How to Read Forex Chart Patterns

LEARN FOREX TRADING WITH chart patterns

- How to Access Forex Charts

- How to Read Forex Charts

- 1. Line Charts

- 2. Bar Charts (sometimes called OHLC (Open, High, Low, Close) Charts)

- 3. Candlestick Charts

- Common Chart Patterns

- Reversal

- Continuation

- Final Thoughts

In the international forex market, investors, shareholders and retailers influence the relative value for converting one currency into another by acquiring and trading currency pairs. Successful forex traders benefit from the changes in value between different international currencies by choosing two currencies and predicting which will go up in value compared with the other.

Forex charts can be used to provide an illustration of a currency’s behaviour or performance over time. Traders often use forex charts to help them to gain a better understanding of past performance; this information is then used to help them make informed trading decisions in the future.

Since forex charts can signal uptrends and downtrends in currency performance, they can be a helpful resource when it comes to planning your next trading move.

How to Access Forex Charts

There are many different options available, so it's important to look for one that will suit your skill level and trading style.

One of the most popular forex trading software solutions is TradingView. This software offers a free basic solution which can be used to trade any market. It is cloud-based, so you can access it from any device.

TradingView is designed to meet the needs of new and experienced traders alike. There are plenty of customisation options to ensure it meets your needs and you can set up alerts to prompt you when your favourite currency pairs begin to move.

If you would prefer to use an ad-free service, there are three different paid-for options which offer a range of additional benefits.

How to Read Forex Charts

Choosing a timeframe is one of the most important aspects of reading forex charts. To toggle between timeframes, zoom in and out of the chart. Time is represented on the ‘x’ axis and exchange rate pricing on the ‘y’ axis. To view historical data, move to the left of the chart.

In simple terms, a downtrend can be identified by looking for a line that moves downwards from left to right, whereas an uptrend is depicted by a line moving upwards from left to right.

The three main charts used in forex trading are:

The Best Trading Platforms

Let’s take a look at the best trading to earn more.

1. Liteforex

Best for: Learning from others

Liteforex is one of the most popular online reliable brokers over the world. Over the past 15 years, it has developed a strong reputation for beginners and experienced investors alike, has a minimum $100 deposit.

The Liteforex app aims to use easy for every clients. It is available on Google Play and the App Store and allows you to move seamlessly between devices.

It’s innovative features include:

- Pre-programmed one-click trading

- Copy Trader – Copy the trades of others in real-time

- Its own social networking platform

- Pre provided investment strategies which they call Copy Portfolios

The app boasts the ability to allow you to place online trades even if the trading platform is down.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

2. FXTM

The FXTM Platform itself is intuitive and easy to use, suitable for those just getting into trading and those more experienced alike.

It is designed to offer a full replication of an institutional trading environment including depth of market.

With advanced risk management and order functionality, this is a detailed platform for trading stocks.

The FXTM app offers a premium range of order types, with advanced technical analysis tools.

You can set up push and email notifications for the important things that you want to know in relation to your stock trading needs – such as price alerts and trade statistics.

Within the app, you can:

- Complete a range of order types

- Work with all your accounts in one app

- Understand detailed trade analysis

- Review detailed order tickets – base currency dollar value and pip distance

As a platform, there are comprehensive educational videos and explanations of symbols, so you can find optimized processing for expert advisors and indicators.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

3. FBS

Best for: CFDs

This app is designed for those wanting to trade outside of the US. It is considered one of the best for CFDs on shares and has a minimum $100 deposit.

There are low trading fees but considerable fees for inactive users.

The educational section is average, as are the research tools. However, the app is easy to use overall.

