What Is Equity Trading?

- What Do Equity Traders Do?

- Cash

- Derivatives

- Exotics

- What Are the Key Skills Needed to Become an Equity Trader?

- What Qualifications Are Needed to Become an Equity Trader?

- What Is It Like Working as an Equity Trader?

- Salary and Career Progression

- Exit Strategy

- Final Thoughts

Equity trading involves the buying and selling of stocks. An equity or stock is a piece of ownership that a company sells to other companies and individuals to make money.

In this article, we will look at what an equity trader does, the skills and qualifications they need, and the kind of salaries and career progression they can expect.

What Do Equity Traders Do?

An equity trader buys and sells stocks, and advises investors looking to trade in stocks.

They may carry out their transactions online, or they might work on the floor of a stock exchange.

An equity trader will monitor market trends, evaluate how individual equities are performing and calculate financial risk to decide when to buy and sell, or how to advise investors. They also spend time contacting potential new clients or forming professional relationships.

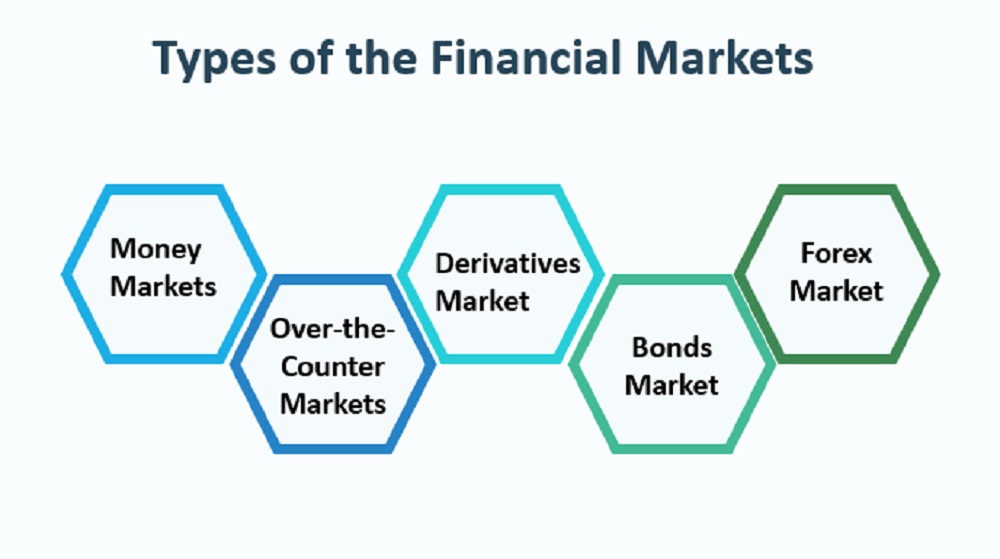

Equity trading desks will often be split into different trading roles; cash, derivatives and exotics.

Cash

This type of equity trading deals with normal company stocks.

Cash equity traders must have a strong market instinct, excellent mental arithmetic and be able to respond at speed to major events affecting the market.

Much of this area has been automated (see the Key Skills section) so may be better suited to traders with an interest in programming.

