Stock Brokers

As bank interest rates have been at an historic low for over a decade, savers are increasingly turning their attention to the stock market in a bid to make the most of their money.

Thanks to Hollywood films such as Wall Street and The Wolf of Wall Street, there are many misconceptions about what the stock market is, and who can invest.

The stock market isn’t just for those with large sums of money. It is also accessible for anyone who wants to try and improve their savings. But how do you get started?

The first step is to find a stock broker. This is someone who can manage your investment on your behalf.

To find out more about how you can start to invest in stocks and shares, we’re taking a look at what stock brokers are, and how to find the right stock broker for you.

What Is a Stock Broker?

A stock broker is someone who buys stocks and shares on behalf of someone else. This may be on behalf of a commercial organization or a person.

The stock broker looks after the investment portfolio. They will work as an intermediary between the stock exchange and the investor.

Stock brokers can work in different ways:

- Some will take full management of the investment and make decisions on behalf of their client (known as a discretionary way of working).

- Others will work in an advisory capacity where they will advise and offer suggestions but only act when given authorization by their client.

- The final option is those who are execution-only. This is when stock brokers only make the investments that they are directed to. They will not offer any advice or support.

What Are the Different Types of Stock Brokers?

The UK stock market has grown enormously in recent years. If you are keen to start investing your money, then you must first understand the different types of stock brokerages:

Full-Service Brokers

These offer everything you need so that you do not need to worry about managing your wealth portfolio.

Your broker will make recommendations and offer advice and guidance. They’ll manage investments on your behalf and will provide you with comprehensive reports giving details of your portfolio performance.

Discount Brokers

These will be more affordable than full-service brokers. They will only act upon a client’s orders – so whilst they will manage the actual buying/selling of stocks, they will not provide any advice or support.

It’s more affordable but more time-consuming for investors who will need to stay up to date with their investments.

Online Stock Brokers

These can be used by new investors as well as experienced investors. You’ll have the opportunity to manage your wealth portfolio and you can make new investments at the click of a button.

The Best Trading Platforms

Let’s take a look at the best trading to earn more.

1. Liteforex

Best for: Learning from others

Liteforex is one of the most popular online reliable brokers over the world. Over the past 15 years, it has developed a strong reputation for beginners and experienced investors alike, has a minimum $100 deposit.

The Liteforex app aims to use easy for every clients. It is available on Google Play and the App Store and allows you to move seamlessly between devices.

It’s innovative features include:

- Pre-programmed one-click trading

- Copy Trader – Copy the trades of others in real-time

- Its own social networking platform

- Pre provided investment strategies which they call Copy Portfolios

The app boasts the ability to allow you to place online trades even if the trading platform is down.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

2. FXTM

The FXTM Platform itself is intuitive and easy to use, suitable for those just getting into trading and those more experienced alike.

It is designed to offer a full replication of an institutional trading environment including depth of market.

With advanced risk management and order functionality, this is a detailed platform for trading stocks.

The FXTM app offers a premium range of order types, with advanced technical analysis tools.

You can set up push and email notifications for the important things that you want to know in relation to your stock trading needs – such as price alerts and trade statistics.

Within the app, you can:

- Complete a range of order types

- Work with all your accounts in one app

- Understand detailed trade analysis

- Review detailed order tickets – base currency dollar value and pip distance

As a platform, there are comprehensive educational videos and explanations of symbols, so you can find optimized processing for expert advisors and indicators.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

3. FBS

Best for: CFDs

This app is designed for those wanting to trade outside of the US. It is considered one of the best for CFDs on shares and has a minimum $100 deposit.

There are low trading fees but considerable fees for inactive users.

The educational section is average, as are the research tools. However, the app is easy to use overall.

This app is recommended for those familiar with CFDs and who are actively trading. Reviews of the app show that users like the:

- Account-opening process

- Deposit and withdrawal features

- Customer service

- Actual trading platform

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

How Do Stock Brokers Make Money?

Typically, a stock broker will take a small commission, or they will charge specific fees for managing your investment.

Are UK Stock Brokers Regulated?