This app is recommended for those familiar with CFDs and who are actively trading. Reviews of the app show that users like the:

- Account-opening process

- Deposit and withdrawal features

- Customer service

- Actual trading platform

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Common Chart Patterns

Reversal

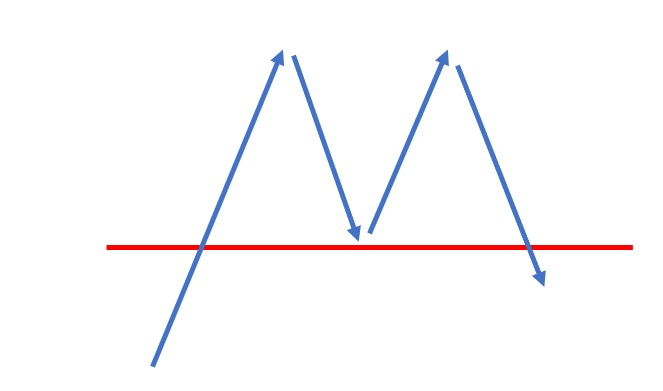

Double Top:

After this level has been reached, the price tends to dip slightly before returning back up to the top level again. If it bounces back down again, this is known as a double top. After reaching the second top, it is likely that the price will dip again.

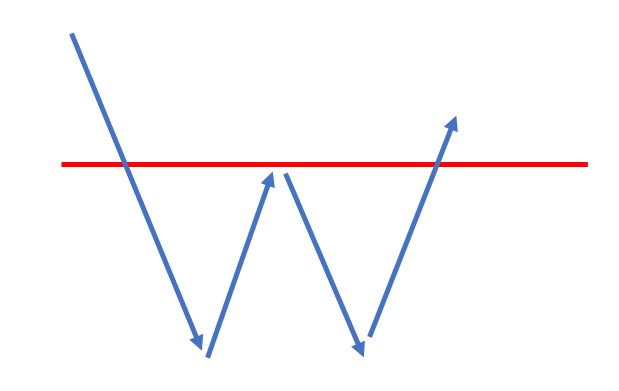

Double Bottom:

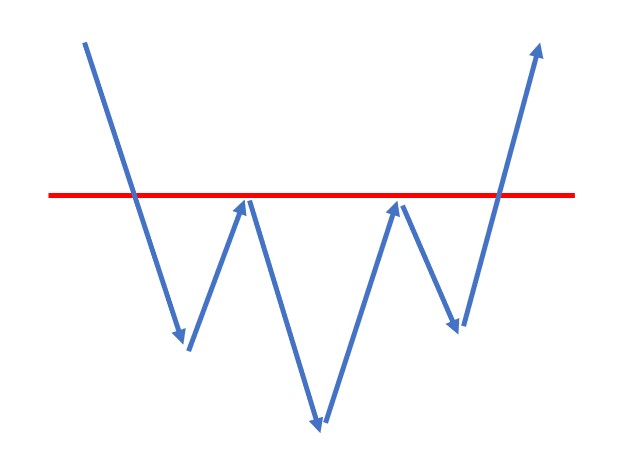

Head and Shoulders:

Inverse Head and Shoulders:

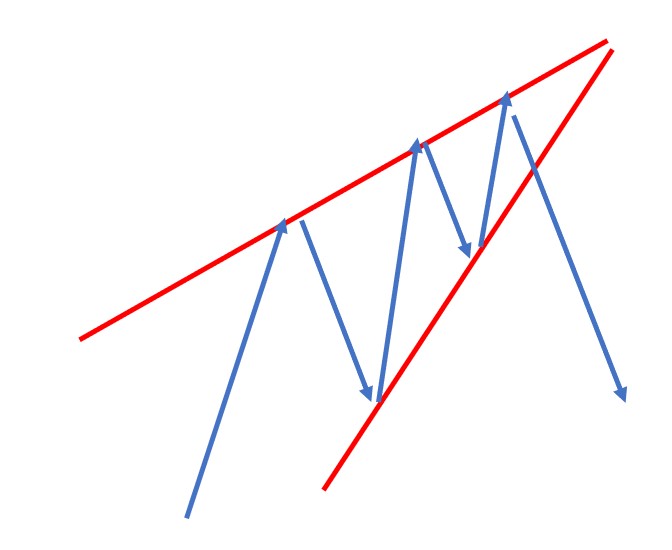

Rising Wedge:

Continuation

Rising Wedge:

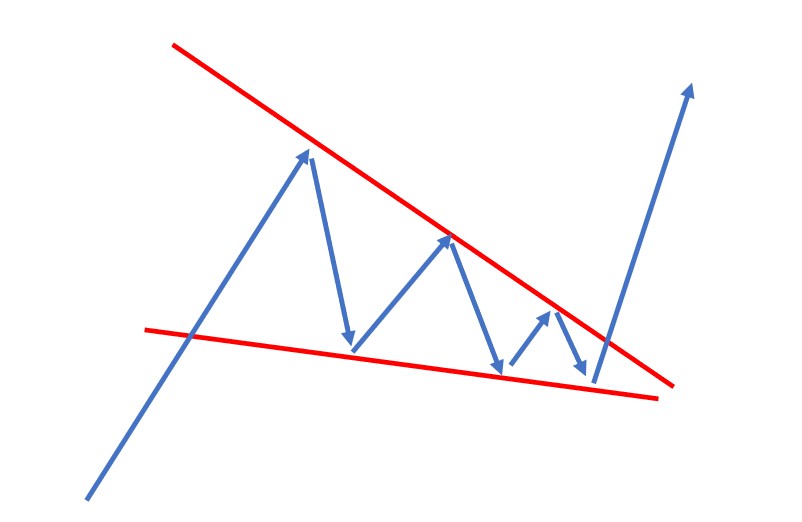

Falling Wedge:

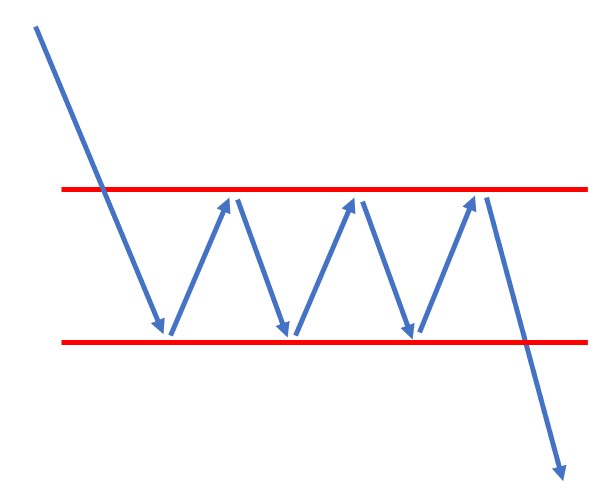

Bearish Rectangle:

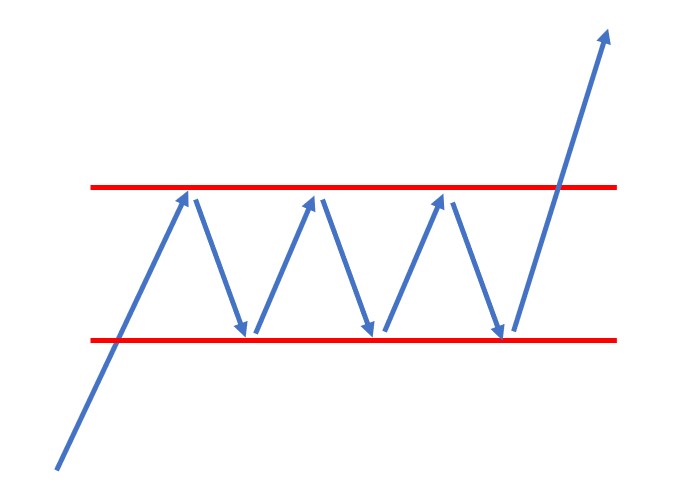

Bullish Rectangle:

Bearish Pennant:

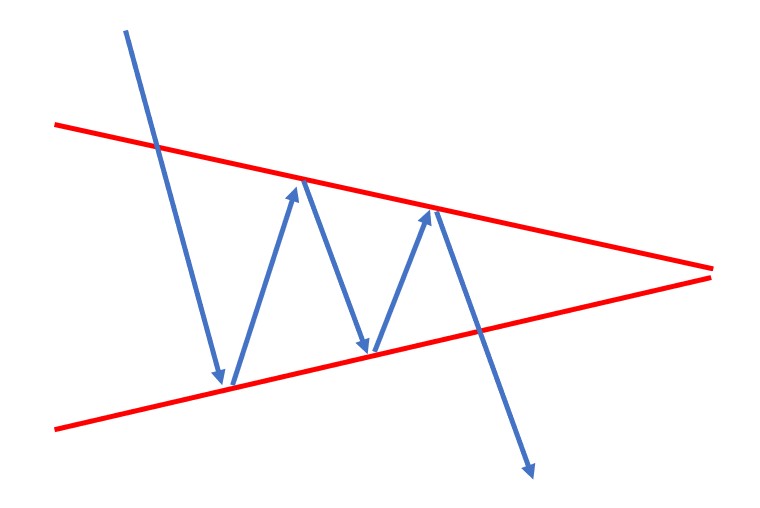

Bearish pennants form during vertical, steep downturns. Following a sudden drop in price, some traders will choose to close their positions whereas others opt to join the trend, meaning that the price consolidates for a short time.

Once enough sellers have moved into the trade, the price drops below the bottom point of the pennant and it can be expected to continue moving down.

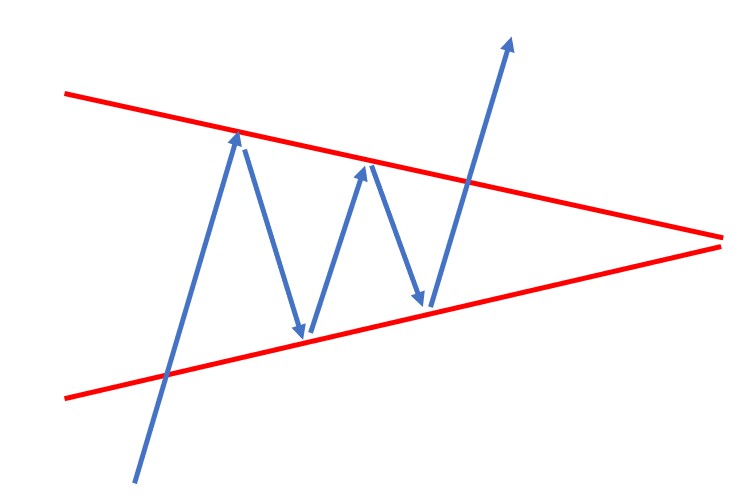

Bullish Pennant:

Triangles:

