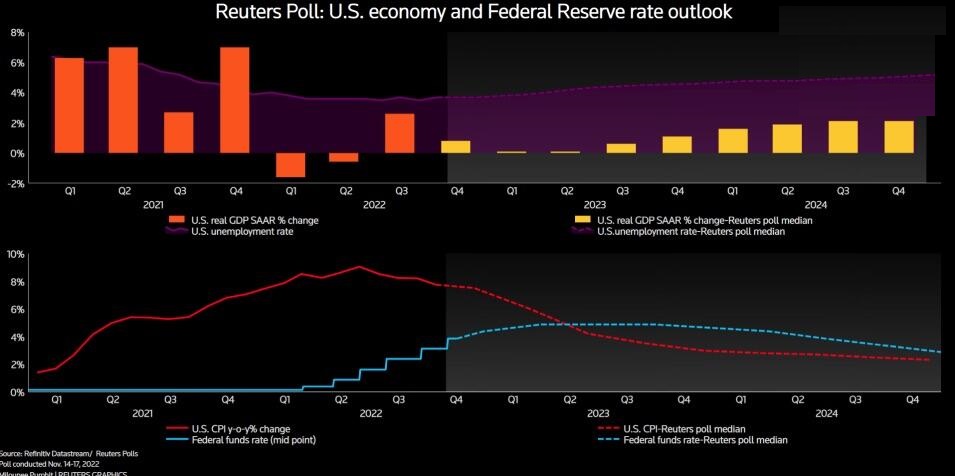

Despite signs of a CPI slowdown, according to Reuters experts, inflation will not return to the 2% target before 2025. It is hard to imagine that prices would decline in 2023 as quickly as they rose in 2022. Experts raised the estimate of the peak rate to 5%. 16 out of 28 respondents consider that the biggest risk is that it will reach a higher ceiling later than expected. Four predict an earlier date. The rest forecast a lower ceiling.

EURUSD, unlike stock indexes, believed the hawkish speeches of the FOMC officials. The pair rose despite the S&P 500 fall, Bloomberg’s forecast that the ECB wants to slow down the monetary restriction pace, and the biggest tax increase in the UK in a decade, which weakened the pound. The euro has support in the face of warm weather. When gas storage facilities are 95.5% full and gas demand is 71% of the 5-year average, falling prices reduce recession risks in the eurozone. However, the first cold snaps will be a real test for the euro.

Weekly EURUSD trading plan

The EURUSD fate will depend on US inflation. While there are no new data, stick to purchases on the breakout of 1.0405 and sales on the retest of support at 1.033.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.