If you are providing money to a stock broker to act on your behalf, you must have confidence that they are fully regulated and trustworthy.

In the UK, there are stringent checks which are used to confirm the viability of stock brokers. This means that the London Stock Exchange is one of the strongest in the world. Investors can have confidence that they are fully protected from fraud and/or financial mismanagement.

Reputable UK stock brokers should be a member of the Financial Conduct Authority (FCA). Not only does this provide peace of mind for investors that the broker is following operational guidelines, but it also provides insurance. If a firm becomes insolvent, investors can receive compensation up to a specified limit.

Before appointing any stock broker, you should check to see that they are listed within the Financial Services Register.

Key Considerations Before You Choose a UK Stock Broker

When it comes to finding a UK stock broker, there are many different things that you should consider.

It’s important to remember that each stock broker will work differently. You need to consider whether you are looking for a stock broker who can manage your investment on your behalf or whether you want to remain in control.

Listening to References but Keeping an Open Mind

An easy way to find a UK stock broker is to find references and recommendations from other investors.

Listen to what they have to say but remember to keep an open mind. Different investors will have different needs – so what works well for one person, may not work for another.

This is particularly true if you are new to the stock market but are seeking advice from an experienced investor.

Is Your UK Stock Broker Regulated?

As previously mentioned, make sure you check on the Financial Services Register to see if your chosen broker is regulated.

Your broker should have details of professional memberships available on their website.

What Are the Trading Fees?

Stock brokers will make their money via commissions and trading fees. It may seem simple to choose the UK stock broker with the lowest possible trading fees, but that could cost you far more money in the long run.

Fees may differ depending on whether you are a casual trader, a beginner or an experienced investor.

It’s worthwhile comparing fees to your budget – this will help you to identify the right brokerage for your investment needs.

You may also need to consider whether you are charged a flat-fee or a percentage fee. Some brokers will charge for each transaction (deposit and withdrawals) which can become pricey. You may even be charged fees for inactivity on your account.

Before signing up with any brokerage, make sure that you are aware of the terms and conditions.

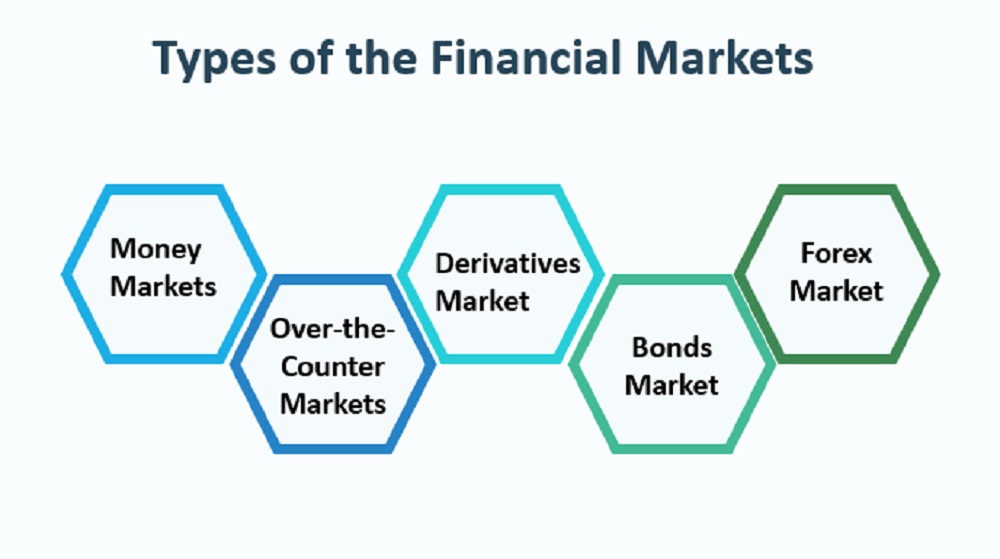

What Tradable Assets or Other Markets Are Offered?

As well as trading stocks and shares, many brokers (particularly online brokers) may offer opportunities to trade other assets such as foreign exchange currencies (Forex) or even cryptocurrencies.