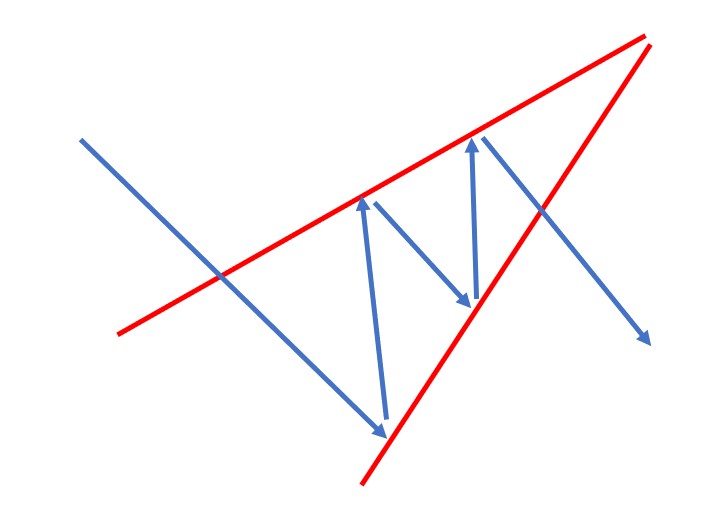

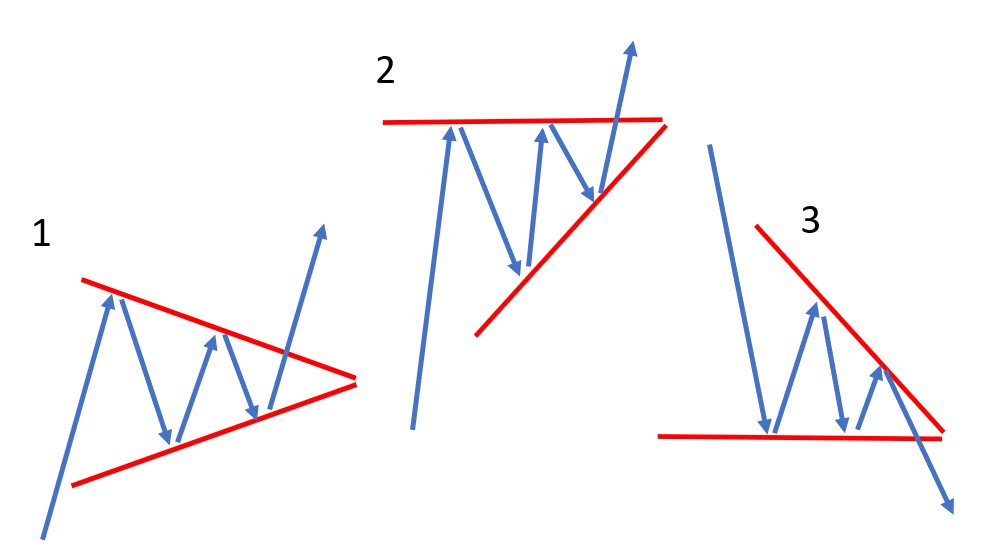

- Symmetrical triangle: In this pattern, the incline of the price’s highs and the decline of the price’s lows come together to create a pattern resembling a triangle. It’s impossible to predict which direction the market will eventually break out in.

- Ascending triangle: In this pattern, there is a clear point of resistance, but the lows can be observed as increasing.

- Descending triangle: This pattern is the opposite of an ascending triangle – there is a support level line which the price doesn’t seem to be able to break and a series of lower highs creates the upper line of the triangle.

Final Thoughts

Many trading platforms offer the option to open a demo account which will allow you to trade risk-free before putting any of your money at risk. This is a good way to boost your overall trading knowledge and give yourself time to become familiar with forex charts, interpret patterns and act upon any trends that you identify.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

The candlestick chart has Japanese origins and is probably the most useful of the three main chart types. When reading

A bar forex chart gives traders a little more information than a line chart. They show closing prices but, at

These are the most straightforward type of forex chart to read so they are a good starting point for new

What Are the Benefits of Forex Trading?

- 10 Main Benefits of Forex Trading

- 1. It’s a Large and Global Market

- 2. It’s Good for Beginners

- 3. You Can Trade 24 Hours a Day

- 4. There Are Low Transaction Costs

- 5. You Can Benefit from Leverage

- 6. It’s a Market with High Liquidity

- 7. Volatility of the Forex Market

- 8. You Can Buy or Sell Currency Pairs Depending on the Market

- 9. There’s Good Technology for Trading

- 10. It’s Well Regulated

- Final Thoughts

Foreign exchange trading, commonly referred to as forex trading, is the practice of buying and selling currency values with the aim of making a profit. As a global market, forex trading is conducted all over the world, with the largest markets located in major financial centers including New York, London, Tokyo and Hong Kong.

The forex market is vast and consists of numerous entities including banks, financial/business institutions and brokers, all speculating on the movement of currency pairs. It is also becoming increasingly popular with retail and hobbyist traders owing to its accessibility and suitability for beginners.

If you’re interested in forex trading and are considering it as a potential investment, you’ll need to make sure that it’s the right market for your individual circumstances. This article will look at the main benefits of forex trading, hopefully giving you a good idea of whether or not it’s right for you.

10 Main Benefits of Forex Trading

Every trader is likely to cite different reasons to trade forex, and there’s a lot of information out there relating to this particular market. We advise that you reference multiple sources thoroughly before making any final decision on your next steps.

That said, here are our thoughts on the top benefits of forex trading.

