The EURUSD‘s downtrend may reverse as political risks weaken, the European economy turns out strong enough, and the EU is unwilling to join an embargo on Russian oil and gas. Let’s discuss it and make a trading plan.

Weekly fundamental forecast for euro

The US dollar feels good when investors run to extremes: buy it to avoid risks or because the US economy looks better than others. The war in Ukraine has helped the greenback in both senses: it won as a safe haven asset and consolidated amid expectations that the eurozone would face severe troubles due to its dependence on the Russian oil and gas imports. As a result, the USD index soared to its highest since the pandemic’s start. Hasn’t the greenback climbed too high? Won’t the success turn its head?

The euro’s weakness also played an important part in the USD’s victory march. The EURUSD dropped to its 2-year lows as investors felt concerned about the uncertainty around the French presidential election and the impact of sanctions on the eurozone’s economy. The pair has lost over 5% since the start of the year, but the situation may change at the end of April.

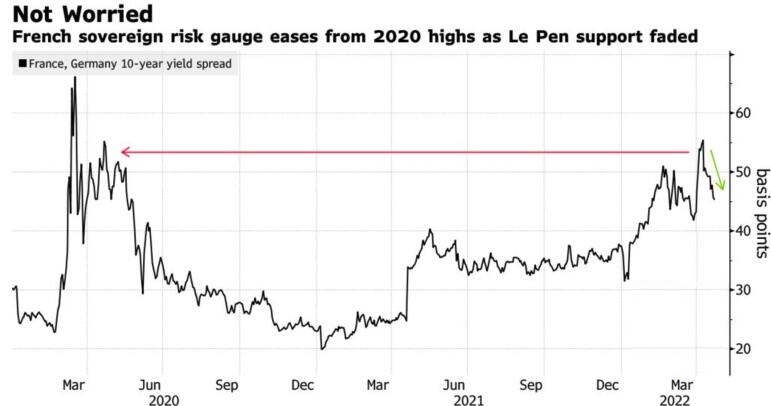

Emmanuel Macron defeated Marine Le Pen with 58%, which does not look as convincing as in 2017, when the difference was 30%. However, this victory lowers political risks in Europe, which is proved by a reduction in the bond yield differential between France and Germany. The euro will likely turn into the main beneficiary of the French election.

The sanctions against Moscow are a double-edged sword. The Bundesbank estimates that the GDP will drop 2% in 2022 already and won’t recover to the current level before 2024 since the EU joined the Russian oil and gas embargo. Research institutions that consult the government think that the loss will amount to €220 billion within two years. At the same time, top-ranking diplomat Josep Borrell asserts that the EU countries do not support a full embargo on Russian oil imports while business activity stats show the eurozone’s economy feels better than expected.

A pandemic-driven pent-up demand helps the service sector compensate for production problems caused by supply chain breaches. As a result, the European composite Purchasing Managers Index grew unexpectedly from 54.9 to 55.8 in April against Bloomberg’s forecast of 53.9.

As the economy is getting steady, the ECB may end QE in July or August and start raising rates in Q4. Christine Lagarde drew that chart while making her latest speech, and investors have no reasons for doubt. The derivatives market expects the deposit rate to rise by 75 basis points by the end of 2022.

Weekly trading plan for EURUSD

The Fed’s aggressive monetary restriction and the war in Ukraine will support the greenback, but the foundation for a downtrend reversal is being laid now. The EURUSD may break out support at 1.075 – 1.0755, but it can reverse at around 1.06 – 1.065. That will allow us to start buying the euro on a fall.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.