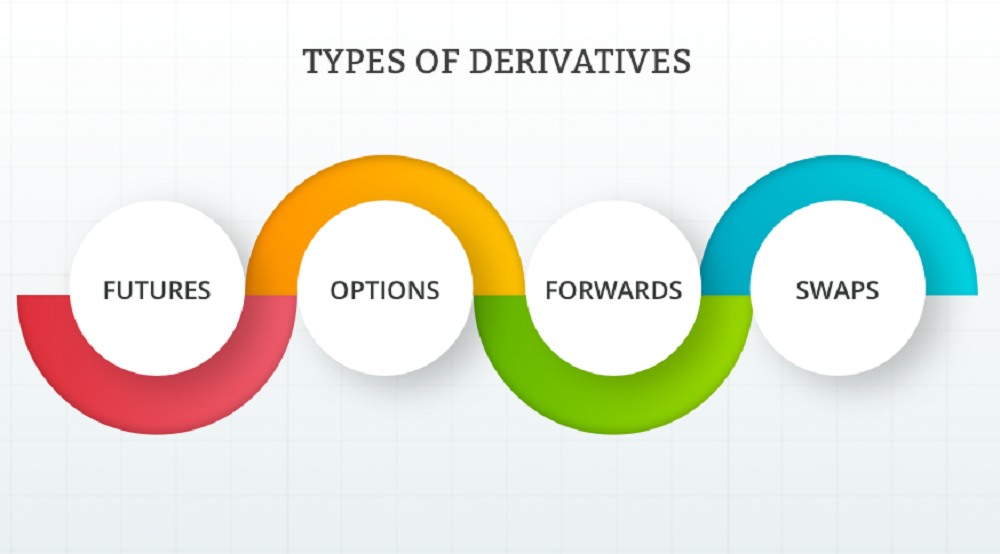

Derivatives

An equity derivative is a financial instrument that derives its value from the price movement of an underlying asset or assets.

Equity traders use derivatives to manage risk on long or short positions and to speculate on fluctuations in the value of the underlying asset.

Equity traders in this area must have good quantitative skills as well as market instincts, and will need to make calculations quickly.

Exotics

These are the most complex products on an equities desk. There is no single or universally-accepted definition, but any derivative that has extra features in addition to a strike price (the set price at which the security can be bought or sold) and expiry date (the point when a position automatically closes) would generally be considered an exotic.

Equity traders working in exotics will create the structure and value them for clients, and then manage them on the client’s behalf.

The pricing of the products is key, so keen analytical and quantitative skills are crucial for this role.

What Are the Key Skills Needed to Become an Equity Trader?

It goes without saying that equity traders will need an interest in and thorough knowledge of the financial markets, along with the ability to monitor and interpret market trends.

They must be mathematically-minded, with strong analytical skills.

They also need to be able to think strategically and make decisions. And they should have an appetite for risk-taking but also understand how and when to manage risk.

In addition to this, equity traders need strong communication skills, as much of their work is likely to involve collaborating and liaising with colleagues and building relationships with clients.

IT skills also play an increasingly important role in an equity trader’s job.

As an equity trader, you will be working with portfolio accounting programs, trading platforms and other software, so you must be confident with this kind of technology.

As mentioned previously, much of trading is now automated, particularly on cash equities desks where the product is simpler and more liquid.

Goldman Sachs has reportedly automated 99% of its equity trading jobs since 2000, reducing its cash equities trading desk from a team of 600 to just two.

While more complex equity products, such as derivatives and exotics, are less likely to be automated, there is no doubt that technology will play an increasingly important part in this industry.

In light of this, programming knowledge would be a useful skill for any equity trader looking to future-proof their job and ensure a wide range of career options.

It could also be helpful to learn about data science and data mining (the process by which raw data is turned into useful information).

What Qualifications Are Needed to Become an Equity Trader?

Most equity traders will have a bachelor’s degree and, ideally, this would be in a related field of study, such as finance, economics or business.

An MBA (Master of Business Administration) may also put you at an advantage.

Many employers will also expect their equity traders to be registered with the Financial Industry Regulatory Authority (FINRA) and to have passed one or more of its exams. For entry-level roles, the candidate may work towards this on the job.

Typically, an equity trader would take the Series 7 exam, which covers areas such as sales of corporate securities, investment company securities and variable annuities.

A FINRA member firm or self-regulatory organization (SRO) must sponsor you to sit this exam and the sponsoring firm will usually pay the examination fees.

You may also be required to take FINRA’s Series 63 exam, which assesses your understanding of industry regulations and how to protect clients’ interests, and the Series 57 exam, which measures the knowledge and abilities needed to trade securities.

Some employers will also favor applicants who hold the Chartered Financial Analyst (CFA) designation. This is a postgraduate certification for investment and financial professionals.

Equity trading is a highly competitive field so, aside from gaining official qualifications, you should look for ways to set yourself apart from the competition.

This will also be useful if you feel your educational qualifications are lacking for some reason.

You could gain experience by applying for internships and work placements, either through your school or college or via the relevant firm directly.

