Which is better to lie now, claiming that you will raise rates above 5%, and then find out that you made a mistake? Or to pause monetary restriction, and when the inflation accelerates, to look like a fool? Let’s discuss this topic and make up a trading plan for EURUSD.

Weekly US Dollar fundamental forecast

While other central banks have begun to prepare investors for the end of monetary restriction, the ECB acts as if it is just beginning. Christine Lagarde and her colleagues hope for greater stability in the eurozone economy, which, together with the positive eurozone PMI, kept EURUSD in the zone of six-month highs. Alas, the main currency pair can only fall when the Fed and US stocks are bearish.

For almost the entire year, the markets have been focused on the topic of high inflation. At the end of 2022, investors are worried about a completely different problem. A further increase in rates by central banks after the most aggressive monetary restriction in decades risks undermining demand and triggering a severe cut in hiring and a deep recession. The eurozone has been ready for it for a long time, while the US hoped for a soft landing. However, a series of disappointing data brought stock indices back down to the ground.

After the worst decline in retail sales since the beginning of the year and the first decline in industrial production since June, PMI presented an unpleasant surprise. Apart from the pandemic-related recession of 2020, the fall in US PMI data in December was the most severe since 2009.

As investors become more afraid of a recession, markets are starting to react in a classic way. Bad news turns bad for the S&P 500. As a result, the stock index fell, global risk appetite declined, and the US dollar strengthened as a safe-haven currency.

The hawkish remarks of FOMC members exacerbated the situation. According to the head of the New York Fed, John Williams, the Fed can reduce inflation to 3-3.5%, but there are huge problems with its return to the 2% target. Such a stance suggests that rates will likely stay at their peak until the end of 2023 and not fall, as investors expect. The president of the San Francisco Fed, Mary Daly, believes that the risks are associated with rising inflation. At the same time, her colleague from Cleveland, Loretta Mester, noted that much more evidence is needed that prices are falling.

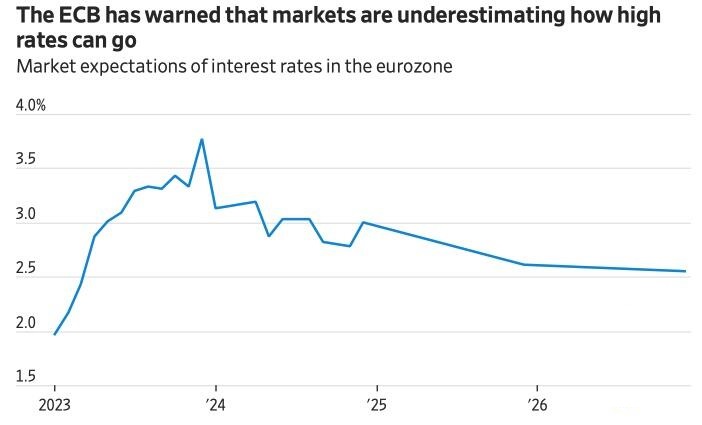

The US stock fall has greatly undermined the ECB’s efforts to strengthen the euro. After Christine Lagarde’s words that the central bank has a lot of work to do, the futures market raised its expectations of the deposit rate ceiling to 3.7%.

Weekly EURUSD trading plan

Fed officials are more likely to make a mistake now, claiming they are ready to continue aggressively raising rates, only to discover later that they no longer need to do this, than to pause the process at all. Then if inflation starts accelerating again, the Fed will look stupid. The markets will soon understand this, and the S&P 500 will begin to rise, contributing to the EURUSD growth. However, for now, hold short trades entered at 1.0625 in the hope of a price rebound from supports at 1.0535, 1.05 and 1.044 with a subsequent reversal.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.