It’s a Large and Global Market

When it comes to the benefits of trading forex, its sheer size and scale sit at the top of the list.

As the world’s largest financial market, in excess of $4 trillion USD is exchanged on average per day. Traders in all corners of the world are buying and selling currency pairs at all hours, making forex a truly global marketplace with plenty of scope for profitability.

It’s the breadth of the market that contributes to many of the benefits of forex trading, including accessibility, liquidity, volatility, technology and trading hours.

It’s Good for Beginners

Accessibility is one of the biggest advantages of forex trading. Compared to other markets, it is relatively easy to enter and does not require a large initial investment, explaining its popularity with hobbyist traders.

However, regardless of the amount of capital you put down, successful trading takes knowledge and skill.

Free demo accounts allow you to practice trading forex without risk, essentially providing a ‘try before you buy’ test run. By simulating a live trading environment, demo accounts give you the chance to get used to a trading platform, familiarise yourself with market movements and develop a risk management strategy, all without making any financial commitments.

Most brokers offer demo accounts so if you’re considering trading forex, be sure to take full advantage of these tools first.

You Can Trade 24 Hours a Day

The rolling hours of the market are another of the main advantages of forex trading. Foreign exchange takes place over-the-counter (OTC), meaning transactions are made directly between trading parties, facilitated by a forex broker.

Since it operates this way, forex trading is not subject to the opening hours of any centralised exchange system. As long as there’s a market open somewhere in the world, deals can take place.

In the UK, trading begins at 9 p.m. on Sunday with the opening of the Sydney market and rolls continuously until close of session in New York at 10 p.m. on a Friday.

While the forex market is closed to retail traders over the weekend, it’s important to note that rates will continue to move, and you should factor this into your trading strategy to mitigate any potential risk.

There Are Low Transaction Costs

Not only does the forex market require little capital for entry, but there are also low transaction costs once you’re in. Typically, brokers make money from spreads, which are measured in pips and factored into the price of a currency pair.

Note: Pip stands for ‘point in percentage’ and is the unit of measurement used to show a change in one currency’s value against another.

When a broker offers you a currency pair, they’ll quote a bid (sell) price and an ask (buy) price, the pip difference between the two indicates the spread, the associated value of which you’ll pay the broker for facilitating the trade.

Spreads are usually low, making forex trading relatively cheap. However, you should look into all associated costs when choosing a broker, as some may also charge a flat fee or variable commission.

You Can Benefit From Leverage

Of all the reasons to trade forex, the availability of leverage is perhaps the most appealing as it allows you to open a high position with a relatively small amount of capital.

Most forex brokers permit retail traders to put down a deposit and borrow against this in order to control a much higher stake, similar to placing a deposit down for a mortgage when dealing in property.

Your available leverage will be expressed as a ratio, with most regulated forex brokers limiting maximum leverage for retail traders, with 1:30 and 1:50 being common. So, if you took advantage of 1:50 leverage, you could trade up to £50 for every £1 of capital in your account.

Whilst this opens up the potential for increased profit, it can also lead to greater losses, so leverage should always be used with caution.

It’s a Market With High Liquidity

In trading terms, liquidity refers to the ease with which an asset can be bought or sold with limited effect on its value. In a nutshell, this depends on how active a particular market is. The global scale of foreign exchange combined with the high volume and 24-hour activity, make the forex market the most liquid market in the trading world.

What this means to you as a trader is that if you’re dealing in major currency pairs such as GBP/USD or EUR/GBP, your assets can easily be exchanged with little variance to their value.

This may seem counterproductive, as little variance means little profit, but with a strong trading strategy, this liquidity allows you to trade effectively with minimal risk. Forex liquidity falls when you move into minor or exotic currency pairs but equally, so potential profit margins can be much higher.

Ultimately, the path you choose to take comes down to your approach to risk management and your confidence in your market predictions.

Volatility of the Forex Market

The forex market is influenced by a number of external factors, including but not limited to:

- The economic stability of a given country

- The global economy as a whole

- Political news, events and policies

- Trade deals

- Natural disasters

This can make it highly volatile at times, meaning there can be significant movements in currency values and, subsequently, the opportunity to make a substantial profit. Though this could be seen as one of the advantages of forex trading, it also comes with a high level of risk, since movement can occur in either direction.