You could also consider joining a professional network, such as your local Security Traders Association (STA), which will offer you networking opportunities and the chance to meet equity traders and find out more about the role – and possibly secure work experience or job interviews.

Developing in-depth knowledge of a specific product will also help to set you apart, especially for entry-level roles.

For instance, you could study one particular exotic equity derivative, such as the compound option or the lookback option. This will give you something to discuss at interview and is likely to impress a potential employer.

And, as covered in the previous section, programming and data science qualifications and experience will also help you to stand out from the crowd and open up more opportunities within the field of equity trading.

The Best Trading Platforms

Let’s take a look at the best trading to earn more.

1. Liteforex

Best for: Learning from others

Liteforex is one of the most popular online reliable brokers over the world. Over the past 15 years, it has developed a strong reputation for beginners and experienced investors alike, has a minimum $100 deposit.

The Liteforex app aims to use easy for every clients. It is available on Google Play and the App Store and allows you to move seamlessly between devices.

It’s innovative features include:

- Pre-programmed one-click trading

- Copy Trader – Copy the trades of others in real-time

- Its own social networking platform

- Pre provided investment strategies which they call Copy Portfolios

The app boasts the ability to allow you to place online trades even if the trading platform is down.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

2. FXTM

The FXTM Platform itself is intuitive and easy to use, suitable for those just getting into trading and those more experienced alike.

It is designed to offer a full replication of an institutional trading environment including depth of market.

With advanced risk management and order functionality, this is a detailed platform for trading stocks.

The FXTM app offers a premium range of order types, with advanced technical analysis tools.

You can set up push and email notifications for the important things that you want to know in relation to your stock trading needs – such as price alerts and trade statistics.

Within the app, you can:

- Complete a range of order types

- Work with all your accounts in one app

- Understand detailed trade analysis

- Review detailed order tickets – base currency dollar value and pip distance

As a platform, there are comprehensive educational videos and explanations of symbols, so you can find optimized processing for expert advisors and indicators.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

3. FBS

Best for: CFDs

This app is designed for those wanting to trade outside of the US. It is considered one of the best for CFDs on shares and has a minimum $100 deposit.

There are low trading fees but considerable fees for inactive users.

The educational section is average, as are the research tools. However, the app is easy to use overall.

This app is recommended for those familiar with CFDs and who are actively trading. Reviews of the app show that users like the:

- Account-opening process

- Deposit and withdrawal features

- Customer service

- Actual trading platform

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

What Is It Like Working as an Equity Trader?

Equity trading involves dealing with unpredictable and constantly changing financial markets, so there is no typical day for an equity trader and they must be prepared to respond quickly to rapidly evolving events and scenarios.

An equity trader would usually get into the office early, at around 6 or 6:30 a.m., and spend the first few hours of the day getting themselves up to date with the latest market news and how this may impact the stocks they are trading.

They will also catch up with colleagues to exchange news and information before the market opens at 9:30 a.m. Eastern time.

Once the market opens, an equity trader will spend much of the day on the phone, updating clients and making trades.

A trader will be working multiple orders at once for several different clients so they can’t afford to miss anything and will constantly be monitoring news and events.

The US stock market doesn’t pause for lunch so neither can the trader – sometimes there isn’t even time to go to the bathroom.

Throughout the day they will also be in ongoing dialogue with other traders, sharing information that may affect their trades.

The market closes at 4:30 p.m. but equity traders may need to work later in the office, and will regularly spend the evening entertaining clients at a restaurant, bar or sports game.

So, working as an equity trader can be exhausting, if exhilarating.

Salary and Career Progression

Like other trading jobs, equity traders can enjoy a financially rewarding career path, with well-structured opportunities for internal promotion.

A typical career would progress roughly as follows:

- Intern

- Analyst

- Associate

- Vice president

- Director

- Managing director

An intern is mostly an observing role. They would not usually talk to clients directly but would spend their time shadowing traders and salespeople.

Analysts start in a similar role to interns, spending much of their time assisting more senior traders. Over time, and depending on performance, they will gradually be given more direct client and trading responsibility.

