Investors are looking forward to the decisions of the Fed and the ECB to determine EURUSD future trend. Fed’s actions are more or less predictable, while the ECB policy remains a mystery. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The situation with the divergence in monetary policy, which has excited investors’ minds over the past few months, could be clarified in December. Investors are focused on the meetings of the Fed, the Bank of England, the ECB, and the Bank of Japan, another 16 central banks colleagues around the world will deliver their verdicts within the next few days. The difference in the regulators’ views is the key driver of Forex pricing. For example, the Turkish lira is falling amid Recep Erdoğan’s attempts to rewrite textbooks on economic theory, and the US dollar is strengthening on expectations of a faster monetary tightening by the Fed.

Central banks usually act in sync. Regulators could have different views on the advisability of interest rates changing, but the Fed, being the world leader, usually sets the tone for the views on inflation. Jerome Powell has abandoned the mantra about the temporary nature of high prices. If Christine Lagarde and other ECB officials follow the example of the Fed, the EURUSD bulls could be encouraged to go ahead. The problem is that the term ‘transitory inflation’ is now interpreted as something short-lived, while it literary means something that passes over time, for example, in ten years.

In this respect, the Fed’s departure from the previous concept occurred not because the phrase about the temporary nature of high inflation was misleading but because it was meaningless. And the European Central Bank has every reason to do the same, to abandon a meaningless phrase. The matter is that markets may not react in the way the Governing Council would like. The sale of European bonds and the growth of their yields are not what the ECB plans. Having accumulated huge debts, the peripheral euro-area countries will face serious difficulties because of the pandemic. Simply put, the Fed doesn’t have Italy, so it can easily raise the rates. The ECB should be more circumspect.

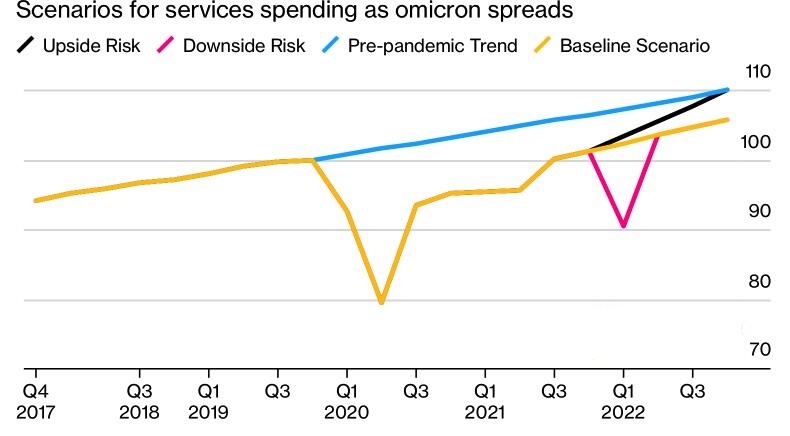

The common headache for all central banks is the omicron. It will be good if the version about low mortality due to this COVID-19 strain is confirmed, and the world economy will not face significant losses. But what if humanity is unlucky?

The Fed’s next steps are more or less predictable, but the ECB’s future policy remains a mystery. Jerome Powell and his colleagues will likely announce the QE end in June, not in March. The FOMC is expected to show in its forecasts the willingness to raise the federal funds rate two or three times in 2022. These actions are expected and have been priced in the US dollar exchange rate, so the EURUSD will hardly crash dramatically. The bears are not strong enough.

Weekly EURUSD trading plan

The major currency pair could feature increased volatility if the ECB raises inflation forecasts for 2022-2023, abandons the mantra about the temporary nature of high prices, and expresses its unwillingness to expand the APP. Traders should be prepared for sharp swings in the EURUSD rate, selling, and buying.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.