What are the drivers of the USDJPY uptrend? Will the bulls’ benefits continue to work out, or have most of the positive factors already been considered in price formation? Let us discuss the Forex outlook and make up a trading plan.

Fundamental Japanese yen forecast for a year

The Japanese yen ends 2021 as the worst performer among the G10 currencies. Since the beginning of January, it has weakened against the US dollar by 11.3%. For comparison, the Swedish krona and the euro, ranked second and third in the list of the main outsiders of the year, lost 10.4% and 7.2%, respectively. The main drivers of the USDJPY uptrend were divergences in monetary policy and economic growth. The situation may change in 2022.

Compared to other countries, Japan’s theoretically low inflation allows BoJ to stick to its methods rather than following the Fed’s lead. Indeed, while US consumer prices are steadily moving towards 7%, CPI in Japan rose by a modest 0.5% in November. Without considering the sharp decline in telephone tariffs, inflation has reached the target of 2%. However, energy prices are at the core of its growth. If so, Haruhiko Kuroda and his colleagues have good reason to adhere to an ultra-easy monetary policy.

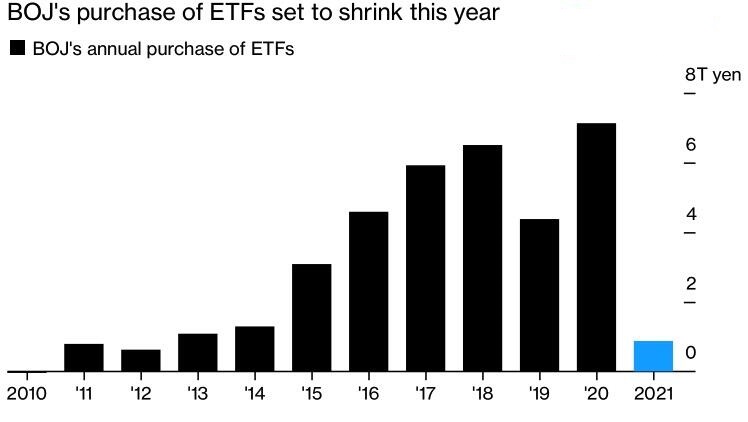

Nevertheless, it is already being corrected. At its last meeting in 2021, the Board of Governors announced the termination of support for large enterprises in the form of concessional loans. The Bank of Japan this year bought a record low ETF volume of ¥873.4 billion, which is a drop in the bucket compared to ¥7.1 trillion in 2020.

For most of the year, the state of the Japanese economy was poor amid restrictions due to COVID-19, supply chain disruptions and the energy crisis. At the same time, at the end of 2021, the situation began to change for the better. Retail sales increased in November for the third straight month, and industrial expansion hit an all-time high, signaling a positive shift in the economy. On January 16-17, the Bank of Japan will release new forecasts for key macroeconomic indicators, including inflation. Their improvement could support the USDJPY bears amid expectations that the regulator will change monetary policy.

In 2022, the yen can benefit from the uncertainty associated with central banks’ monetary policy. Regulators will be faced with a choice, is it worth tightening monetary policy too quickly, or is it worth slowing down this process? The slowdown in the Chinese economy, political and geopolitical conflicts will also encourage USDJPY bears.

Most of these events will take place in the second-third quarter of 2022. The rise in the likelihood of a federal funds rate hike in March will allow USDJPY bulls to update November highs.

USDJPY trading plan for a year

Thus, the pair’s dynamics are likely to be unstable over the next year. I expect USDJPY to hit levels 117, 118, 117, and 115 in three, six, nine, and twelve months respectively. In this regard, I recommend holding the longs entered at the level of 114.2 and periodically adding up to them on the correction.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.