As a trader moves up through the positions of associate, vice president and director, their day-to-day role may stay largely the same. However, they will manage larger trades and be granted more freedom in how they manage their positions.

They will also gain larger risk limits, enabling them to make more aggressive trades, and therefore potentially bigger wins. They may also be supported by an analyst or associate.

The move from analyst to associate is fairly standard and straightforward. However, from that point on, those who perform well can see themselves promoted quickly, possibly even skipping over some positions, while under-performers may find themselves holding onto the associate role for some time.

In 2018, the US Bureau of Labor Statistics reported a median salary of $64,120 for professionals in the category of Securities, Commodities and Financial Services Sales Agents, which includes equity traders.

Earnings for equity traders can vary greatly because they depend to a great extent on the performance of individual traders. However, an analyst can expect to earn somewhere in the region of $75k as their base salary.

This rises to around $100k base salary for an associate, $200k for a vice president, $250k for a director and around $350k for a managing director.

Bonuses will boost these figures significantly; however, as you move up the career ladder, you will receive less of your bonus in cash and more in stock or deferred compensation (such as in a pension or retirement plan).

Exit Strategy

There is less focus on exit options in this field than there is in investment banking, as the majority of equity traders tend to carry on trading.

Some may choose to move into hedge funds, asset management or proprietary trading (also known as prop trading).

Traders could also make the transition into a role in risk management or become a regulatory specialist.

Those deciding to leave equity trading may decide to do something completely different – they could put their IT knowledge to use by joining a tech company or even launch their own startup.

Final Thoughts

If you’ve got an analytical mind, a head for numbers, an appetite for risk and a lot of stamina, then equity trading may be the perfect career for you.

Equity trading is about analyzing and trading the stock of individual companies, so it is more suited to those with an interest in micro, rather than macro, analysis.

As the industry becomes increasingly automated it is worth developing your programming and IT skills so that you also have the option to work with the technology involved in automating trades.

Equity trading is fast-paced and competitive, so you will need to be hard-working and ambitious. But you will be rewarded with a healthy pay packet and the opportunity to rise quickly through the ranks.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

Types of Equities and Their Risk Profiles

- How Are Equities Bought and Sold?

- How Are Equities Priced?

- Initial Public Offering

- What Factors Make Share Prices Go Up or Down?

- Large-Cap vs Mid-Cap vs Small-Cap

- Growth, Value and Income Equities: Risk Differences

- 10 Risk Factors Affecting Equities

- 1. Exposure to Fortunes of Market and Wider Economy

- 2. A Drop in Investor Confidence

- 3. Liquidity Risk

- 4. Lack of Diversification

- 5. Currency Exchange Risk

- 6. Poor Management (of Funds or Companies)

- 7. Investment Fraud

- 8. Horizon Risk

- 9. Investor Dilution

- 10. Changes in Law, Regulation or Government Policy

- Final Thoughts

The equities (also known as stocks or shares) of a corporation are a type of financial security that denote ownership in a business.

How Are Equities Bought and Sold?