Volatility is strongly linked to liquidity, and the more liquid major currency pairs tend to be less volatile. Some major currency pairs, such as Australian Dollar/US Dollar (AUD/USD) and Canadian Dollar/Japanese Yen (CAD/JPY) are subject to more volatility, as are emerging market currencies.

Ultimately, if you’re looking to take advantage of market volatility, you need to tailor your strategy to any potential risk.

You Can Buy or Sell Currency Pairs Depending on the Market

The ultimate goal of any form of trading is to buy low and sell high, turning a profit on your initial investment. One of the benefits of forex trading is that you have the option to either buy or sell currency pairs depending on the state of the market.

In forex trading terms, this is known as going long or short.

- If your instinct tells you a currency pair is likely to increase in value, you would go long; for example, you would buy the pair based on a prediction of the base currency rising against the quote currency.

- You would go short if your predictions went the other way; for example, you would sell the pair if you thought the base currency was likely to fall in value against the quote currency.

In the stock market, this directional trading usually requires significant investments as it has high associated costs. Thanks to low transaction fees and liquidity, however, foreign exchange allows for easy directional trading in line with market trends.

There’s Good Technology for Trading

Compared to other markets, such as those dealing in stocks and shares, forex trading is a relatively new practice. As such, it has been quicker to adapt to the technological advancements of the trading world.

Its decentralised nature means connectivity is vital to its existence and software developers continue to improve on the platforms available to forex traders.

Innovations in mobile applications, trading algorithms and global connectivity, including the rollout of 5G, continue to make it easier for individuals to trade effectively in real time from anywhere in the world, making technology one of the major benefits of forex trading.

It’s Well Regulated

As it takes place in a global and digital landscape, the regulation of foreign exchange is no easy task. Thankfully, though, this works in a trader’s favour and can actually be considered one of the advantages of forex trading. Since there’s no centralised exchange system, independent bodies are responsible for regulation in respective countries. In the UK, this role falls primarily to the Financial Conduct Authority (FCA).

This consumer watchdog ensures that UK brokers are licensed and follow strict guidelines that protect the interests of forex traders using their services. So, although it comes with an element of risk, as with any form of trading, using a UK-regulated forex broker will give you peace of mind that its activities will be fair, transparent and tightly monitored.

Final Thoughts

There are many benefits to forex trading but, as with any market, there are also associated risks and it should not be entered into lightly. Whilst this article has covered the main advantages of forex trading, it’s also vital that you familiarise yourself with the potential pitfalls to ensure it’s the right decision for you.

Forex trading is not a get-rich-quick scheme. Rather, it is a long-term strategy that requires knowledge and a keen understanding of how global events can affect the market.

Before you commit to any form of financial investment, you should carry out extensive research and ensure you understand the ins and outs of the market, are familiar with all related technical terms and are comfortable taking speculative risks with your capital.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.

HYCM was established in 1972 as a gold and silver

Best for: Long-term investmentPrice: Payment is taken as membership to the platform

Best for: Beginner tradersPrice: £162 for lifetime access. Payment can also be

Best for: Reliable coaching-based training Established in 2003 by veteran trader

Best for: Training recommended by professionals. This training, like many others

Best for: Those on a budgetPrice: Free Forex School Online offers an

Best for: Complete beginners on a budgetPrice: Free, if you register for

Best for: Personal tuition Thomas Kralow is a seasoned investor who has

Best for: Forex beginners looking for a comprehensive startPrice: Usually £44.99 (appears

Want to Trade Online?

Easy Trading Platform

Copy Experienced Traders

Trade from Your Pocket

Trade with Liteforex

- Best Mobile App

- Free Trading Courses

- Low Fees

- Fast Execution

- 24/7 Customer Support

CFD Trading on financial markets carries risks. Before deciding to trade, you need to ensure that you understand the risks involved.