If you are considering diversifying your investment portfolio, you may be interested in working with a stock broker with experience in other markets.

What Trading Platforms Are Available?

A trading platform is a specific software that allows individual investors and stock brokers to make trades.

Some UK stock brokers may offer easy access to their trade platforms. This is typically in exchange for having full management of the investment.

Trading platforms can vary hugely. Some may have intuitive and easy-to-understand dashboards that allow investors to see how their investment is performing. Others may be complex, real-time charts and news feeds that are designed specifically for stock brokers to monitor the market.

Investors may wish to think about what features they need before deciding on a particular trading platform. For example, do they need the information to help with immediate decision making or are they looking for a platform that could make predictions and strategies for future investments?

The fees charged for trading platforms will also vary. You can expect to pay lower fees for trading platforms with reduced features.

What Is the Minimum Amount of Money I Need to Invest in Stocks and Shares?

Stock brokers and online trading platforms will have different minimum requirements for investments. Some may be as little as £10, whilst other interactive brokers may require a minimum deposit of £100+.

Pay attention to the terms and details to establish how much you should invest.

Customer Care

It’s important to remember that if you are investing your money into a UK stock broker, you need to feel confident that they are supporting you and looking after you as best they can.

Look at customer reviews/testimonials to find out what people are saying.

If you are using an online stock broker, then try sites such as Feefo or TrustPilot to see if there are any advantages/disadvantages. You should be looking to work with a UK stock broker that offers consistent levels of customer care.

If you are trading online, is the dashboard easy to understand? Is it suitable for beginners or do you need extensive experience? Is there a helpline number to call if you need support?

If you’re working with a UK stock broker, what advice and guidance are they giving you? Do you feel that you are receiving a high level of customer care and satisfaction?

Remember that if you are choosing to invest money with a UK stock broker, you are paying for a service. Don’t be afraid to expect high levels of client care and attention.

The Best Stock Brokers in the UK

Now we’ve explained more about what stock brokers are and how to choose one, here is a quick overview of some of the best stock brokers in the UK.

This list provides you with a brief look at different platforms, giving you further insights to make informed decisions.

It’s important to remember that this list isn’t exhaustive and shouldn’t constitute financial advice. Before deciding to invest with any broker, make sure that you have undertaken further due diligence to check on their reliability, their success rate, their fees and their customer care.

Final Thoughts

As you can see, there is much to consider when choosing which UK stock broker to use. Different online stock brokers have their own strengths and weaknesses, and what suits one person may not suit another.

Before you make a final decision on your chosen UK stock broker, we recommend that you spend time working your way through the list and making the most of the free demos.

Most stock brokers will allow you access to its platforms and databases and will provide you with ‘virtual’ funding. This means that you can practice your investments, and see which interfaces work well for you without using your personal money.

As you become attuned to using different stock brokers you may start to establish which is best for your ability, interest and knowledge.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

Financial Market is the main topic of daily business activities. TABLE OF CONTENTS What Are Financial Markets? Understanding Financial Markets

The foreign exchange (forex) market is the largest financial market in the world. TABLE OF CONTENTS What Is the Forex Market? Understanding the

Cash markets are also known as spot markets because their transactions are settled “on the spot.” What Is a Cash Market? A

A commodity market is a marketplace for buying, selling, and trading raw materials. TABLE OF CONTENTS What Is a Commodity