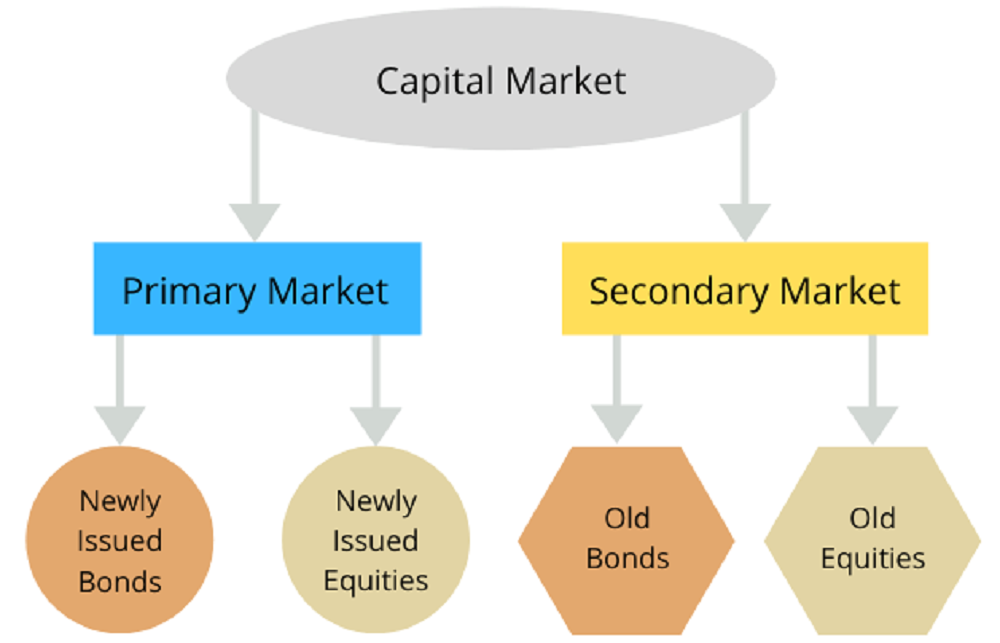

Equities are bought and sold using a stock exchange (such as the London Stock Exchange or New York Stock Exchange). They are usually bought by stockbrokers and form the basis of an investor’s portfolio. All transactions on the stock exchange should conform to government regulations.

A stock exchange is a method through which companies raise capital through selling equities to the investing public (in contrast to borrowing, where capital is raised through a credit or a loan).

How Are Equities Priced?

Fundamentally, share prices are determined (in common with most other markets) by supply and demand.

Once a company goes public and is listed on the stock exchange, generally speaking, the most recent price paid becomes the market value. If the buyer pays more, the market value goes up.

A company’s worth or total market value (market capitalization or ‘market cap’) is calculated by multiplying the share price by the number of shares outstanding.

Therefore, the price of a company’s equities is relative to its worth, representing a percentage change in the market cap at any given point in time. A change of even £0.01p per share can cause a dramatic change in the value of a portfolio if one single investor owns one million shares.

Initial Public Offering

When a company first goes public and is listed on the stock exchange, an investment bank will use valuation techniques to determine a company’s value, how many equities will be offered to the public and at what price. This is known as an initial public offering or IPO and determines a company’s market cap.

What Factors Make Share Prices Go Up or Down?

Share prices are primarily affected by two factors:

- The performance of the company

- The wider environment

Companies have to publish their financial results and provide trading updates that give an insight into performance. Companies are also obliged to publicly notify events that could affect the price of equities, such as the launch of a new product, takeover bids and so on. All of this provides information to investors as to how well a business is doing.

This information will be viewed alongside the wider market environment. In times of financial uncertainty, investors may have less confidence that a company will do well and may raise questions about a company’s profitability. This may lead to reduced demand for equities and, as a result, prices may fall. Tough conditions may even lead to companies who are doing well to experience a fall in their share price. Likewise, a buoyant market may see companies who are doing less well increase their share price.

The sector performance more generally will also affect prices. For example, over the last decade, tech and cloud-related companies have boomed whilst publishing companies have struggled. These factors specific to each industry will play a part in rising or falling prices.

Large-Cap vs Mid-Cap vs Small-Cap

A company’s market capitalization or ‘market cap’ is a company’s worth and is calculated by multiplying the company’s share price by the number of shares outstanding. Market cap reflects only the share value of a company and is used in the ranking of companies by size (and thus also the ranking of stock exchanges).

In general, large-cap (or big-cap), mid-cap and small-cap refer to the size of the company.

Different indexes use different numbers to divide companies into large, mid and small-cap, with others also using additional terms such as mega-cap, micro-cap and nano-cap as further categories of company size. As such, there is no one definition or value of large, mid or small-cap.

Small or mid-cap equities can become large-cap equities in time, and large-cap equities do not guarantee a bigger return on investment. The definitions evolve as time passes, as the terms are relative to themselves. A company defined as big-cap 30 years ago may now only be small-cap.

- Large-Cap. Large-cap companies are the biggest players or the largest publicly traded companies. Generally, large-cap companies are the market leaders or one of the top three performers in the sector and are commonly household brands. Large-cap or big-cap companies are sometimes known as ‘blue-chip’.

