Both the Fed and the markets can be wrong simultaneously. But they realize that the previous views were wrong at different times. This indicates that the EURUSD fate in 2023 will not be so rosy. Let’s discuss this topic and make up a trading plan.

US dollar fundamental forecast for a year

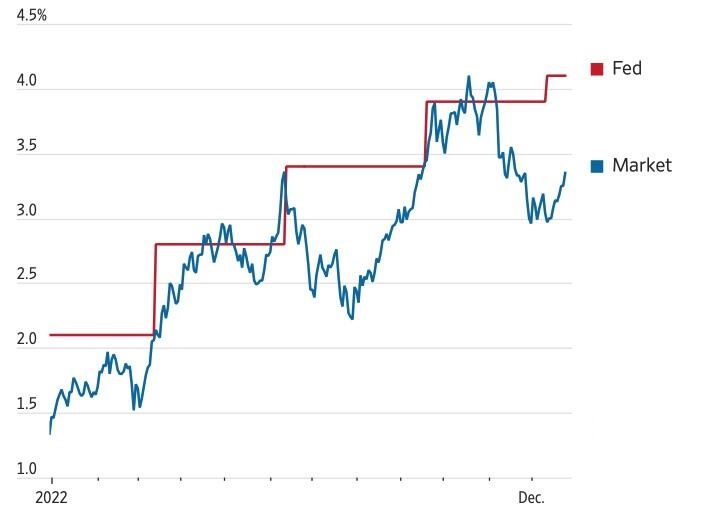

In 2022, the market was often wishful thinking, felt superior to the Fed, and was frequently punished for it. But at the end of the third quarter, the central bank reduced the pressure, which allowed EURUSD to recover. Further, due to the fall in gas prices in Europe to the lowest levels since the beginning of the war in Ukraine, the aggressive hawkish stance of the ECB, expectations of the opening of the Chinese economy and greater stability in the eurozone, many assumed that the euro tested the level of $1.07 twice in half a month. Was it an illusion?

The market seemed to turn a blind eye to FOMC rate forecasts for the end of 2023 (5.1%) and 2024 (4.1%). It predicts the cost of borrowing to be 4.6% and 3.4%. If investors are right, stocks and bonds will skyrocket and EURUSD will rise to 1.1. If the Fed proves to be right, the S&P 500 risks closing for the second consecutive year in the red, which has only happened four times since 1928. As a result, the USD will strengthen.

However, both the market and the central bank can be wrong at the same time! The Fed will stick to its point of view during the first three to four months of 2023, after which investors will realize that they are wrong. But then, against the backdrop of a rapid economic recovery in China and the approaching recession in the US, Fed officials will begin to discuss rate cuts. The euro will rise steadily against the US dollar. However, everyone will have to wait for that to happen.

Investors are overly optimistic about the ECB’s willingness to act aggressively. The market’s deposit rate cap forecast of 3.4% looks overpriced. Not to mention the statements of the Governing Council’s main hawks that the ECB is only halfway through the implementation of monetary restriction and that investors underestimate the bank’s determination. Four out of five Financial Times experts believe that the European regulator will stop raising borrowing costs within six months, while two-thirds of 37 respondents expect the ECB to cut them in 2023. The consensus forecast for a peak rate is 3%, which is more likely than market estimates.

Although the coming year will be mostly a year of optimists, pessimists will reign during its first few months. A lot of disappointing news for euro buyers and a return of interest in the US dollar amid the continued cycle of monetary tightening and rising demand for safe-haven assets due to the approaching recession will force EURUSD to correct.

Yearly EURUSD trading plan

EURUSD will definitely fluctuate in 2023. By the end of March, the rate risks falling to 1.04, after which it will begin to recover. EURUSD will rise to 1.07, 1.09, and 1.1 at the end of the second, third, and fourth quarters respectively. Thus, in January-March, it will be profitable to focus on sales. Later, stick to purchases.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.