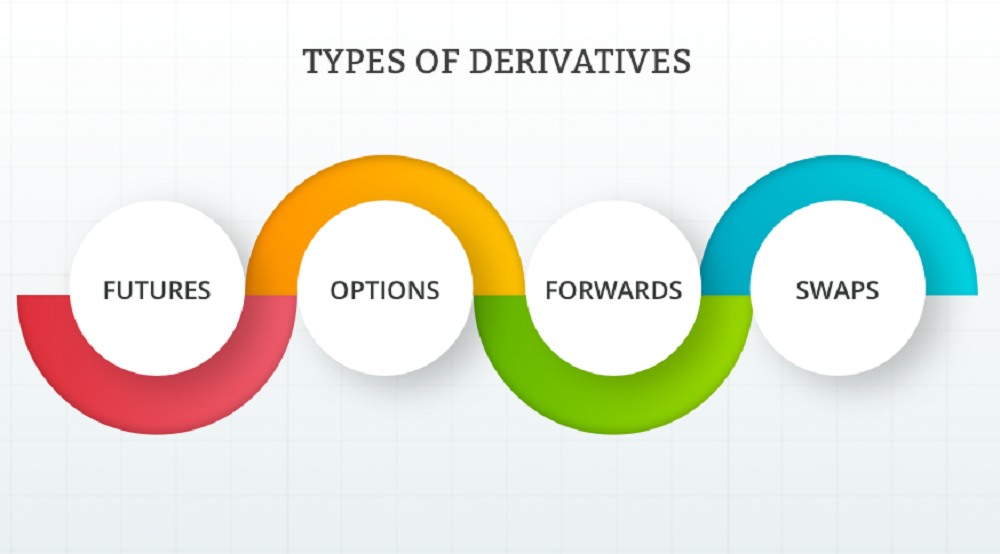

A derivative is a complex type of financial security that is set between two or more parties. TABLE OF CONTENTS

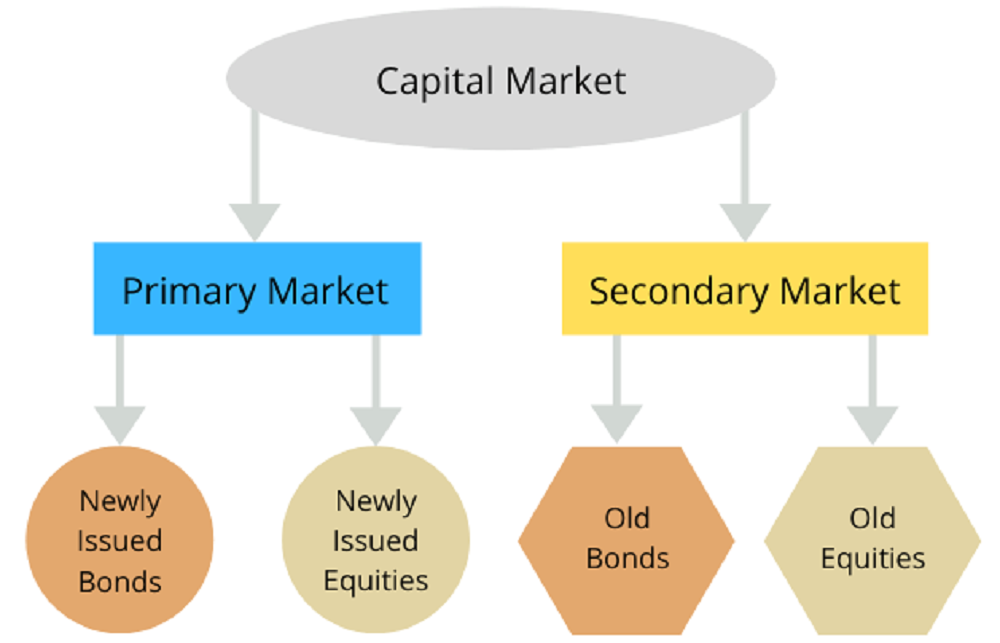

What Are Capital Markets? Capital markets are where savings and investments are channeled between suppliers—people or institutions with capital to lend

The equity capital market (ECM) is broader than just the stock market. TABLE OF CONTENTS What Is the ECM? Understanding

TABLE OF CONTENTS What Is the Bond Market? Understanding Bond Markets History of Bond Markets Types of Bond Markets Bond

What Is an Over-the-Counter Market? An over-the-counter (OTC) market is a decentralized market in which market participants trade stocks, commodities,

What Is Cryptocurrency? A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to

Want to Trade Online?

Easy Trading Platform

Copy Experienced Traders

Trade from Your Pocket

Trade with Liteforex

- Best Mobile App

- Free Trading Courses

- Low Fees

- Fast Execution

- 24/7 Customer Support

CFD Trading on financial markets carries risks. Before deciding to trade, you need to ensure that you understand the risks involved.