Large-cap companies are companies that are perceived as well established, safe, stable, profitable in both good and bad times and are often deemed to be a low-risk investment as people will continue to buy their products despite difficult economic market conditions. Large-cap companies typically have a market capitalization in the billions, commonly over $10 billion. - Mid-Cap. Mid-cap equities are shares of public companies usually with market capitalizations between $1 billion and $5 billion, or $2 billion and $10 billion, depending on the analyst.

As you would expect, mid-cap companies are established companies in the process of expanding and operating in an industry expected to experience rapid growth. Investors find mid-cap companies beneficial as they have the potential for growth, but this must be balanced against their higher risk profile as they are not so well established as a (usually) safer large-cap company. - Small-Cap. Companies classified as small-cap usually have a market cap of somewhere between $300 million and $1 billion. Small-cap companies will usually be either newly established, operating in a niche market or serving a new industry, all of which make them considered a higher-risk investment and more prone to falter in a poor economic climate.

Growth, Value and Income Equities: Risk Differences

Investors typically invest for two reasons – either to make income from dividend profits or to benefit from being able to later sell their equities at a higher price. Some investments will happily offer an investor both but typically an investor will have some of each type of share in their portfolio.

- Growth Equities. These are, as the name suggests, equities held in companies that are expected to grow or have the potential for growth. These companies often operate in emerging industries and plough revenue back into expansion. Growth companies are naturally more prevalent in some sectors, such as biotechnology, but all sectors have growth companies.

Growth equities can be a risky choice for investment as outside or unexpected factors may impact growth. - Value Equities. Investors look for investment potential in companies who are temporarily performing at an under-value. This means that the equity price is valued lower than would normally be estimated based on financial status and trading indicators. This may be because of a technical reason such as high dividend payout ratios or, perhaps, an issue of public perception which does not affect the operation (and therefore profit) of the company.

Whatever the reason, investors take the risk that the dip will be short-lived and the price will soon increase. Value equities are typically those of well-established companies and are perceived as less risky than less established companies. - Income Equities. Investors choose income equities for a steady income received from, they hope, higher than average dividends.

When assessing whether a company will pay out high dividends, investors calculate a company’s dividend cover to see how robust and reliable its shareholder payouts will be. This is calculated by dividing a company’s earnings per share (EPS) with its dividend per share (DPS). As a rule of thumb, a dividend cover of two or more generally points to a safer bet; lower than 1.5 may be cause for concern.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

10 Risk Factors Affecting Equities

As we have explored above, the price of equities may vary depending on variables relating to the company and various external factors including the instability of the global economic market.

There is always the intrinsic risk that the company will go out of business and take with it any investment. Investments in large corporations unlikely to fold are arguably ‘safer’ but the financial reward may be smaller.

Investing in equities carries risk and investors need to balance this risk against the potential rewards. All investors or fund managers must carry out risk management to identify, analyse and, where appropriate, accept or mitigate against objectives and risk tolerance.

Here are some of the most common risk factors that affect every type of equity regardless of sector:

Exposure to Fortunes of Market and Wider Economy

The market or wider economy may collapse, or just ‘go bad’ if there is a financial downturn. It could be due to a specific event (such as a terrorist attack) or the impact of a specific set of circumstances (such as the subprime mortgage market crisis which led to an international banking crisis followed by a global financial recession).

This can lead to a so-called ‘bear market’ in which prices can fall 20% or more.

A Drop in Investor Confidence

When investors believe something is about to happen they will take action, such as selling off their equities to avoid losses, which can impact prices. This can also signal the onset of a bear market.

Liquidity Risk

Liquidity risk is the risk that an investor may not be able to sell assets quickly enough without a loss of capital or a reduction in price. If there are few buyers for your type of share, they may take longer than expected to sell and they may sell at a lower price.

Lack of Diversification

Investors manage risk by ensuring that investments are spread across a diverse range of products and markets. By investing in different areas and types of assets, investors hope to both maximise investment and reduce the risk of loss.

Currency Exchange Risk

By contrast, currency exchange risk is an example of systematic market risk that cannot be eliminated or reduced.

Put simply, when an asset or investment is held in a foreign currency, there is always a risk that the currency will lose value due to exchange rate fluctuations against the investor’s domestic currency.

Poor Management (of Funds or Companies)

Poor risk management by an investor or fund manager, such as failing to identify risk, sub-standard analysis, inability to adequately mitigate and so on, can lead to a loss.

Poor risk-management decisions can escalate rapidly with catastrophic consequences. The financial crisis of 2008 can be traced back to the poor decisions made in the subprime mortgage market.

One key example was extending mortgages to those with poor credit ratings, which were then compounded by the repackaging of those mortgages and excessive investing in those repackaged mortgage-backed securities.

Investment Fraud

Investors should always be aware of the risk that some equities may either be worthless or not actually exist – and therefore any money invested might fall straight into the hands of the criminal who has set it up to catch them out.

Often these schemes promise returns which are too great. Risk can be mitigated by always seeking independent advice (and legal advice if required) and ensuring the firm used for investments is both on the FCA register and allowed to give financial advice.

Horizon Risk

Investment horizon is the length of time that an investor proposes to hold a portfolio or investment. Generally speaking, if an investor plans to hold a portfolio for several decades, they would probably invest in more high-risk products early on and, as the length of the horizon reduces (i.e. approaching retirement), would seek to move investments to less risky products to minimise losses.

A risk with a long investment horizon is that an unforeseen event, such as a change in circumstance or market event, may force an investor to sell to create liquidity, but not at the predicted time or price, causing a loss.

Investor Dilution

If a company offers additional equities to market, perhaps to raise revenue or fund a new venture, buy a competitor, or launch a new product, the short term result is that the existing value and proportional ownership reduces.

It is not automatically a bad thing: if the company is successful in its aims, profits will rise. However, investors should be aware that it can lead to a decrease in value.

Changes in Law, Regulation or Government Policy

So-called legislative risk is the risk that the government may alter laws or bring in new tax policies that change the basis on which previous investment decisions have been made.

Legislative risk is viewed as a huge risk by investors – what was given as a competitive advantage by one government may then be taken away in an increase or change in the tax position by the next.

Final Thoughts

The risks of investment are many and varied and there are no guarantees, which is also what makes investing in equities such a compelling prospect. It is possible to take steps to mitigate loss, but investors should ensure they are dealing with reputable institutions and experienced professionals.

The biggest returns usually follow the greatest accepted risks, and it wise for investors to view investments over a long investment horizon and invest in a diverse portfolio of products that are reviewed regularly.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

Financial Market is the main topic of daily business activities. TABLE OF CONTENTS What Are Financial Markets? Understanding Financial Markets

The foreign exchange (forex) market is the largest financial market in the world. TABLE OF CONTENTS What Is the Forex Market? Understanding the

Cash markets are also known as spot markets because their transactions are settled “on the spot.” What Is a Cash Market? A

A commodity market is a marketplace for buying, selling, and trading raw materials. TABLE OF CONTENTS What Is a Commodity

A derivative is a complex type of financial security that is set between two or more parties. TABLE OF CONTENTS

What Are Capital Markets? Capital markets are where savings and investments are channeled between suppliers—people or institutions with capital to lend

The equity capital market (ECM) is broader than just the stock market. TABLE OF CONTENTS What Is the ECM? Understanding

TABLE OF CONTENTS What Is the Bond Market? Understanding Bond Markets History of Bond Markets Types of Bond Markets Bond

What Is an Over-the-Counter Market? An over-the-counter (OTC) market is a decentralized market in which market participants trade stocks, commodities,

What Is Cryptocurrency? A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to

Want to Trade Online?

Easy Trading Platform

Copy Experienced Traders

Trade from Your Pocket

Trade with Liteforex

- Best Mobile App

- Free Trading Courses

- Low Fees

- Fast Execution

- 24/7 Customer Support

CFD Trading on financial markets carries risks. Before deciding to trade, you need to ensure that you understand the risks involved.